by Lance Roberts, Clarity Financial

“Price Is What You Pay. Value Is What You Get.” – Warren Buffett

One of the hallmarks of very late stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90’s if you were buying shares of Berkshire Hathaway stock it was mocked as “driving Dad’s old Pontiac.” In 2007, valuation metrics were being dismissed because the markets were flush with liquidity, interest rates were low and “Subprime was contained.”

Today, we once again see repeated arguments as to why “this time is different” because of the “Central Bank put.”

First, let me just say that I have tremendous respect for the guys at HedgEye. They are insightful and thoughtful in their analysis and well worth your time to read. However, a recent article by HedgEye made a very interesting point that bears discussion.

“Meanwhile, a number of stubborn bears out there continue to make the specious argument that the U.S. stock market is expensive. ‘At 22 times trailing twelve-month earnings,’ they ask, ‘how on earth could an investor possibly buy the S&P 500?’

The answer is simple, really. Valuation is not a catalyst.”

They are absolutely right.

Valuations are not a catalyst.

They are the fuel.

But the debate over the value, and current validity, of the Shiller’s CAPE ratio, is not new. Critics argue that the earnings component of CAPE is just too low, changes to accounting rules have suppressed earnings, and the financial crisis changed everything. This was a point made by Wade Slome previously:

“If something sounds like BS, looks like BS, and smells like BS, there’s a good chance you’re probably eyeball-deep in BS. In the investment world, I encounter a lot of very intelligent analysis, but at the same time I also continually step into piles of investment BS. One of those piles of BS I repeatedly step into is the CAPE ratio (Cyclically Adjusted Price-to-Earnings) created by Robert Shiller.”

Let’s break down Wade’s arguments against Dr. Shiller’s CAPE P/E individually.

Shiller’s Ratio Is Useless?

Wade states:

“The short answer…not very. For example, if investors followed the implicit recommendation of the CAPE for the periods when Shiller’s model showed stocks as expensive they would have missed a more than quintupling (+469% ex-dividends) in the S&P 500 index. Over a shorter timeframe (2009 – 2014) the S&P 500 is up +114% ex-dividends (+190% since March 2009).”

Wade’s analysis is correct. However, the problem is that valuation models are not, and were never meant to be, “market timing indicators.” The vast majority of analysts assume that if a measure of valuation (P/E, P/S, P/B, etc.) reaches some specific level it means that:

- The market is about to crash, and;

- Investors should be in 100% cash.

This is incorrect.

Valuation measures are simply just that – a measure of current valuation. More, importantly, it is a much better measure of “investor psychology” and a manifestation of the “greater fool theory.”

If you “overpay” for something today, the future net return will be lower than if you had paid a discount for it.

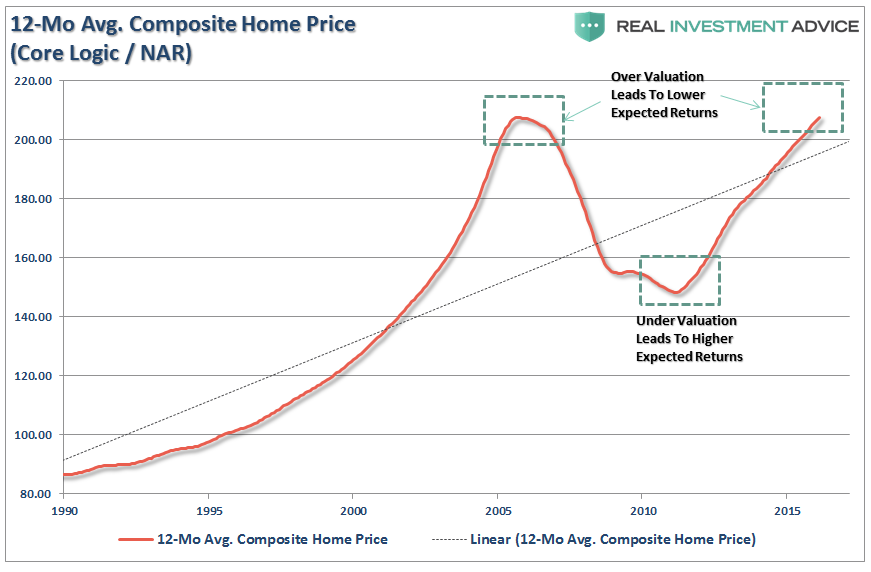

Think about housing prices for a moment as shown in the chart below.

