by Richard Turnill, Global Chief Investment Strategist, Blackrock

The Federal Reserve has engineered a turnaround in March hike expectations, but Richard explains why we do not see gradually rising rates derailing reflation for now.

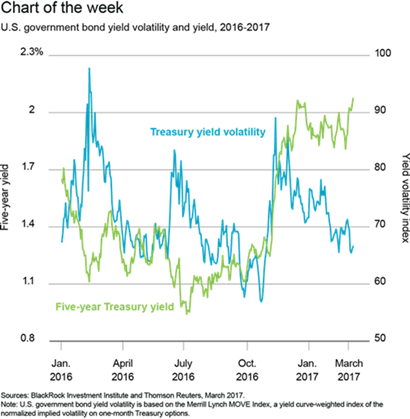

The Federal Reserve has engineered a turnaround in March rate rise expectations without significantly disturbing markets. This is no easy feat – a quickening pace of rate normalization in the past has often led to spikes in volatility. In contrast, Treasury yield volatility has recently headed lower – even as five-year Treasury yields have risen along with expectations of a March rate increase. See the chart below.

Why are markets unfazed? It’s a sign of confidence the U.S. economy can now stand on its own two feet with less monetary accommodation, we believe.

Bond markets too complacent?

A growing global reflationary trend implies less economic vulnerability to Fed tightening. Also, we do not see the rising likelihood of a March hike as a meaningful shift in the Fed’s gradualist approach to tightening. Plus, structural trends – such as modest nominal growth, aging populations and low rates in Europe and Japan – should cap any rise in long-term U.S. yields. Yet we see reasons for caution. Rock-bottom volatility across asset classes may reflect market complacency. Bond markets are pricing in fewer rate increases than signaled by the Fed.

A stronger economy may justify a faster Fed pace. Yet an overshoot in market expectations of monetary tightening could cause a disruptive rise in the U.S. dollar and tighten global financial conditions. Potential triggers of an overshoot include unexpectedly hawkish Fed rhetoric or anticipation of a growth boost from large tax cuts. Higher rates may also eventually undermine risk assets’ valuations.

For now, the reflationary backdrop and benign market reaction to a likely March Fed move reinforce our preferences for equity over debt, and credit over government bonds. Elevated valuations keep us cautious in fixed income, as tightening credit spreads offer little cushion against rising rates in many parts of the market. We favor investment grade credit and Treasury Inflation Protected Securities (TIPS). Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owners.