In this week’s Equity Leaders Weekly we are going to take a commodity focus and give an update on both Crude Oil and Natural Gas as both have seen some significant positive moves since they were last covered.

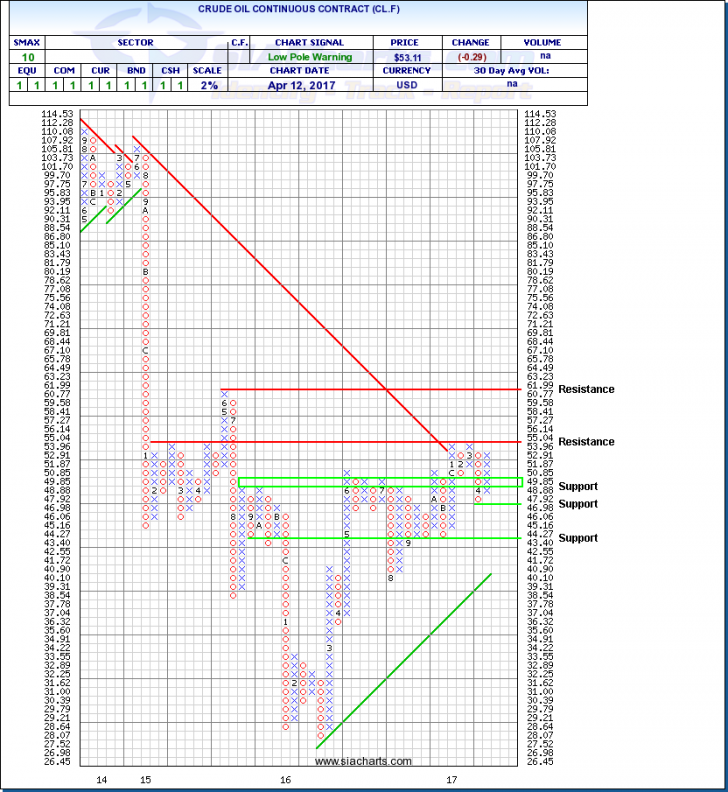

Crude Oil Continuous Contract (CL.F)

Crude oil snapped its longest streak of daily gains in 2017 on Wednesday after 8 consecutive positive trading days as the markets priced in both support coming from short-term inventories as well as the longer-term outlook for supplies in the US – closing at $53.11/bbl. Both the Energy Information Agency (EIA) and the American Petroleum Institute (API) both reported declines in crude inventories of 2.2 million barrels and 1.3 million barrels, respectively – the first draw of stockpiles in a month. While short term numbers were positive, the EIA also issued a report showing US crude output rising to a record 9.9 million barrels per day (bpd) in 2018. This number is up over 7% from the projected 9.22 million bpd for 2017.

On May 26th the Organization of Petroleum Exporting Countries is set to meet in Vienna where they will discuss the progress of their coordinated production cuts where the cartel pledged to cut production by 1.2 million bpd. So far the group has managed to meet that mark and Saudi Arabia is rumored to support extending the cuts into the second half of 2017 in order to prevent a downside price shock to crude, however the final decision is yet to be made.

In looking at the chart we can see that CL.F is having a tough time breaking through the strong technical resistance level at $55 having bounced and reversed off this level on its last two attempts. The most recent pull back column of 6 O’s CL.F has since rebounded and is once again attempting to break that $55 level. A move above this level could signal strength to the next resistance mark just above $60. A failed break through at $55 resistance may find support at $48.88, $46.98 and below this at $43.40. Sometimes these strong technical resistance levels take multiple attempts to break through - so the $55 range will be an important inflection point to keep an eye on along with news from OPEC, inventory information and global geopolitical risks which could influence short-term crude prices.

With an SMAX of 10 out of 10, CL.F is showing near term strength versus the asset classes.

Click on Image to Enlarge

Natural Gas Continuous Contract (NG.F)

Natural gas closed at $3.19 on Wednesday, up 0.95% for the trading day and snapping a two day slide for the commodity. NG.F still sits up over 5% over the last month with positive surprises coming from inventory numbers three out of the last five weeks and one week in line with expectations. The EIA reported on April 6, 2017 a build of 2bcf for the week ended March 31, 2017 which, while increasing, was well below analyst estimates of 7bcf. Total inventories now sit at 2.051tcf which is 17.2% lower than this time last year but still 12.9% above the 5 year average. This is the first build in inventories in the same five week period as we head into spring seasonal lows where mild weather typically reduces demand for winter heating units. As we head into the summer NG.F demand generally picks up as residences and businesses begin to use gas fired electricity to power air conditioning units.

The 2% NG.F chart has posted solid gains of late after bouncing off of 2017 lows at $2.66 at the beginning of March. Since then, natural gas has reversed and added 13 consecutive boxes of X’s (approximately 26%) without a three-box reversal. Continuing on this trend, NG.F will look to break through resistance levels at $3.44, and $3.58 before taking another go at breaking to 2016 highs. WE can find support at $3.06 and $2.94.

With an SMAX of 9 out of 10, NG.F is showing near-term strength versus the asset classes.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For further discussion on this relationship and what it means for your portfolios, you can contact our customer support at 1-877-668-1332 or siateam@siacharts.com.

Copyright © SIACharts.com