by Eric Bush, CFA, Gavekal Capital

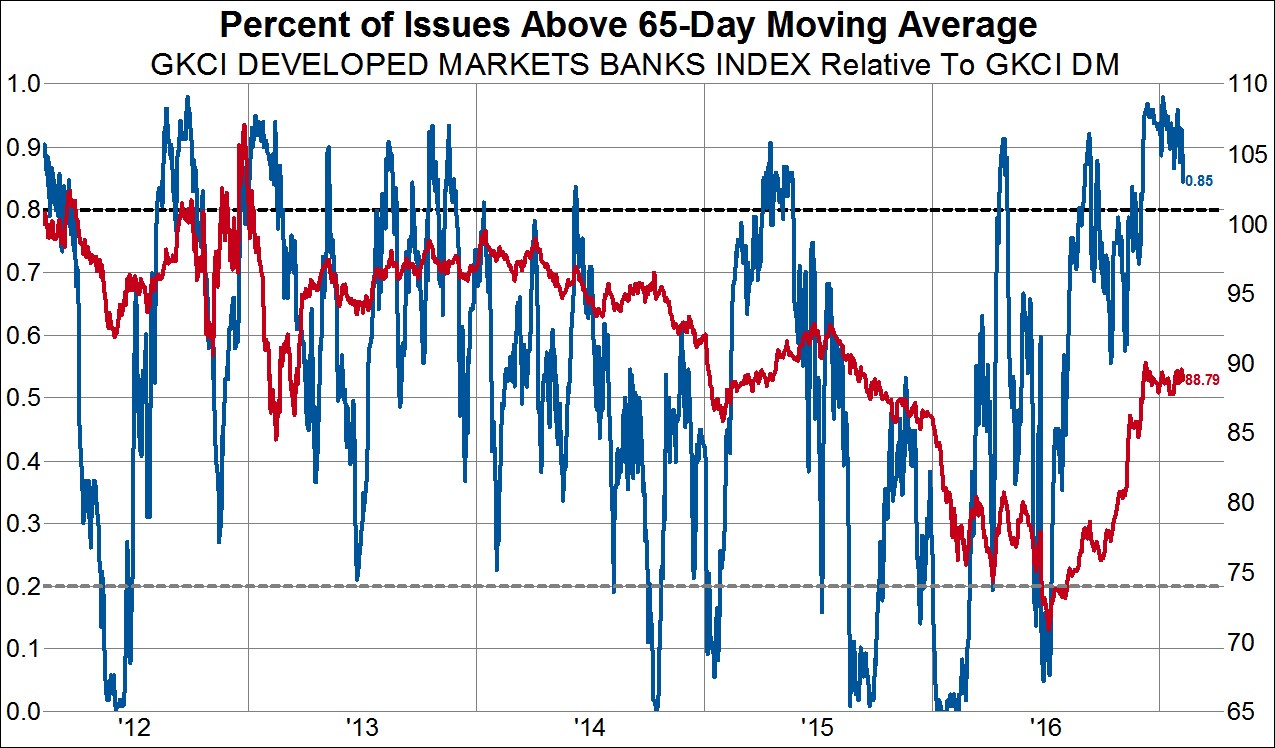

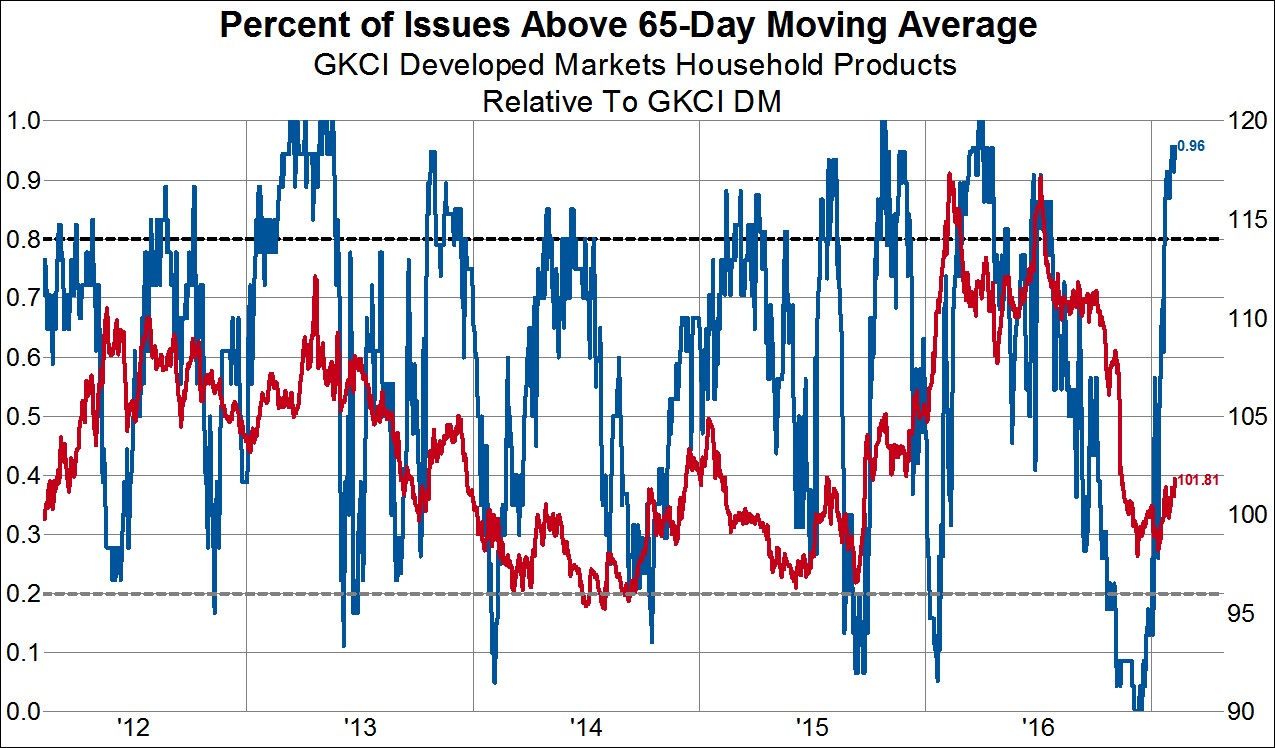

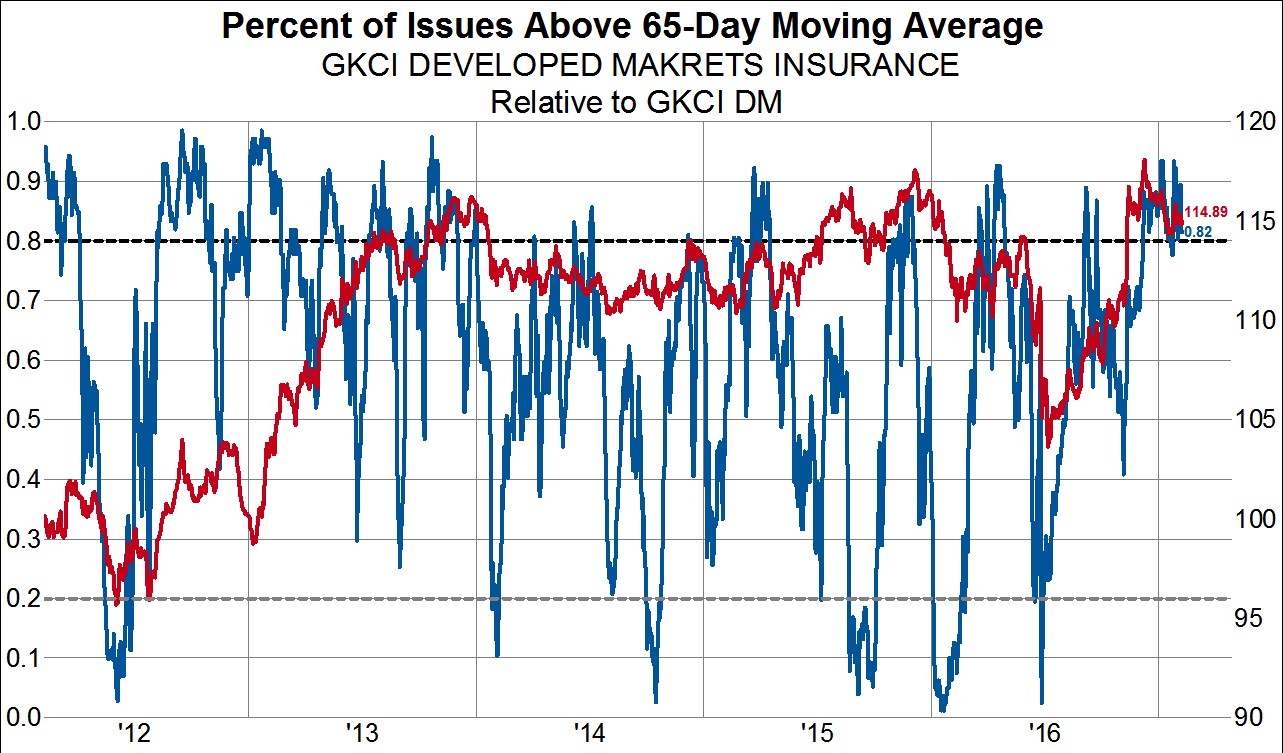

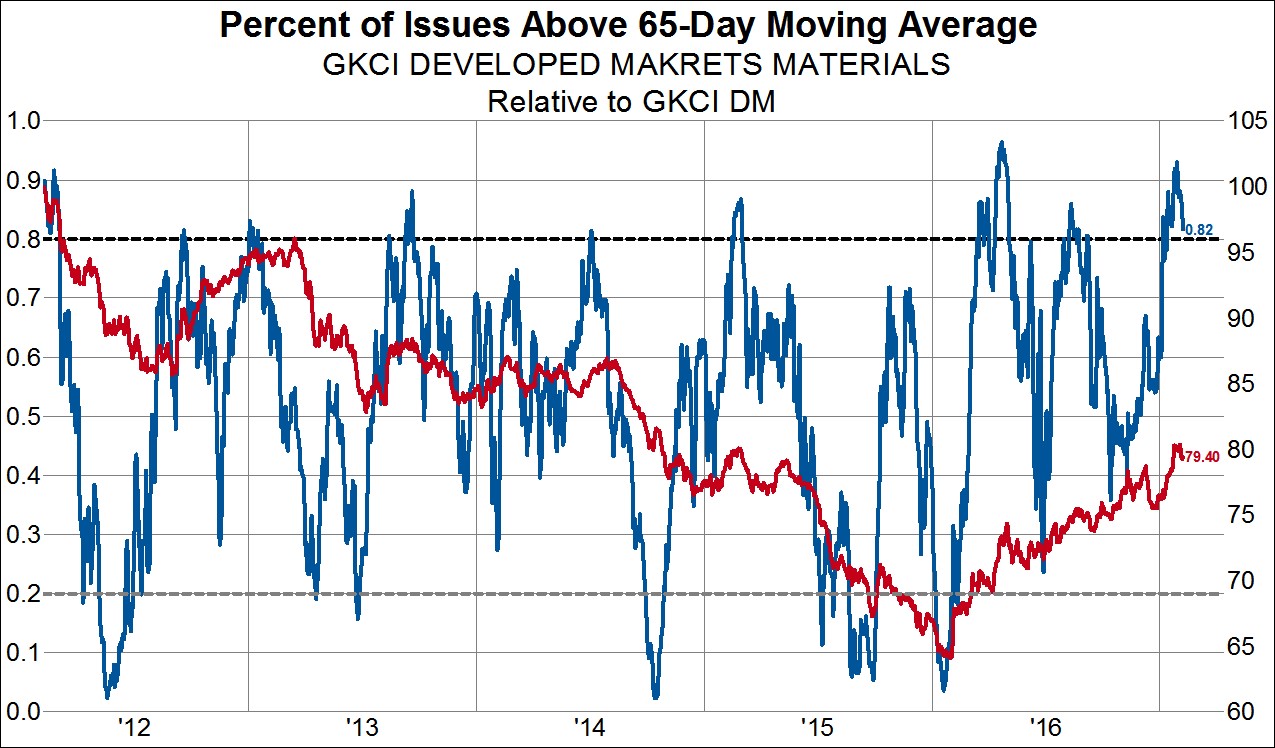

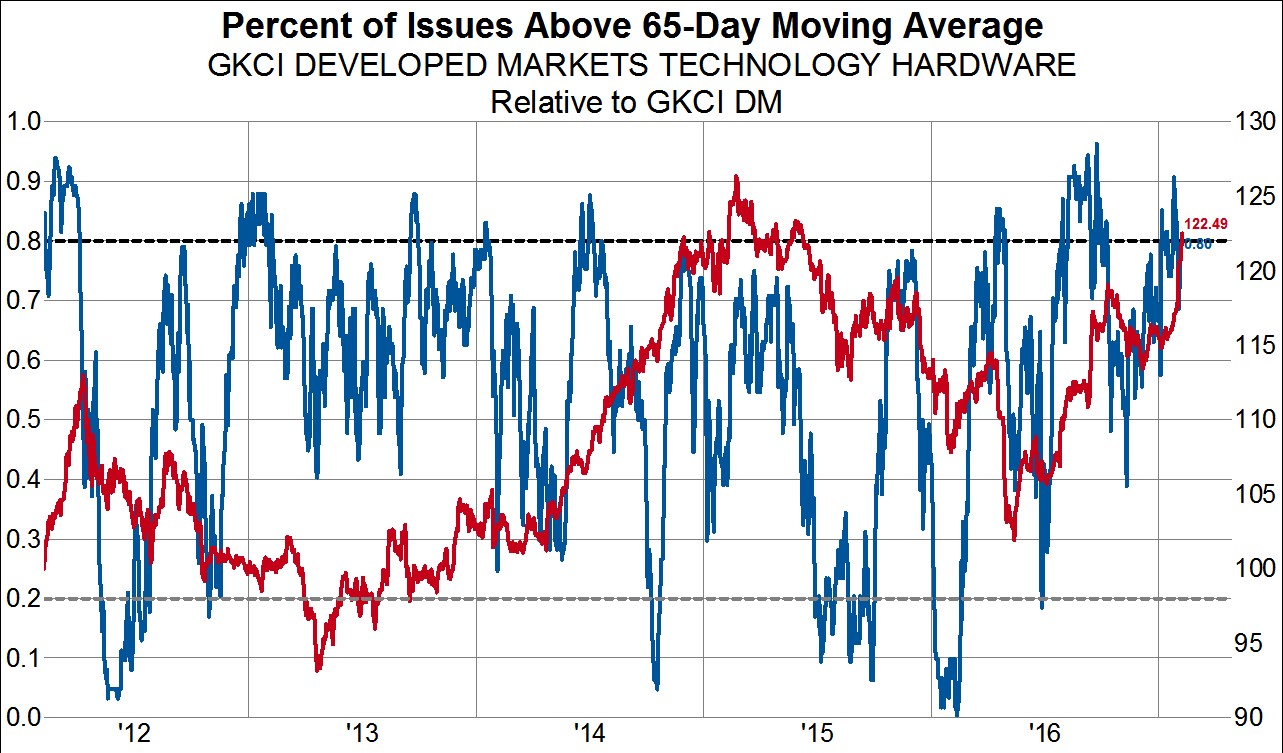

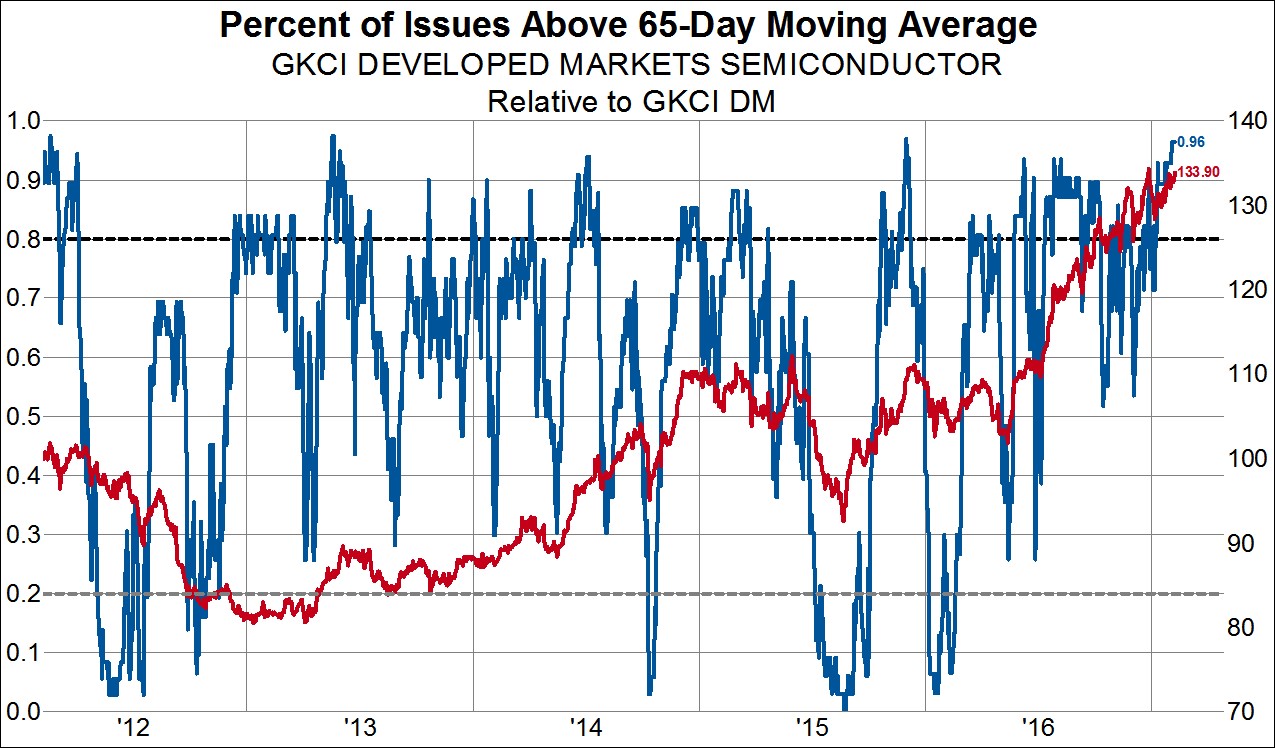

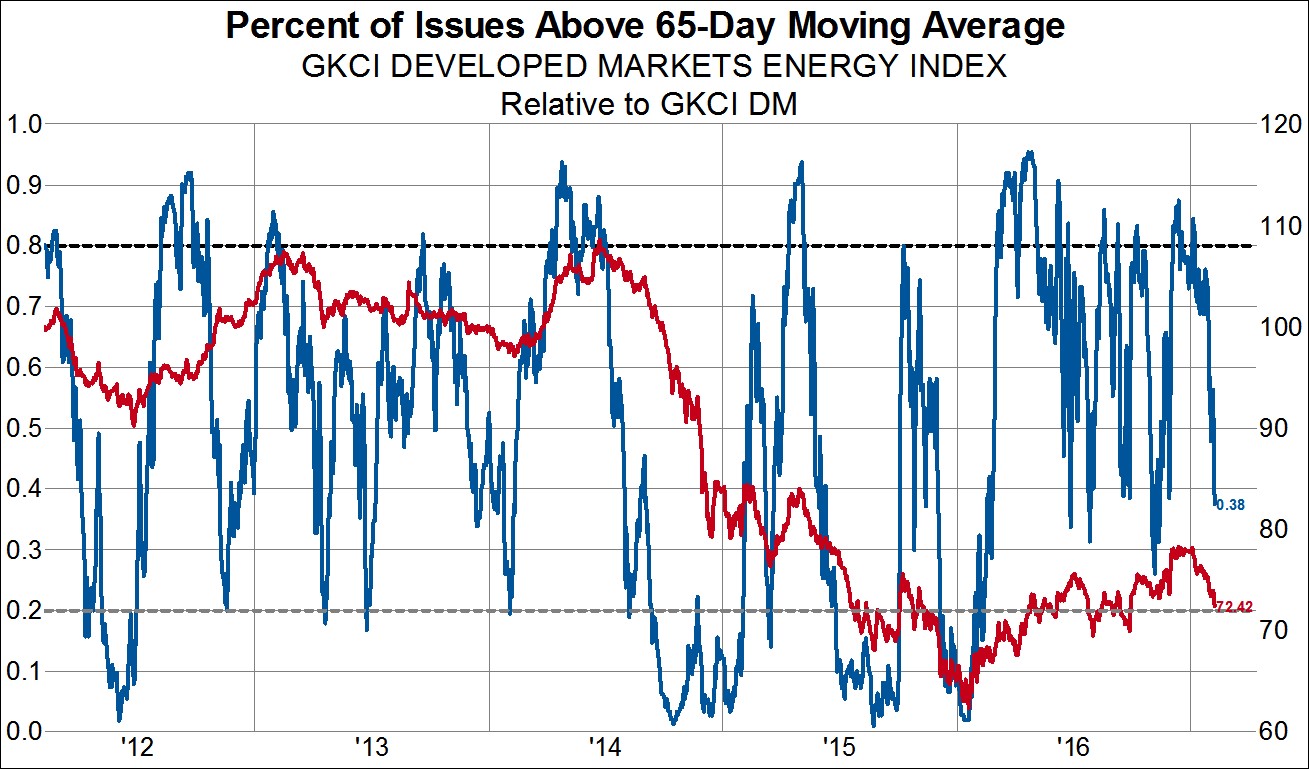

Out of 24 developed market industry group, six currently look overbought in the short-term. Two come from the financial sector, two come from the technology sector, one from consumer staples sector (surprisingly) and one from the materials sector. Below we plot the percentage of stocks trading above the 65-day moving average (blue line) and the relative performance of the industry group against the broader stock market over the past five years (red line). When less than 20% of stocks in an industry group are trading above the 65-day moving average, this is generally an indicator that the industry group is oversold in the short-term and most likely due for a bounce. Likewise, when more than 80% of stocks are trading above the 65-day moving average, this is in indicator that the group has become overbought and at the very least will need to consolidate. This is the circumstance for the first six industry groups below. So while a quarter of the industry groups appear to be overbought in the short-term, not a single industry group appears to be oversold. The energy industry group is the closest to approaching the oversold level as just 38% of energy stocks are trading above the 65-day moving average.

Copyright © Gavekal Capital