by Ryan Detrick, LPL Research

With the Dogs of the Dow back in the headlines and roaming around social media, should we be concerned? What are these dogs all about? The Dogs of the Dow strategy involves investing in an equally weighted portfolio of the 10 Dow Jones Industrial Average (DJIA) stocks that have the highest dividend yield at the end of each calendar year and holding those 10 stocks for exactly one year. The idea behind the strategy is to look for the 10 cheapest (or highest dividend-yielding), large cap, blue chip stocks of the Dow 30, and you will be purchasing high-quality businesses at a better value relative to the other 20 companies in the DJIA.[1]

Tracking the Dogs – How May the Dogs of the Dow Fare in 2017?

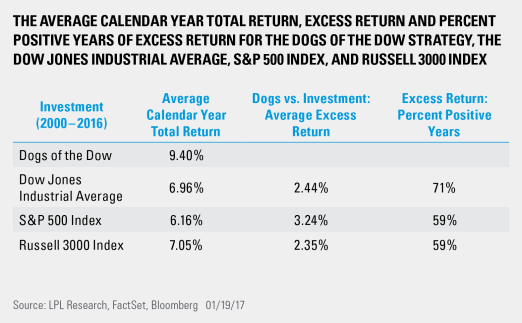

Looking back over the past 17 years, the Dogs of the Dow strategy has on average outperformed three broad-based U.S. equity indices, as the below table shows.

Since 2000, the Dogs of the Dow strategy has outperformed its parent index, the DJIA, 71% of the time, on average by 2.4%. Comparing the results against the other broad-based U.S. equity benchmarks, since 2000, the Dogs of the Dow strategy has also done well against the Standard & Poor’s 500 and the Russell 3000 Indices outperforming 59% of the time, on average by 3.24% and 2.35%, respectively.

Here in January, should we be paying attention to the 10 highest-paying DJIA dividend-yielding stocks (based on closing performance for 2016)? Well, there are no guarantees to performance in this business; however, when looking at the track record and statistics for this strategy over time, the Dogs of the Dow has historically done well against the major U.S. equity indices. The one thing to keep in mind is that much of the lookback period has been during a long bull market in bonds, which provides some support to dividend payers.

[1] The Dogs of the Dow strategy was popularized by the 1991 book: Beating the Dow, by Michael B. O’Higgins.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Dow Jones Industrial Average Index is comprised of U.S.-listed stocks of companies that produce other (non-transportation and nonutility) goods and services. The Dow Jones Industrial Averages are maintained by editors of The Wall Street Journal. While the stock selection process is somewhat subjective, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth, is of interest to a large number of investors, and accurately represents the market sectors covered by the average. The Dow Jones averages are unique in that they are price weighted; therefore, their component weightings are affected only by changes in the stocks’ prices.

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-574150 (Exp. 1/18)

Copyright © LPL Research