by Blaine Rollins, CFA, 361 Capital

It was a big first week of 2017 for the weather and for the U.S. markets. As temps dropped and snow hit nearly every state in the union, stocks only wanted to move into the clouds. The numbers showed that it was a different type of week with growth, biotech and FANG stocks leading the week one charge. Basically, many of the names that had a rough 2016, and were likely tax sold into year end, saw the most buyers. The action should have pleased the stock pickers and hedge funds as correlations between names and sectors continued to vary widely. Retail stocks were pounded on worse-than-expected sales and newly announced store closures, while auto company stocks glitched on every new Trump tweet. It is about to get even crazier in stock land as Q4 earnings results, and a first look at 2017 guidance, will impact names for the next four weeks. The biggest day this week will be Friday when four big banks hit the tape (JPM, BAC, WFC, PNC). Earnings may not be exciting, but what management says about 2017 will be very exciting. Also whipping the market this week will be Trump’s first press conference on Wednesday followed by his Inauguration on Friday.

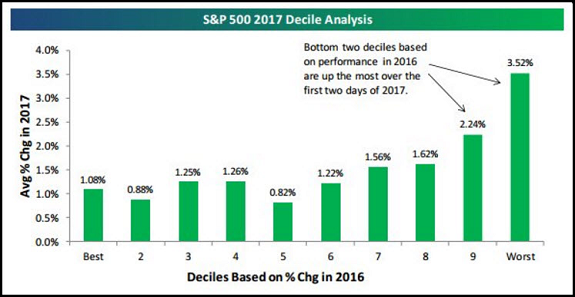

Bespoke shows you that the worst deciles in 2016 were the best for Week one of 2017…

Chalk it up to tax loss selling, window dressing, tactical rotations, the J.P. Morgan Healthcare conference and even heavenly spirits.

(@bespokeinvest)

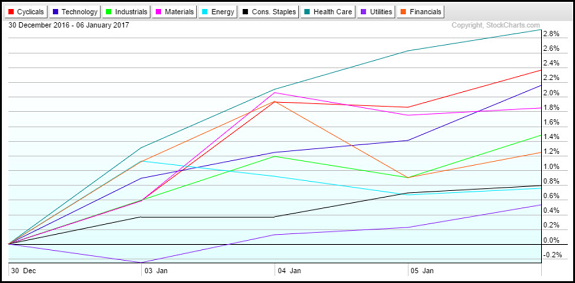

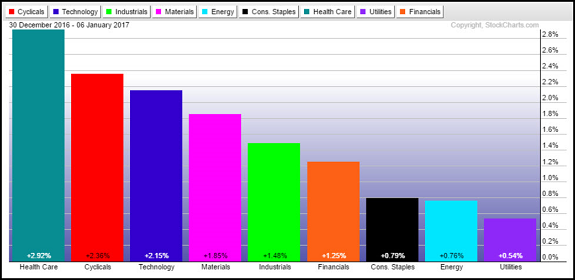

Equally interesting was that all sectors lifted on the week…

Healthcare led behind a big bounce in Biotech. Consumer Cyclicals got a leg up from Amazon, Disney and Nike. Tech was pushed higher by the Internet names…

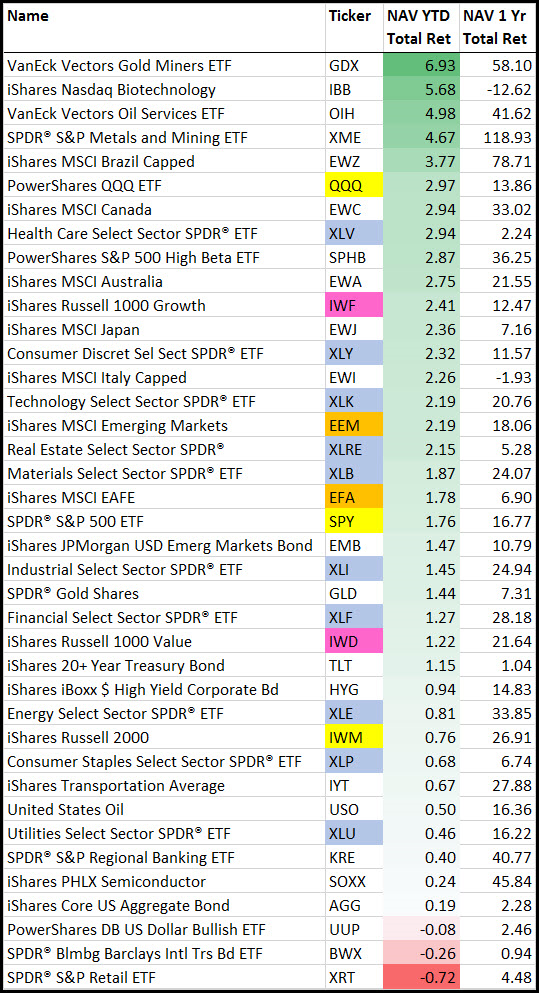

Looking at the major asset ETFs, it was a difficult week to lose money…

Mining, Oil Service, Biotech, Brazil and the Nasdaq led the tape. Only Retail stocks and Int’l Govt Bonds lost money. The Russell Growth doubled the return of the Russell Value. With the U.S. Dollar flat, Emerging Markets and Developed Int’l kept pace with U.S. Equities.

