by Russ Koesterich, Portfolio Manager, Blackrock

Volatility is low, but political uncertainty is high. Russ discusses what is causing this and whether it can continue.

Back before the holidays I highlighted what I thought was an unsustainable trend: low equity market volatility. Since then, U.S. equity market volatility has continued to decline; last week, the VIX Index—a commonly used measure of equity volatility—dropped below 11, the lowest level since the summer of 2014, before the U.S. travel ban-related selloffs sent the index climbing earlier this week to near 13. Still, the VIX is very low by historical standards, and this is occurring against a backdrop of considerable political uncertainty. What is causing this and can it continue?

Equity investors are enjoying an unusually tranquil start to the year, particularly in contrast to last January. Benign credit markets and a more robust economy deserve much of the credit. As I’ve written about in the past, equity markets rarely struggle when credit conditions are benign. This is why high yield spreads explain approximately 60% of the variation in the VIX. Back in late October high yield spreads were already low, at around 470 basis points (bps). Since then they’ve moved even lower, falling below 400 bps for the first time since the summer of 2014. As tighter spreads indicate more confidence, one would expect volatility to fall, albeit not quite to these levels.

The second factor driving volatility is economic growth, or more accurately, expectations for growth. This time last year investors were worried about another recession. Today they are raising their estimates for growth. Since the election, 2017 U.S. consensus growth estimates have increased by 0.2%. Most leading indicators suggest that despite political uncertainty, both U.S. and global growth are firming. Historically, expectations for accelerating growth generally coincide with lower volatility.

What’s the catch?

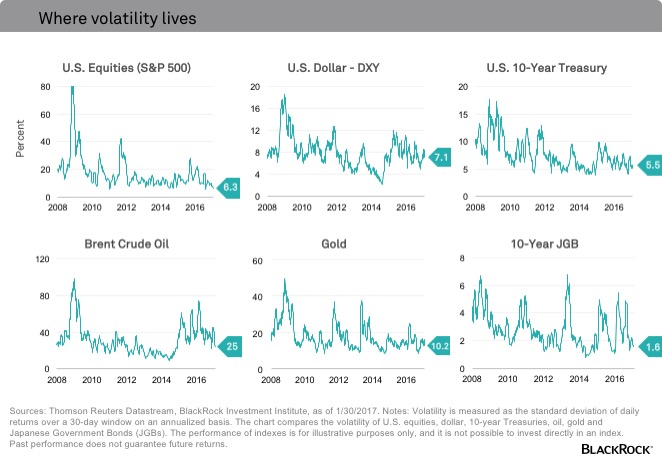

Investors outside of the U.S. equity market are not quite as sanguine. Currency traders, for example, are experiencing more volatility. The CVIX, which measures currency volatility, remains in the middle of its six-month range and approximately 10% above the autumn low. Treasury volatility, measured by the MOVE Index, displays a similar pattern and is roughly 25% above the October bottom (see the accompanying chart).

A similar dynamic is visible in non-U.S. equity markets where volatility is low but starting to rise. The European equivalent of the VIX, the VSTOXX, has bounced in recent days. While still very low, the index is up more than 15% from the January bottom. Having spent most of last week in Europe, I can report that investors there are more and more nervous, both about U.S. politics and increasingly their own. With pivotal elections scheduled in Germany, France, the Netherlands and possibly Italy, Europe has the potential to once again be a source of anxiety.

Back in the U.S., despite protests and rising uncertainty, optimism over tax cuts and deregulation are offsetting concerns regarding trade and immigration at the moment. This may continue to work, assuming Washington delivers on the aforementioned stimulus and reform. In the absence of that, today’s low volatility looks odd in the context of an increasingly uncertain backdrop.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.