There are two things to take away from the chart above in relation to valuation models. The first is that if a home was purchased at any time (and not sold) when the average 12-month price was above the long-term linear trend, the forward annualized returns were significantly worse than if the home was purchased below that trend. Secondly, if a home was purchased near the peak in valuations, forward returns are likely to be extremely low, if not negative, for a very long time.

This is the same with the financial markets. When investors “pay” too much for an investment, future returns will suffer. “Buy cheap and sell dear” is not just some Wall Street slogan printed on a coffee mug, but a reality of virtually all of the great investors of our time in some form or another.

Cliff Asness discussed this issue in particular stating:

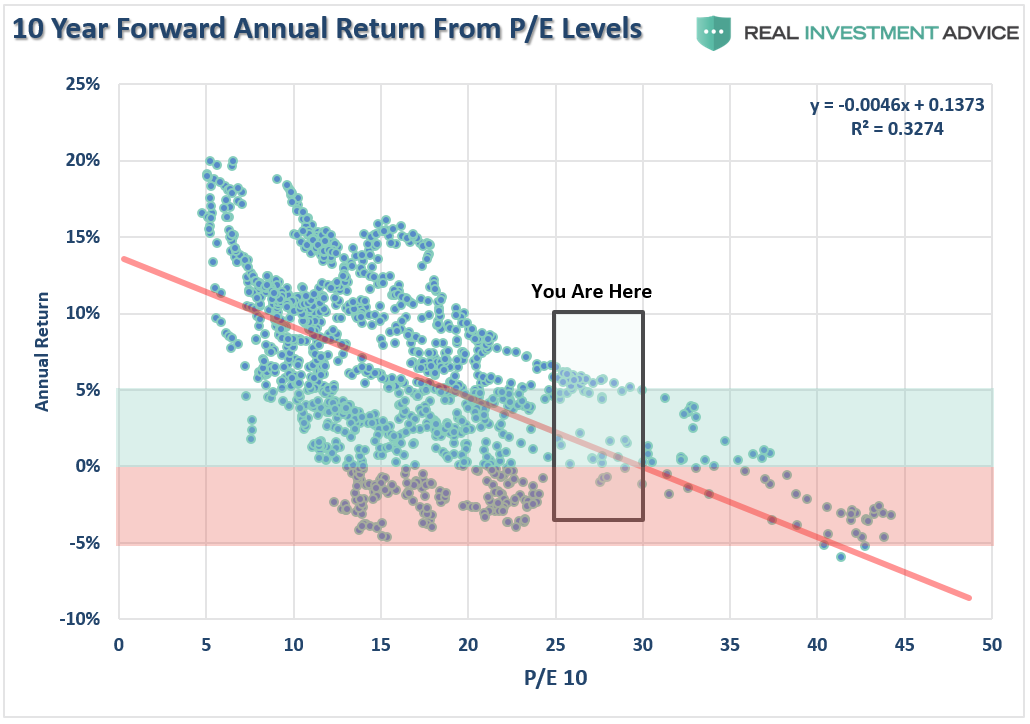

“Ten-year forward average returns fall nearly monotonically as starting Shiller P/E’s increase. Also, as starting Shiller P/E’s go up, worst cases get worse and best cases get weaker.

If today’s Shiller P/E is 22.2, and your long-term plan calls for a 10% nominal (or with today’s inflation about 7-8% real) return on the stock market, you are basically rooting for the absolute best case in history to play out again, and rooting for something drastically above the average case from these valuations.”

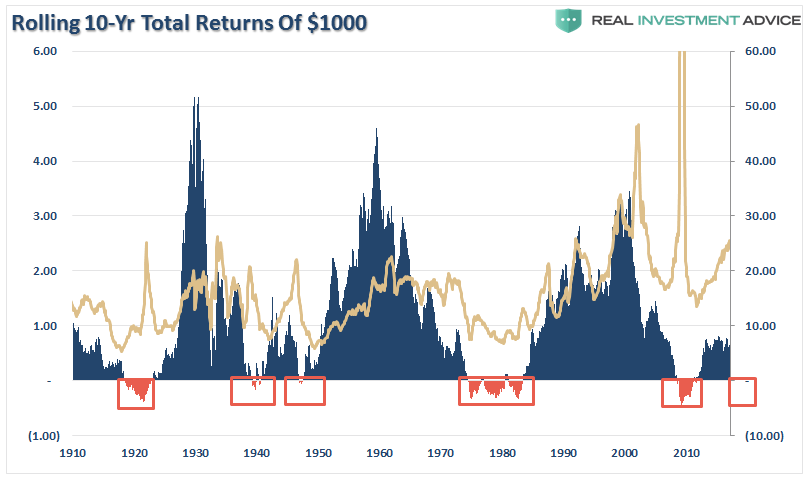

We can prove that by looking at forward 10-year total returns versus various levels of PE ratios historically.

