by Matthew Peterson, Chief Wealth Strategist, LPL Financial

KEY TAKEAWAYS

§ China looms large at the beginning of 2017 across economic and political fronts; President-elect Donald Trump has suggested branding China a “currency manipulator” as early as his first day in office.

§ China has been depleting its currency reserves to support its economy and its currency, possibly reducing its ability to deal with its growing bad debt problem.

§ The Chinese government does influence the yuan by measuring it against a trade-weighted basket of currencies; the adjustment of this basket creates the appearance of policy changes.

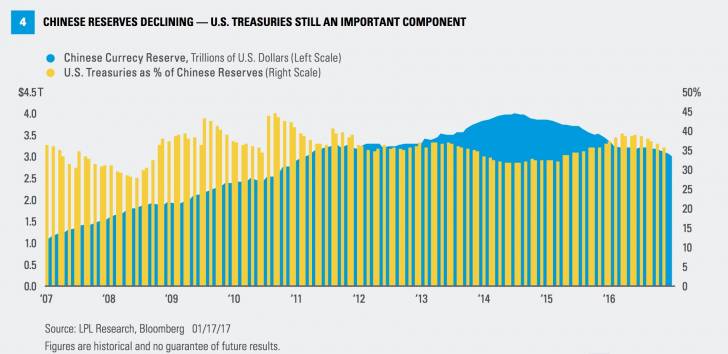

China’s role in the global economy has seldom been more important or controversial. China has been a major producer of global consumer goods for the past 20 years, but at the same time, it has become an important engine of global economic growth. More recently, it has sought to become a major player in global finance. China accumulated a massive reserve of foreign currency, reaching $4 trillion as of June 2014. However, this cache has declined by 25% to just over $3 trillion in December 2016 as the Chinese government sells assets to support the yuan and provide stimulus for its economy. The election of Donald Trump may complicate life even more for Chinese policymakers, as Trump has suggested branding China a “currency manipulator” as early as his first day in office.

Trading policies

The broadly accepted thesis that international trade is intrinsically good for an economy has been rejected. Problems with trade agreements have long been acknowledged. However, it was believed that these problems could be ameliorated by a country internally; say by offering impacted workers retraining, or by finely negotiating terms in the treaty itself. The incoming Trump administration appears to believe that many treaties themselves are flawed. NAFTA is an obvious example. During the September 26 presidential debate he stated that, "NAFTA is the worst trade deal maybe ever signed anywhere, but certainly ever signed in this country," and suggested that NAFTA should be renegotiated.

Trump’s view of trade with China appears to be different. Trump and Peter Navarro, one of his key policy advisors and a professor of economics at the University of California at Irvine, appear to view trade with China in a structurally negative light. Of particular interest is the value of the Chinese yuan. The yuan, which has at times been considered undervalued, has been the source of blame for the trade imbalance between the U.S. and China and the loss of manufacturing jobs.

The value of the yuan has not been constant throughout its history [Figure 1]. After its very limited reintroduction into global commerce in the 1980s, the yuan depreciated from being worth roughly $0.50 in 1984 to being worth around $0.11 by 1994. Ultimately, the Chinese government “pegged” the exchange rate at 8.3 yuan/dollar, making the yuan worth about $0.12 from 1995 to 2005. The U.S. trade deficit in goods increased dramatically during that time, leading many economists, politicians, and corporate executives across the political spectrum to complain that the yuan was undervalued.

What’s in the basket?

Beginning in 2005, China enacted two major reforms. First, China began to allow the yuan to move in small increments daily, initially 0.3%; it was no longer a perfect peg. More importantly, it was priced relative to a “reference basket” of currencies designed to better represent China’s trading patterns. Initially China did not provide information on the composition of this basket, which is known as The China Foreign Exchange Trading System (CFETS). As a result, the yuan appreciated against the U.S. dollar by over 25% from 2005 to 2014. Yet, with the exception of the 2008 financial crisis, there does not appear to have been any meaningful change in the pace of trade deficit expansion.

