by Blaine Rollins, 361 Capital

2016 was a rather boring year for the markets. That is until the surprising November election results left Americans thinking “Now What?”

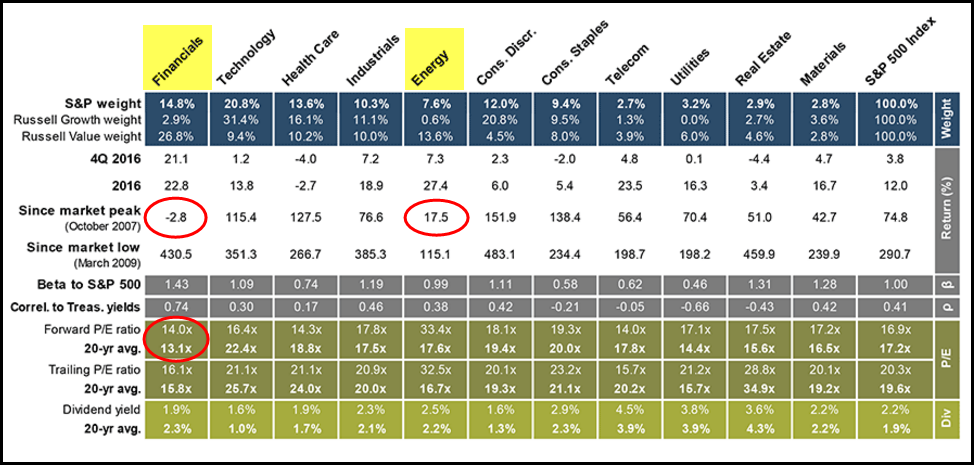

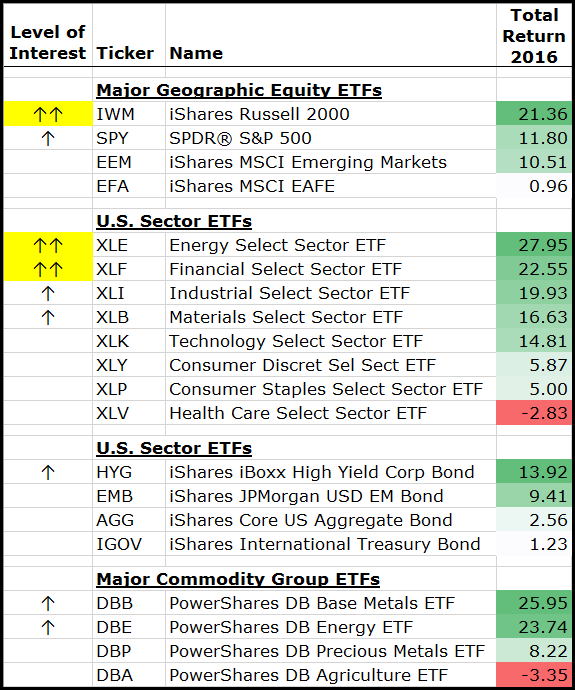

Between Congressional action and Presidential tweeting, I believe the markets will be on edge in 2017. But even in this time of uncertainty, I do see opportunities in a few major asset classes which I would easily be overweight: Financials, Energy and U.S. Small Caps. While all three assets posted large gains after the election, I still believe they have the potential for further gains. Both Financial and Energy stocks have underperformed the market for the last decade, while Small Caps have treaded water versus Large Caps over the same time frame. All three assets should outperform their peers because of corporate tax and regulation changes, while the strong U.S. dollar could especially aid Small Cap stocks.

Financials and Energy stocks have been the two worst performing groups since the market peak of October 2007. Financial stocks are trading in line with their historical P/E valuation even though their future earnings potential has been unadjusted for the upcoming tax and regulatory changes in Washington, as well as the upward glide expectations of interest rates and a strengthening economy.

What do I see in the Financial Sector?

- Rising U.S. interest rates

- A stronger U.S. economy means better loan growth & reduced credit losses

- A corporate income tax cut has a significant impact given the concentrated U.S. revenues and earnings

- Less rules and regulation

- Financials have not outperformed the market for back-to-back years since 2000-2002

- The Bridesmaid for 2016

I think Banks, Brokers, Life Insurers, and Finance companies are best positioned in this sector.

I still believe there is a decent base value in the Energy sector, despite having both an OPEC and strong U.S. dollar risk. For 2017, I think U.S. growth could help global growth and that investors want more value-oriented and commodity-based equity exposure.

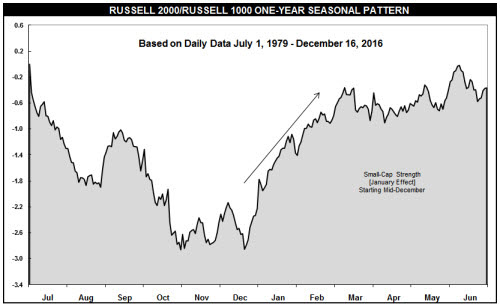

As I wrote in a December blog post, I see opportunities in Small Caps and believe they should outperform in 2017 because:

- We have a very strong U.S. dollar, which will give Small Caps the earnings advantage over Large Cap Multinationals

- The reduction in the corporate income tax will also give extra leverage to Small Caps who don’t have the 100+ person tax departments to shield their incomes

- The largest Small Cap index (Russell 2000) is heavy Financial stocks at an 18% weight

- Small Caps have flat relative performance vs. Large Caps for almost a decade

- The annual seasonal effect of small caps versus large caps expects out-performance right now

I have noted some other assets below which could help round out a portfolio if you need some other areas to invest, but they come with added risks. Large Cap U.S. stocks, Industrials and Materials could do well, but will have the strong U.S. dollar to contend with impacting multi-national earnings and commodity prices, as well as a potential White House attack on foreign manufacturing. Junk Bonds remain the most attractive area of the fixed income markets to invest in especially with the ongoing mend of Energy credits, but yields have tightened significantly from a year ago, so the upside returns have diminished. Among commodities, the best trends are in Base Metals (think copper and zinc) as well as Energy. If global growth picks up as the U.S. expands, these economically sensitive commodities will do well but they will likely be swimming into a strengthening U.S. dollar so the returns could be muted.

Maybe some of these ideas will be of interest to you. Do not be afraid of the recent momentum. It only shows you that after years of ignoring the underperforming groups, many institutional investors have changed their minds and are repositioning. Growth stock investors have had it easy for the last decade as the world over-owned Healthcare, Technology and Consumer Discretionary stocks. The very big changes in Washington, D.C. have given us all an opportunity to rethink where changes in earnings growth will come from next. Keep an open mind and be flexible if you have the opportunity to be an active investor.

Copyright © 361 Capital