Asness continues:

“It [Shiller’s CAPE] has very limited use for market timing (certainly on its own) and there is still great variability around its predictions over even decades. But, if you don’t lower your expectations when Shiller P/E’s are high without a good reason — and in my view, the critics have not provided a good reason this time around — I think you are making a mistake.”

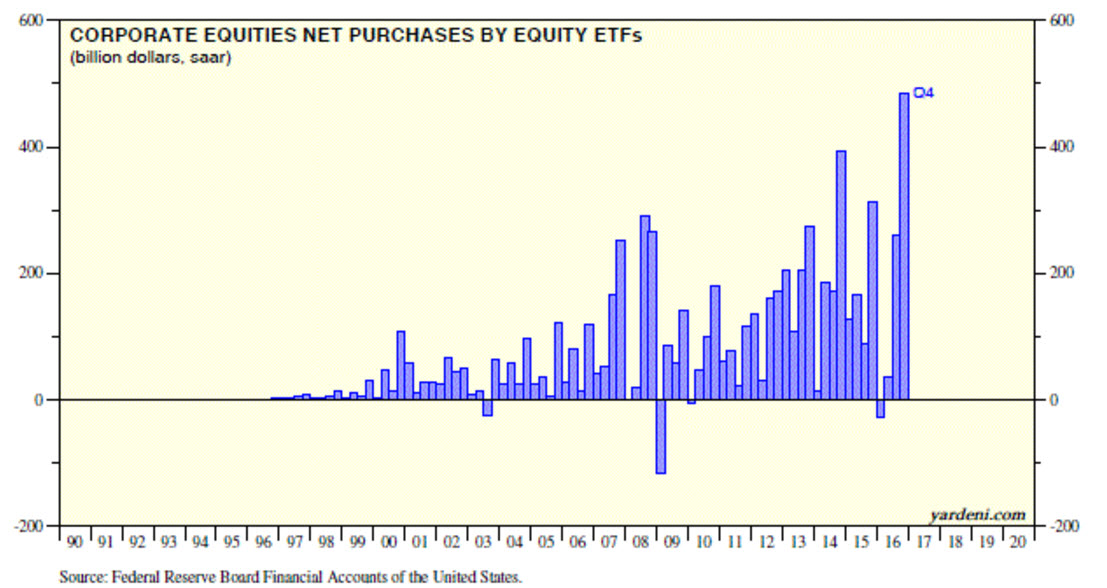

While, Wade is correct that investors who got out of the market using Shiller’s P/E ratio would have missed the run in the markets from 2009 to present, those same individuals most likely sold at the bottom of the market in 2008 and only recently began to return as shown by net equity inflows below.

In other words, they missed the “run up” anyway. Investor psychology has more to do with long-term investment outcomes than just about anything else.

What valuations tell us, is that at current levels investors are strictly betting on there always being someone to pay more in the future for an asset than they paid today.

Huckster Alert…

It is not surprising that due to the elevated level of P/E ratios since the turn of the century, which have been fostered by one financial bubble after the next due to Federal Reserve interventions, there has been a growing chorus of views suggesting that valuations are no longer as relevant. There is also the issue of the expanded use of forward operating earnings.

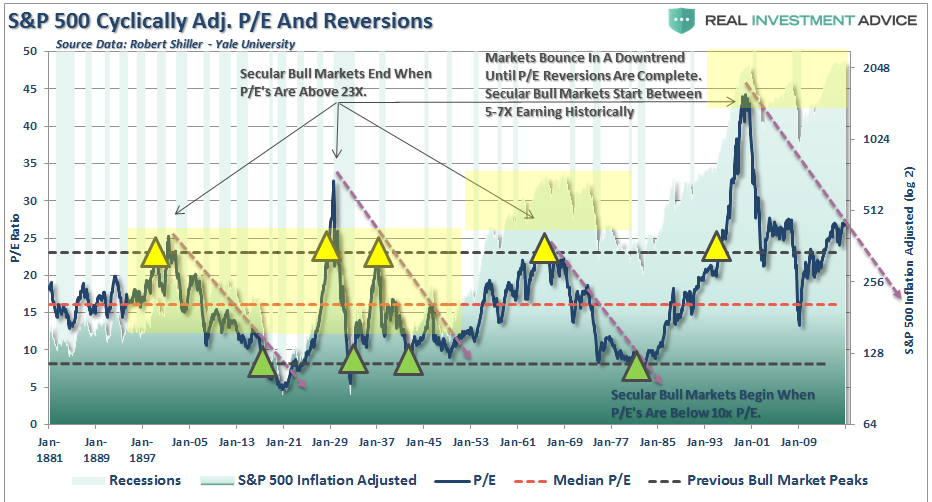

First, it is true that P/E’s have been higher over the last decade due to the aberration in prices versus earnings leading up to the 2000 peak. However, as shown in the chart below, the “reversion” process of that excessive overvaluation is still underway. It is likely the next mean reverting event will complete this process.

