Credit Risk? Interest-Rate Risk? Both Are Critical - Context

by Fixed Income AllianceBernstein

February 21, 2017

Investors often ask us which of the two primary bond market risks—interest rate or credit—they should focus on in 2017. Our answer? Both of them—and the interaction between the two.

Fixed-income investors know, of course, that they must manage both types of risk. And both pay off over time, because investors who take more risk are compensated with higher returns.

But usually, the two types of risks don’t pay at the same time. After the global financial crisis, for instance, the most important variable for bond markets was central bank policy. With inflation having evaporated and interest rates at record lows, interest-rate risk—also known as duration risk—wasn’t much of a concern. Investors could afford to focus more intently on credit quality.

That’s not true anymore. Central banks are still important, but they’re one factor among many. And they’re not just pumping liquidity into the system anymore. The Federal Reserve has already hiked rates twice and the Bank of Japan is now focused on targeting the yield curve. In addition, governments are moving toward more expansionary fiscal policies, which could stoke inflation—particularly in places like the US, where the economy is at full employment.

At the same time, valuations look rich in many corporate bond markets, and credit cycles are diverging across sectors and regions, with some nearing the end of a multiyear expansion.

In other words, interest-rate and credit risk are equally important today. Both require constant attention. In a way, that’s a good thing. Markets are healthier when there are multiple variables that can influence prices. But they’re also more volatile and less predictable.

Balancing Out Your Risks

That’s where a barbell approach can come in handy. Barbell strategies balance risk by pairing interest-rate-sensitive government bonds with high-yielding credit assets.

They work well because they blend asset classes whose returns are usually negatively correlated; government bonds—known as risk-mitigating assets—tend to do well when growth slows, while return-seeking assets such as high-yield corporates shine when growth accelerates and interest rates rise.

Strong returns on one side of the barbell can outweigh weakness on the other. For instance, during the global financial crisis, a rally in government bonds compensated investors for weakness in financial-sector corporate bonds and other credit assets.

Just as importantly, the negative correlation between the two lets investors rebalance their portfolios by selling the outperformers on one side of the barbell and buying the underperforming bonds on the other.

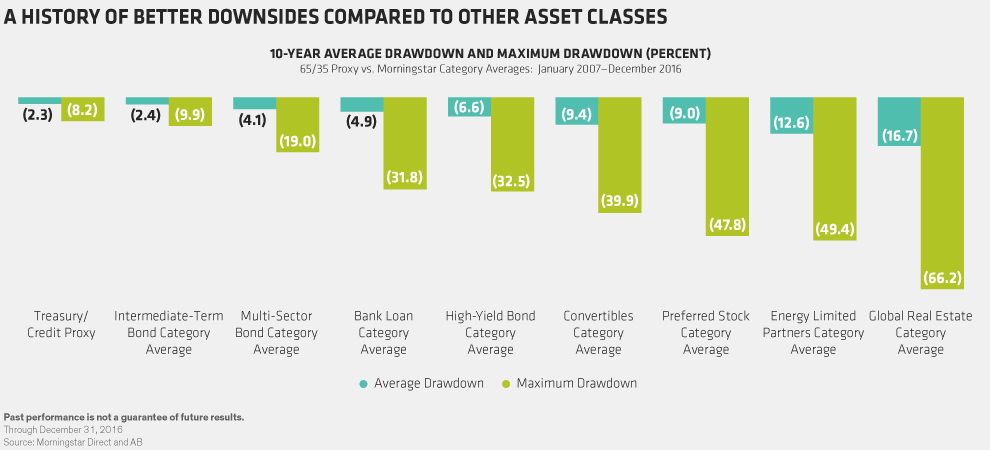

Over time, we’ve found that a 65/35 split between risk-mitigating assets such as global treasuries and return-seeking ones such as high yield or emerging-market debt can minimize large drawdowns (Display) while still providing a high and steady stream of income.

Occasionally the prices of government bonds and credit rise or fall at the same time. But such occurrences are rare and usually brief.

Diversification Matters

Another reason barbells work well is that they provide exposure to different sectors, industries and regions, as well as varying economic, interest-rate and credit cycles around the world.

This diversification is critical now that growth rates and central bank policies are starting to diverge. The ability to use different sectors—high-yield bonds, emerging-market debt, securitized assets—gives managers more levers to pull as they search for high-income opportunities.

Staying Flexible—and Digging Deep

Of course, that doesn’t mean investors can decide on a static allocation and simply let it ride. If the assets on one side of the barbell look expensive, a manager should be able to change the balance and lean toward lower-priced opportunities on the other side. If asset prices on both sides of the barbell seem high, she may need to reduce overall portfolio risk.

It’s not hard to imagine such a scenario today. If the US economy were to grow more quickly than expected, the Fed could start raising rates at a faster pace, which would hurt interest-rate-sensitive assets. At the same time, a faster-than-expected rise in rates could spell trouble for CCC-rated “junk” bonds, which soared by some 30% in 2016—nearly double the broader high-yield market—and look expensive relative to history.

Knowing which way to lean requires a deep understanding of the interest-rate and credit cycles around the world and how they interact. And on a security-specific level, the ability to carry out intensive credit analysis on each security lets managers find the winners and—more importantly—avoid the losers.

Bond investors need to be exposed to both interest-rate risk and credit risk to capture fixed income’s two primary sources of return. Striking the right balance between the two increases the odds of success.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein