by Brad Tank, Chief Investment Officer—Fixed Income, Neuberger Berman

Finding—and sticking to—the facts will be especially crucial for investors in the months ahead.

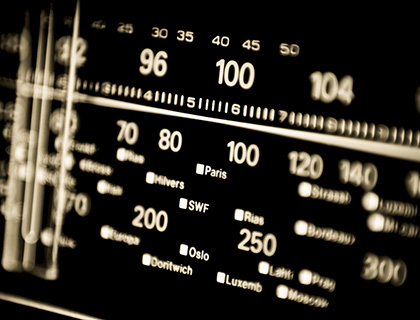

With the inauguration at our backs, it’s a good time to consider how, at a basic level, investors can make their way in the current frenetic landscape. One particularly apt term that comes to mind in the current context is the “signal-to-noise ratio.”

According to Wikipedia, “signal-to-noise” is “a measure used in science and engineering that compares the level of a desired signal to the level of background noise. It is defined as the ratio of signal power to noise power.” We have operated in and will continue to operate in an environment where the signal has been extremely low. It is therefore very difficult to figure out what the true signal is.

Not long ago, I heard a common refrain in my travels: “I can’t wait for the election to be over.” I agreed with the sentiment, and the notion was that all the crazy stuff we were seeing would die down and things would go back to normal.

At this point, I think it’s clear we’re not going back to whatever normal was. To the contrary, the level of partisan rancor concerning the issues of the day remains very high. Moreover, during the election we saw plenty of news that was light on facts and heavy on viewpoint, and that continues. Throw into the mix a new president who thinks out loud in real time and the reality of operating in a very low signal-to-noise ratio world for the foreseeable future is something an investor must confront. I’m afraid these are just realities of the new environment.

Employing a Filter

What can investors do? First, focus on important facts and employ a process for ignoring the noise.

Part of the challenge is that when you look at what the incoming administration has proposed, it’s a very ambitious agenda, focused on substantial reforms—to the tax code, the government’s role in health care, and immigration, among other things. These are truly complex issues. This is evident in all the reporting, noise and rhetoric around the tax code, specifically concerning the border tax adjustment proposal. It has dominated the financial news over much of the past week and is very hard to explain succinctly, so commentators latch onto scary, often misleading headlines. Sorting the facts from the noise is going to take real concentration moving forward.

For us, some of the most important facts are as follows: Of all the objectives in the new administration’s agenda, none is likely to have more impact on markets and the valuation of individual stocks and bonds than reforming the tax code. Given that, we are focused on the process of change, which is crafting legislation and who is working on it. It involves understanding the perspective of the authors and others who might have a meaningful influence, and the timeline to passage and implementation. It’s not clear how much transparency there will be, but I think a starting point for analysis has to be a document that’s been around for seven months: the House Republicans’ budget proposal. The question is, how much will remain by the time we get to the finish line.

Bring the Perspective of a Great Analyst

Second, process all news and information the way a great stock or bond analyst does when analyzing a company. I am fortunate to work with a lot of them here at Neuberger Berman, and they share a common approach. Data, facts and experience all trump opinion. But in markets, of course, opinion does matter. When assessing the viewpoint of a CEO, CFO or sell-side analyst, understanding the messenger’s track record, credibility and biases is paramount. The simple conclusion is that if you can’t check these boxes on a messenger, reject the message.

This decidedly does not mean seeking only viewpoints that mesh with your own—quite the contrary. I am a regular reader of Paul Krugman’s column precisely because he looks at economic and political issues from a viewpoint very different from my own. He expresses his views in a consistent and articulate fashion through time; I know where he is coming from.

Bring Historical Context

Finally, big issues of the day are usually just a point in time that are impossible to understand without a sense of the broad arc of history.

In the aftermath of the financial crisis, Carmen Reinhart and Kenneth Rogoff wrote a well-timed and insightful book called This Time Is Different: Eight Centuries of Financial Folly, which put in perspective the world-changing events we’d just experienced, and everyone in our business either read or should have read their observations.

Similarly, looming tensions with China on trade haven’t just emerged in the last couple years. Nineteen years ago, False Dawn: The Delusions of Global Capitalism, by Thatcherism architect John Gray, predicted that China’s form of capitalism would eventually collide with that of the West.

As for Russia, Putin’s adventures in Ukraine and Crimea are the culmination of more than 100 years of struggle with the West. I’d strongly recommend The Great Game: The Struggle for Empire in Central Asia, by Peter Hopkirk, written in 1992, to understand the dynamics at play.

Looking for that kind of perspective on whatever developments emerge could help investors find the relevant signals and avoid getting caught up in the noise that is sure to resonate throughout 2017.

In Case You Missed It

- U.S. Consumer Price Index: +0.3% in December month-over-month and +2.1% year-over-year (core CPI increased 0.2% month-over-month and 2.2% year-over-year)

- NAHB Housing Index: -2 to 67 in January

- U.S. Housing Starts: +11.3% to SAAR of 1.23 million units in December

- U.S. Building Permits: -0.2% to SAAR of 1.21 million units in December

What to Watch For

- Tuesday 1/24:

- U.S. Existing Home Sales

- Thursday 1/26:

- U.S. New Home Sales

- Friday 1/27:

- U.S. Durable Goods Orders

- U.S. 4Q16 GDP (First Estimate)

– Andrew White, Investment Strategy Group