by Ryan Detrick, LPL Research

Saint Patrick was a fifth-century missionary and bishop in Ireland. By the seventh century he was revered as the patron saint of Ireland. His death occurred on March 17, and for this reason we celebrate his life, Irish heritage, and pretty much the color green on this day.

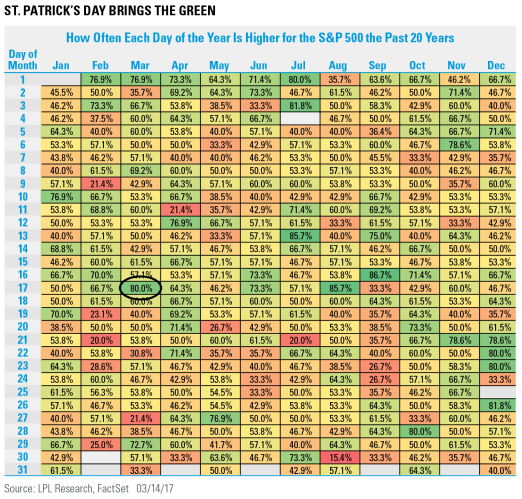

Per Ryan Detrick, Senior Market Strategist, “Although it is purely random, you have to find some humor in the fact that a day that celebrates the color green is also historically a strong day for equities. In fact, going back 20 years, on March 17 the stock market has been higher 80% of the time – one of the most likely days to finish green out of the entire year. Luck of the Irish indeed!”

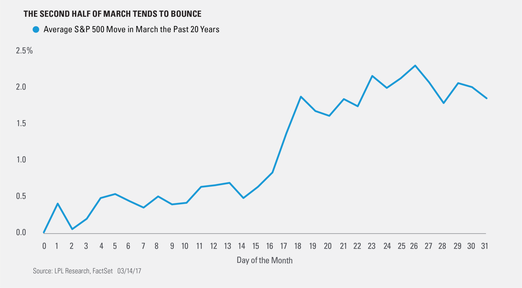

As we noted at the start of the month, March has been the strongest month for the S&P 500 Index on average in each of the past 10 years and one of the strongest the past 20 years, though the majority of those gains have taken place during the second half of the month (right in time for the NCAA Tournament).

Where could you potentially find some green in your investments here and now? Technology, financials, and bank loans all look attractive. Here are some quick bullets on why we like each:

Technology – Strong fourth quarter 2016 earnings, higher business confidence (possibly lifted by expected corporate tax reform), technology’s role as a productivity enabler, and valuations are all supportive. Trade policy is the big risk here.

Financials – Steepening yield curve, deregulation, expanded credit access, strong fourth quarter 2016 earnings, and positive revisions are all supportive. The sector is consolidating recent gains.

Bank loans – Libor is elevated, making floating rate securities (like bank loans) more attractive. Should interest rates continue to rise, floating rates may perform better than longer-term bonds – as they are less sensitive to rising rates.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Bank loan portfolios primarily invest in floating-rate bank loans instead of bonds. In exchange for their credit risk, these loans offer high interest payments that typically float above a common short-term benchmark such as the London interbank offered rate, or Libor.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-590701 (Exp. 3/18)

Copyright © LPL Research