by Benjamin Streed, CFA, Raymond James

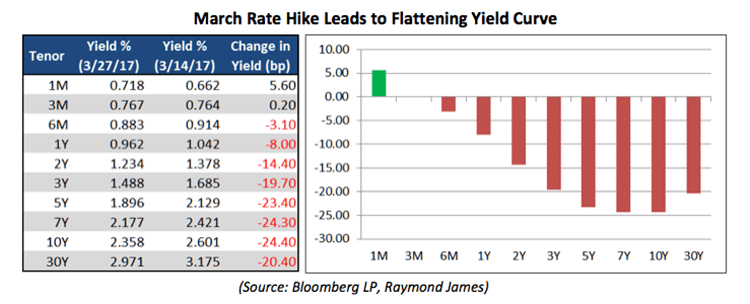

We find ourselves at the end of March, having seen two rate hikes in the last four months, and yet the financial markets seem to at an interesting inflection point. For all the hoopla/euphoria that came out of the November election regarding stimulus and legislative changes to healthcare, the markets are finally waking up to the cold truth that Washington often moves slowly, if at all. As we are all aware, gridlock is a very real thing when it comes to the legislature and it seems that after taking a few months off, markets are just now waking up to this fact. As of Monday morning here is where we stand: the 10-year Treasury yield sits at 2.35%, down a whopping 25 basis points (bp) since March 14th, the day before the Fed’s rate hike. Despite two moves from the Fed, the yield on the 10-year now sits only ~100bp above the all-time low of 1.32% set last July. 5-year breakeven spreads, the difference between nominal and inflation-linked Treasuries, now sit at only 194bp, down from the high of 206bp set in February amidst the Trump “reflation trade” that saw many in the markets preparing for a quick ramp up in US growth, inflation, wages, investment gains…or basically anything “good” you could come up with. The yield curve in the US has flattened considerably in the last few weeks, typically a sign that bond markets are becoming a bit more skeptical of faster economic growth and/or higher interest rates (see table below). The 2s/10s and 2s/30s spreads, or difference in yield between 10-year and 2-year or 30- and 2-year Treasuries now sits at only 112bp and 173bp respectively, the lowest since the election as longer-term growth and inflation are called into question.

Another way to look at inflation expectations is the difference between 10- and 2-year inflation breakevens, or how much is the market expecting inflation to pick up between 2019 (2 years out) and 2027 (ten years out)? Well, that metric stands at a paltry 25bp, well below the post-election high of 65bp and is not even in the realm of the >150bp spread we’ve seen intermittently in the post-recession environment. Meanwhile, amidst last week’s nonstop media coverage of the proposed healthcare bill, markets made a clear statement on inflation: the $11 billion TIPS auction on Thursday showed the weakest demand since January 2016 (well before the election). This week, keep an eye on auctions of 5-year ($34 billion) and 7-year ($28 billion) of Treasury notes to see how markets react to the recent “risk off” trading in the secondary markets.

Copyright © Raymond James