Cliff directly addressed the issue of the abuse of forward operating earnings.

“Some outright hucksters still use the trick of comparing current P/E’s based on ‘forecast’ ‘operating’ earnings with historical average P/E’s based on total trailing earnings. In addition, some critics say you can’t compare today to the past because accounting standards have changed, and the long-term past contains things like World Wars and Depressions. While I don’t buy it, this argument applies equally to the one-year P/E which many are still somehow willing to use. Also, it’s ironic that the chief argument of the critics, their big gun that I address exhaustively above [from the earlier post], is that the last 10 years are just too disastrous to be meaningful (recall they are actually mildly above average).”

Cliff is correct, of course, as it is important to remember that when discussing valuations, particularly regarding historic over/undervaluation, it is ALWAYS based on trailing REPORTED earnings. This is what is actually sitting on the bottom line of corporate income statements versus operating earnings, which is “what I would have earned if XYZ hadn’t happened.”

Beginning in the late 90’s, as the Wall Street casino opened its doors to the mass retail public, use of forward operating earning estimates to justify extremely overvalued markets came into vogue. However, the problem with forward operating earning estimates is they are historically wrong by an average of 33%. To wit:

“The biggest single problem with Wall Street, both today and in the past, is the consistent disregard of the possibilities for unexpected, random events. In a 2010 study, by the McKinsey Group, they found that analysts have been persistently overly optimistic for 25 years. During the 25-year time frame, Wall Street analysts pegged earnings growth at 10-12% a year when in reality earnings grew at 6% which, as we have discussed in the past, is the growth rate of the economy.”

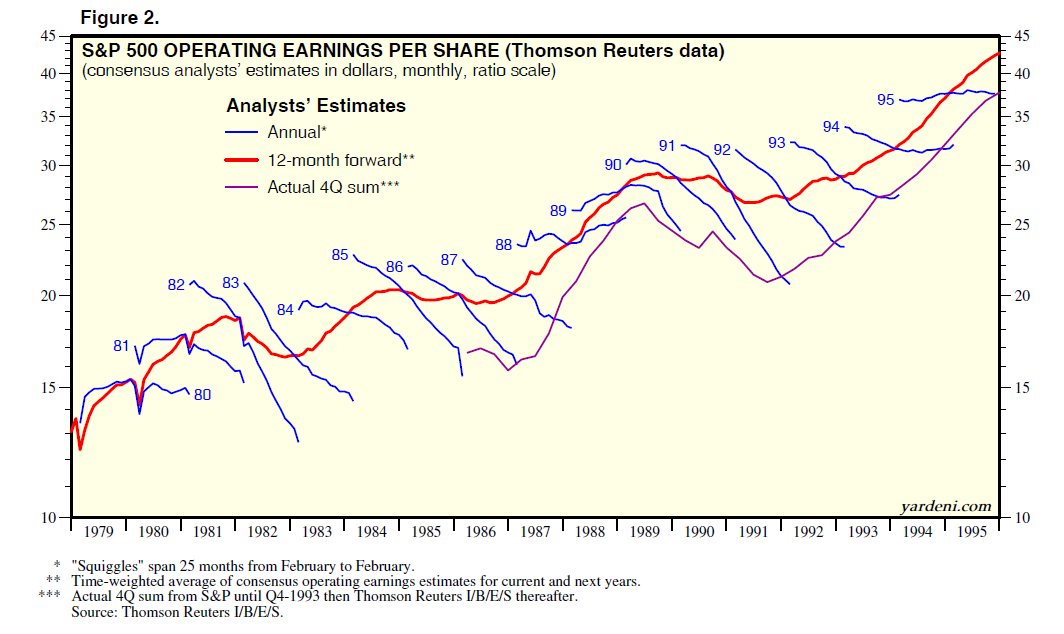

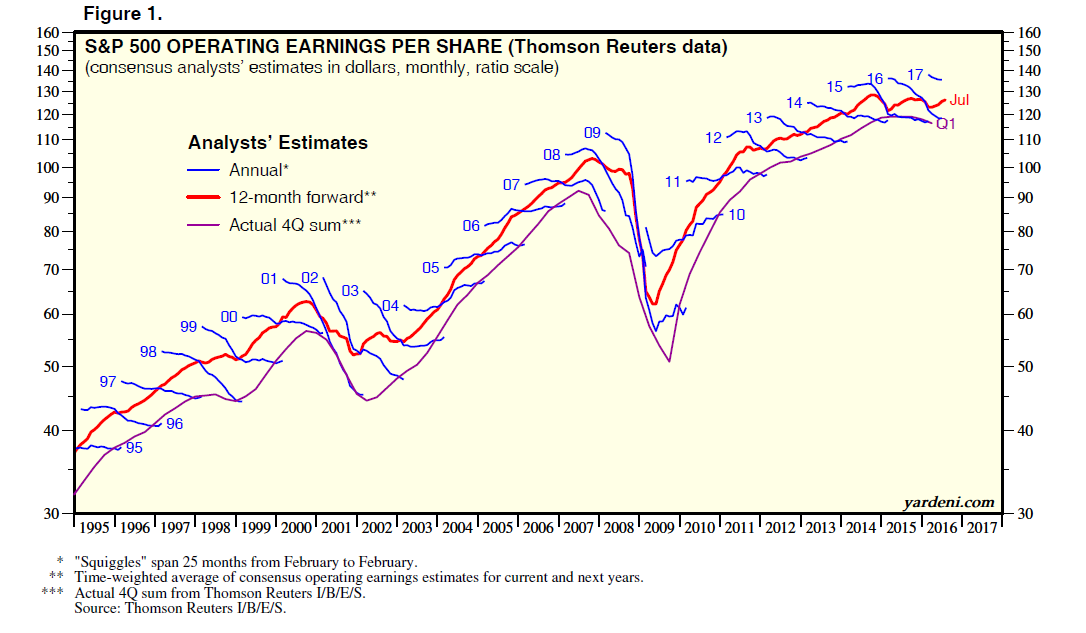

Ed Yardeni published the two following charts which shows analysts are always overly optimistic in their estimates.

“This is why using forward earnings estimates as a valuation metric is so incredibly flawed – as the estimates are always overly optimistic roughly 33% on average. Furthermore, the reason that earnings only grew at 6% over the last 25 years is because the companies that make up the stock market are a reflection of real economic growth. Stocks cannot outgrow the economy in the long term…remember that.

The McKenzie study noted that on average ‘analysts’ forecasts have been almost 100% too high’ and this leads investors into making much more aggressive bets in the financial markets.”

The consistent error rate in forward earnings projections makes using such data dangerous when making long-term investments. This is why trailing reported earnings is the only “honest” way to approach valuing financial markets. Importantly, long-term investors should be abundantly aware of what the future expected returns will be when buying into overvalued markets. Bill Hester recently wrote a very good note in this regard in response to critics of Shiller’s CAPE ratio and future annualized returns:

“We feel no particular obligation defend the CAPE ratio. It has a strong long-term relationship to subsequent 10-year market returns. And it’s only one of numerous valuation indicators that we use in our work – many which are considerably more reliable. All of these valuation indicators – particularly when record-high profit margins are accounted for – are sending the same message: The market is steeply overvalued, leaving investors with the prospect of low, single-digit long-term expected returns.“

As clearly stated throughout this missive, fundamental valuation metrics are not, and were never meant to be, market timing indicators. This was a point made by Dr. Robert Shiller himself in an interview with Henry Blodgett:

“John Campbell, who’s now a professor at Harvard, and I presented our findings first to the Federal Reserve Board in 1996, and we had a regression, showing how the P/E ratio predicts returns. And we had scatter diagrams, showing 10-year subsequent returns against the CAPE, what we call the cyclically adjusted price-earnings ratio. And that had a pretty good fit. So I think the bottom line that we were giving – and maybe we didn’t stress or emphasize it enough – was that it’s continual. It’s not a timing mechanism, it doesn’t tell you – and I had the same mistake in my mind, to some extent — wait until it goes all the way down to a P/E of 7, or something.”

Currently, there is clear evidence that future expectations should be significantly lower than the long-term historical averages.

Do current valuation levels suggest you should be all in cash? No.

However, it does suggest that a more cautious stance to equity allocations and increased risk management will likely offset much of the next “reversion” when it occurs.

My job is to protect investment capital from major market reversions and meet investment returns anchored to retirement planning projections. Not paying attention to rising investment risks, or adjusting for lower expected future returns, are detrimental to both of those objectives.

Next week, I will introduce a modified version of the Shiller CAPE ratio which is more constructive for shorter-term outlooks.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial