by LPL Research

President-elect Donald Trump’s inauguration is happening tomorrow (January 20, 2017), and there is no shortage of news stories discussing what this means for the markets. Given that Trump’s policies have been so widely discussed, we thought it would be fun to take a break from all the seriousness and ask if the weather in Washington, D.C. on inauguration day has historically had any relationship to S&P 500 price returns during a president’s term. To be sure, the weather on any given day is of no consequence to long-term returns for markets, but patterns do emerge at times, even if the correlations are just coincidence.

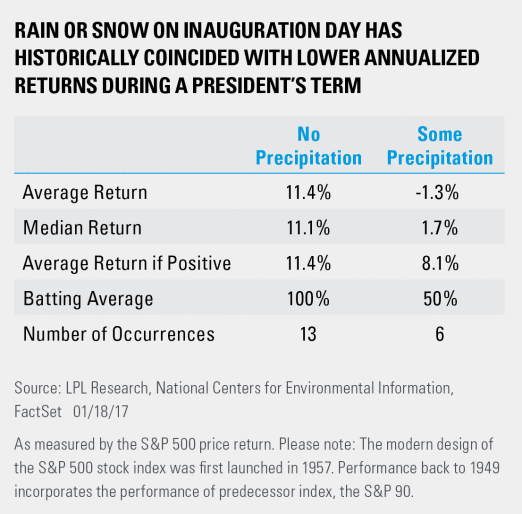

Going back to the 1949 (the second inauguration of Harry Truman, and also the earliest inauguration day where weather data were available), the presence of precipitation appears to be the most impactful data point. As the chart below shows, rain (or snow) on inauguration day has historically been a bad omen for the stock market.

The average annualized price return when there is no precipitation has been 11.4%, significantly higher than the overall average annualized return for presidential terms of 7.4%. The average return when there was rain was -1.3%, but this number was also impacted by Richard Nixon’s second term (ending when he resigned on August 8, 1974), an outlier during which the S&P 500 fell 22%. But even with the outlier removed, the average return was still low, at just 2.7%. Even when looking only at terms where returns are positive (50% of the time when there is precipitation) weather still seemed to have an impact, with returns 3.2% lower than years where it didn’t rain or snow during the inauguration.

So now the big question, what is the weather forecast for the upcoming inauguration day? As of today (Thursday, January 19), forecasts are showing a 60% chance of rain. However, given that this is just for fun and the pattern really is just random, the most important takeaway is that those planning on attending the inauguration should bring an umbrella.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-573660 (Exp. 1/18)

Copyright © LPL Research