by Don Vialoux, Timing the Market

Pre-opening Comments for Tuesday February 14th

U.S. equity index futures were mixed this morning. S&P 500 futures were unchanged in pre-opening trade. Investors are waiting for comments on monetary policy before the Senate Banking Committee by Federal Reserve Chairperson Janet Yellen starting at 10:00 AM EST

Index futures were virtually unchanged following release of the January Producer Price Index at 8:30 AM EST. Consensus was a gain of 0.3% versus an increase of 0.3% in December. Actual was a gain of 0.6%. Excluding food and energy, consensus was an increase of 0.2% versus a gain of 0.2% in December. Actual was an increase of 0.4%.

Aetna (AET $122.05) and Humana (HUM $206.70) terminated their $34 billion merger proposal after 19 months. Aetna is to pay Humana a $1 billion termination fee.

Restaurant Brands (QSR US$53.80) is expected to open lower after RBC Capital lowered its target price to $54 from $59.

General Motors jumped $1.56 to $37.08 on news that Peugeot is in discussion to purchase General Motor’s European operations.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2017/02/13/stock-market-outlook-for-february-14-2017/

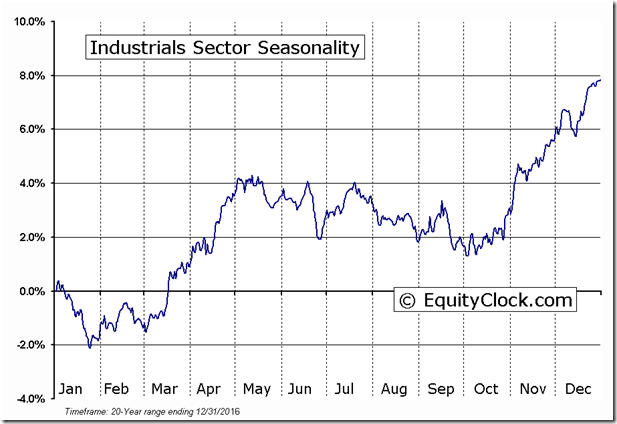

Note seasonality chart on the U.S. Financial Sector

Another Milestone

Number of followers receiving EquityClock’s StockTwits exceeded 34,000 for the first time yesterday. Previous milestone was 33,000 followers set on January 20th

Observations

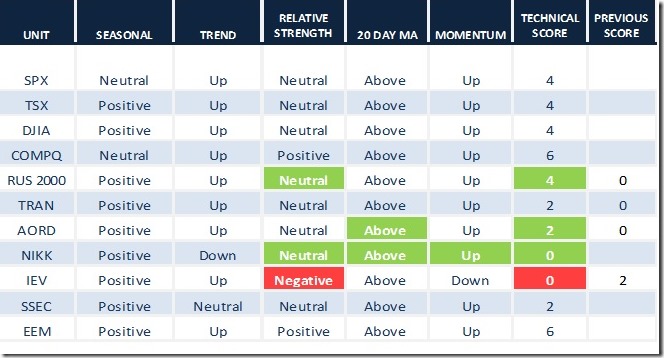

The Russell 2000 Index finally touched an all-time high, last of the broadly based U.S. equity indices to reach that level.

Strength by U.S. equity indices and related ETFs was triggered by exceptional gains by Chinese and European equity indices and related ETFs. Interesting move by iShares China large cap ETF above $38.40 completing a long term reverse Head & Shoulders pattern! Good for commodity sensitive stocks and ETFs!

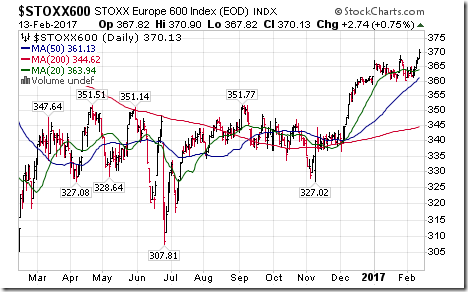

Also, nice move by the Euro Stoxx 600 Index to a 15 month high.

Surprising strength by the Uranium equity ETF!

StockTwits Released Yesterday @EquityClock

S&P 500 Index and NASDAQ Composite testing the upper limits to their year-old trading ranges.

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $BWA $TJX $ZION $MAS $MMM $NOC $RTN $ORCL $AA $MOS $NUE. No breakdowns.

Editor’s Note: After 10:00 AM EST, breakouts included PEP, CB, CINF, PKI, BA, AVP, TMK, AFL, DOW, AMT, CCI and STI. Breakdown: SWN

$MMM, a Dow Jones Industrial stock moved above $180.06 extending intermediate uptrend.

Editor’s Note: The stock subsequently moved above $180.50 to an all-time high.

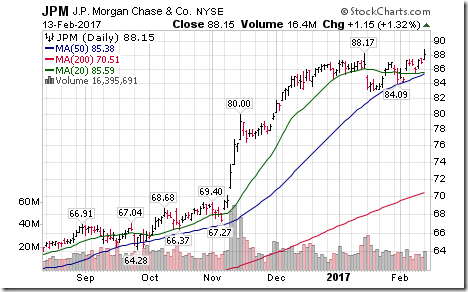

JP Morgan $JPM, a Dow Jones Industrial stock moved above $180.06 extending intermediate uptrend.

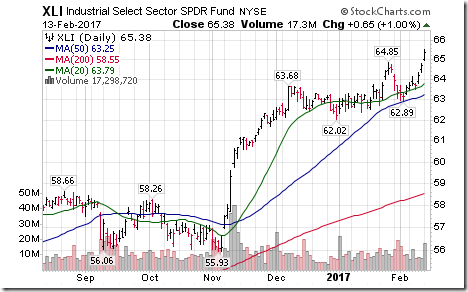

Industrial SPDRs $XLI moved above $64.85 to all-time high extending uptrend. ‘Tis the strength for strength to May.

Editor’s Note: Aerospace & Defense stocks are an important subsector in the Industrial sector.

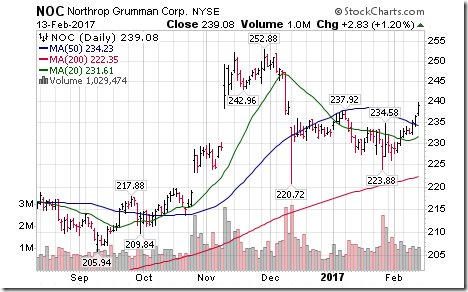

Aerospace & Defense stocks/ETF prominent on breakout list this morning: $RTN $NOC $PAA

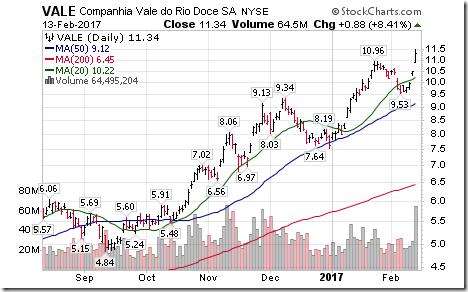

More base metal stocks breaking to new highs: $VALE, $RIO. ‘Tis the season for strength! $ZMT.CA

Cdn. Financials breaking to new highs: $TD.CA $IGM.CA $IAG.CA $LB.CA

Editor’s Note: Toronto Dominion Bank reached an all-time high. Add Power Corp and Power Financial to the list of breakouts.

Boeing, $BA, another Aerospace/Defense stock moved above $168.55 to all-time high extending intermediate uptrend.

Another Canadian base metal stock breaks to a new high: $FM.CA

Trader’s Corner

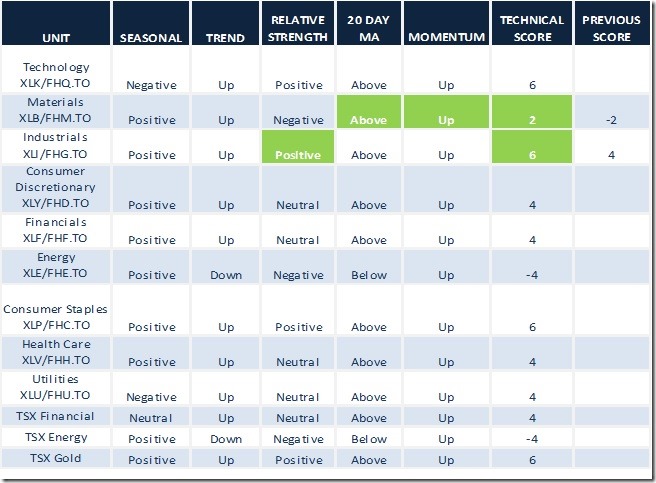

Daily Seasonal/Technical Equity Trends for February 13th 2017

Green: Increase from previous day

Red: Decrease from previous day

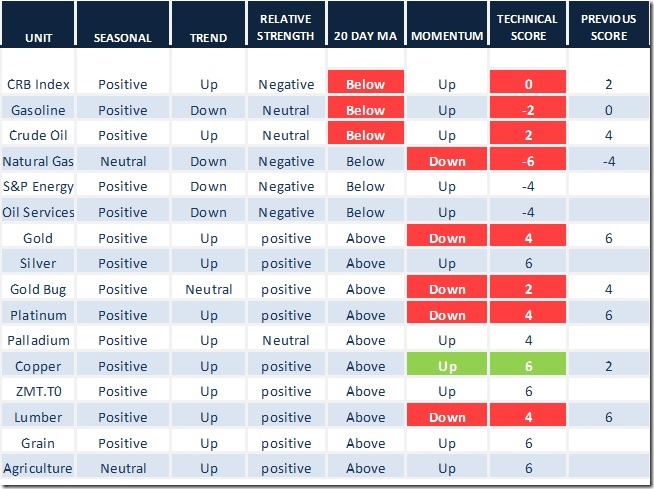

Daily Seasonal/Technical Commodities Trends for February 13th 2017

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for February 13th 2017

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer gained another 4.80 to 75.20 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer advanced 1.39 to 69.46 yesterday. It remains intermediate overbought.

Keith Richards’ Blog

A comment on Bombardier

Following is a link:

http://www.valuetrend.ca/bombardier-add-position/

Disclaimer: Seasonality and technical ratings offered in this report and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © Timing the Market