Download our 2017 Outlook for an around-the-globe look at the challenges and opportunities facing investors today. Highlighted below are some of the key insights from our Outlook.

Political, Economic Uncertainty Signal a World in Transition

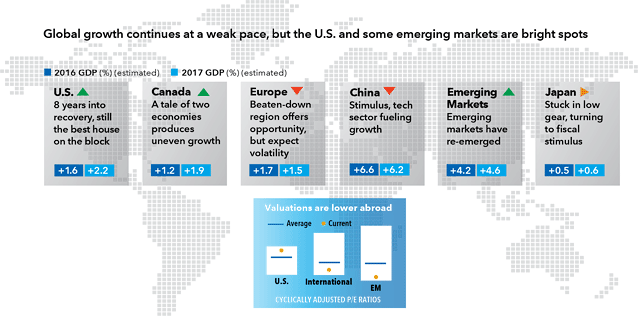

Sources: International Monetary Fund, World Economic Outlook Database, October 2016; MSCI; RIMES; Thomson Reuters Datastream. Cyclically adjusted P/E ratios are the index price divided by the average of the previous 10 years of inflation-adjusted earnings for the 10 years ended 11/30/16.

Investors enter 2017 facing a world in transition. The result of the U.S. presidential election — and the earlier Brexit vote in the U.K. — in part reflect potential populist sentiment that appears to be challenging the decades-long march of globalization. The uncertainty brought on by this political shift, paired with muted economic growth across much of the world, leaves many economies vulnerable to shocks. As the global economy continues along its low-growth path, there are a number of bright spots. Being selective is key.

The World Is a Fertile Hunting Ground for Dividends

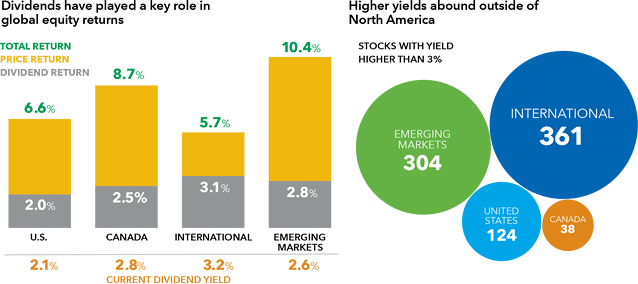

Sources: MSCI, Capital Group, RIMES as of 11/30/16. Market returns are average annual returns for the 15 years ended 11/30/16.

Dividends have historically played a significant role in driving total returns for equity investors. In fact, since 2001, dividends have accounted for more than half of average annual total returns in developed international markets. Given the expectation for low to moderate global growth in 2017 and beyond, dividends may take on even greater importance than they have since the start of the 21st century. For investors willing to look beyond North America, there are a significant number of companies in both developed and emerging markets with dividend yields greater than 3%.

Believe It or Not, Canadian and U.S. Rates Are Relatively High

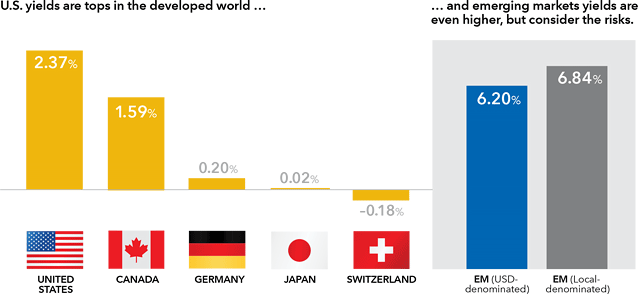

Source: Thomson Reuters Datastream as of 11/30/16. Developed market yields represent 10-year government bond yields.

Global investors searching for yield in a world of negative rates can look to the U.S. and Canada for somewhat better alternatives. However, as hedging costs have risen in the latter part of 2016, the potential pickup in additional yield has begun to decline. In addition to searching for yield abroad, investors can also find opportunities in higher yielding sectors, if comfortable with a higher risk profile. Emerging markets debt could offer such an opportunity. Being selective is the key.

A New Economy Emerges in Emerging Markets

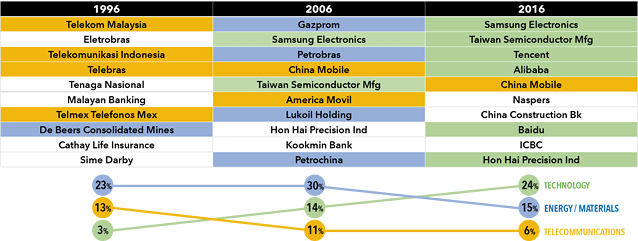

Sources: MSCI, RIMES as of 11/30/16. List represents the 10 largest companies by market capitalization in the MSCI Emerging Markets Index as of 12/31/96, 12/31/06, 10/31/16.

Times have changed in emerging markets. Materials and energy companies used to be key components of developing markets, but the focus has shifted to technology and consumer companies such as internet powerhouses Tencent and Alibaba. More recently, emerging markets are bouncing back after a tough stretch the past few years. Currencies have strengthened, commodity prices have stabilized and some structural reforms are taking root. Investors should take advantage of attractive emerging market valuations, but be prepared for volatility in 2017.

Get the Whole Story

Read our 2017 Outlook to learn more about the challenges and opportunities ahead for investors in a transitional world.

Copyright © Capital Group