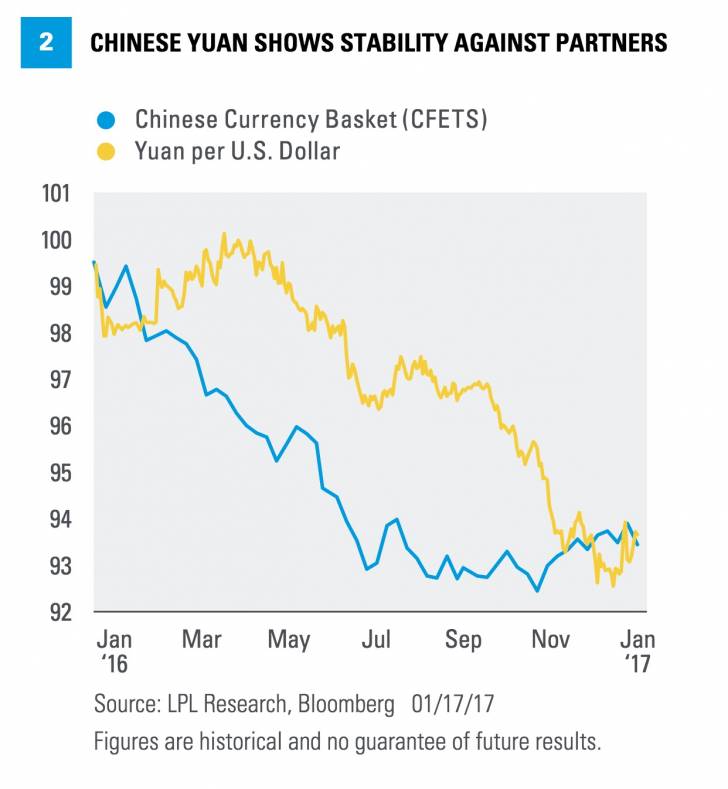

More recently, the yuan has once again started to depreciate against the dollar, reinvigorating charges of currency manipulation. However, the yuan basket has continued to evolve, with the Chinese government now providing full transparency into the composition of the basket. From the Chinese perspective, the yuan has been relatively stable against its basket of currencies [Figure 2]. The Chinese look at this chart and see that the yuan has been stable since the end of June 2016, and that the continued decline against the dollar is as much an issue of dollar strength as it is yuan weakness. The basket now aligns better with China’s trading partners, though does not do so perfectly [Figure 3]. China appears to be not only sensitive to the currency of its trading partners, but also to the currency of countries where Chinese companies have direct competitors, particularly South Korea.

Keeping it afloat

The yuan has been kept afloat largely by China's immense foreign currency reserves, which totaled nearly $4 trillion by June2014 [Figure 4]. China has kept roughly one-third of these reserves in U.S. Treasury bonds, though the percentage has varied over the past few years. Since 2014, China has sold off roughly $1 trillion in assets, including approximately $200-$300 billion in U.S. Treasury bonds. These assets have been sold largely to support the yuan against the dollar and to boost the Chinese economy, though with relatively little direct impact. Since Treasury securities are denominated in U.S. dollars, the simple act of selling them adds dollars to the market, and therefore puts pressure on the dollar. However, there are many factors that determine the value of the country’s currency and the dollar has continued to appreciate even with the sale of Treasury bonds.

Like 2012 Republican nominee Mitt Romney, Trump has threatened to declare China a currency manipulator, as early as his first day in office. Under U.S. trade law, there are three criteria to being labeled a currency manipulator; “(1) a significant bilateral trade surplus with the United States, (2) a material current account surplus, and (3) engaged in persistent one‐sided intervention in the foreign exchange market.”[1] Though the U.S. Treasury Department has found that China (along with Germany, Japan, and South Korea) meet the first two tests, none of them meet the third. The U.S. Treasury Department reported that China had spent $566 billion to support its currency through September 30, 2016.

What would be the impact of being formally declared a currency manipulator? Technically, it would require negotiations between the two countries, with the goal of getting the country accused of manipulating their currency to stop. These negotiations would be awkward given that China is actively supporting the yuan and that the dollar has been rising against many other currencies as well. Congress considered, but ultimately rejected, many actions that could be undertaken in the event of currency manipulation when it revised a number of trade laws in 2015. In fact, there is no specific remedy for currency manipulation beyond those found in other aspects of U.S. and International Trade Law.

Global financial markets continue to watch China closely. Its large holdings of Treasuries and other securities were supposed to be what will provide policymakers in China flexibility to deal with its bad debt problem and issues related to the transition from an export-oriented to domestic consumption-based economy. At $3 trillion, China still retains a huge amount of reserves; for comparison, the country with the next largest amount of reserves is Japan, with $1.2 trillion. But the reduction in reserves, combined with the possibility of extra tariffs or other sanctions imposed by a Trump administration, clearly increases the risks to Chinese investments.

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

The fast price swings in commodities and currencies will result in significant volatility in an investor’s holdings.

[1] Foreign Exchange Policies of Major Trading Partners of the United States: U.S. DEPARTMENT OF THE TREASURY OFFICE OF INTERNATIONAL AFFAIRS October 14, 2016, Page 4.

Copyright © LPL Financial