(priced 1/7/17)

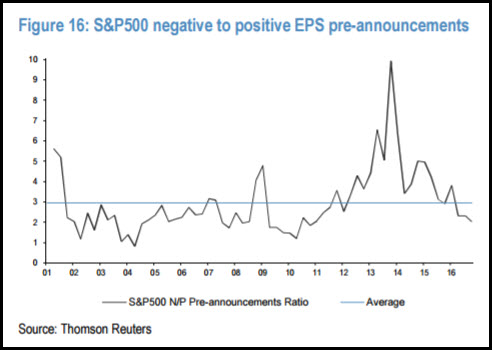

As we head into the Q4 earnings season…

Expectations have been lowered going into the reporting dates so it will be easier for companies to show positive earnings surprises. As the chart below shows, this has been the trend now for three years.

(JP Morgan)

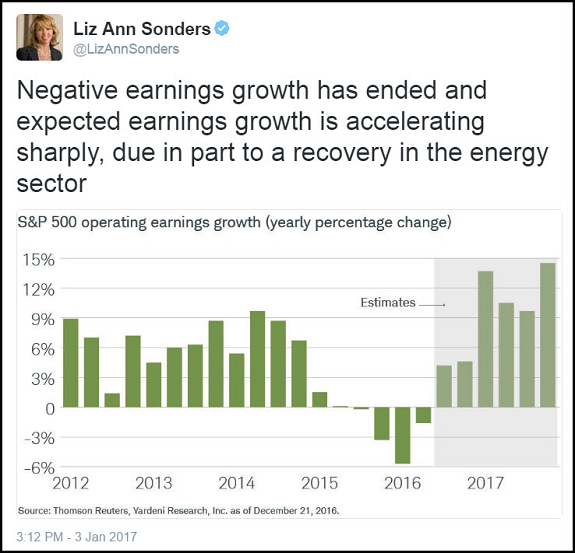

Not only have earnings been beating estimates, but earnings growth is also accelerating…

This will be a difficult market to short unless you know something about earnings estimates that others don’t.

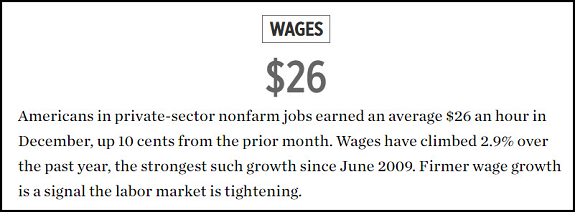

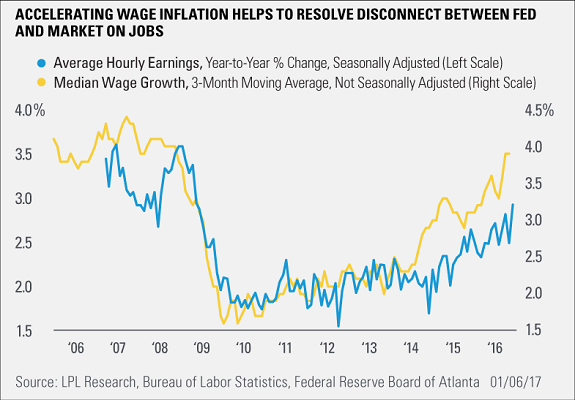

Wages, wages, wages…

“They didn’t vote Trump in to Make America Great Again,” he said, returning from a US tour. “They voted him in to Make American Wages Great Again.” And that one word makes all the difference. Don’t lose sight of it. It will be with us for years. Wages. “The multi-asset class teams and hedge funds think things have changed. But the long-only investors don’t really. They take time,” he explained, having met more than he could count. “Which means a lot of money has yet to come over to the new state of the world.” (Eric Peters/Wknd Notes)

The one thing that Friday’s jobs numbers delivered on was wages…

(WSJ)

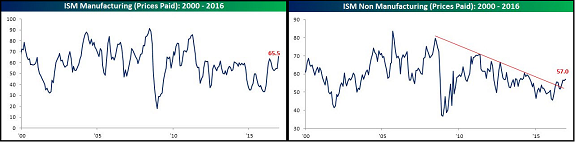

And not just wages, but the ISM data last week also showed further breakouts in Prices Paid by Manufacturing and Service companies…

(@bespokeinvest)

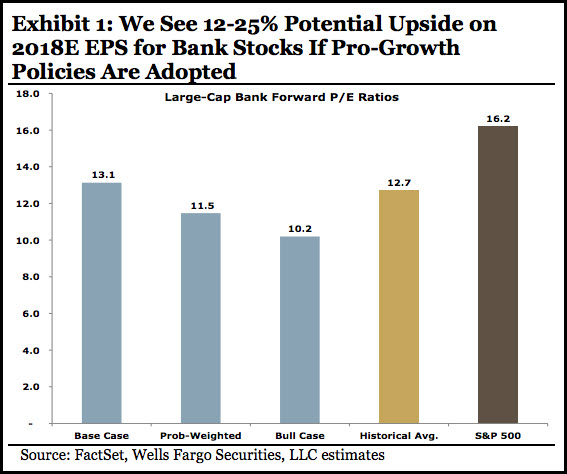

As you would guess, I fully endorse Wells Fargo’s upgrade of the Banking sector. The sector is cheap against itself on a historical basis, cheap against the market on a current basis and has rising earnings momentum. Stock pickers should be very overweight the group…

We see up to 26% EPS upside potential for the banks in 2018 – driving double- digit P/E discounts to historical levels. Our multi-factor analysis of potential benefits from the incoming GOP legislative priorities suggest the potential for 26% EPS improvement vs. our current 2018E EPS estimates. On a probability-weighted basis, potential EPS upside is 12%. Lower corporate tax rates drive the majority (60%) of EPS upside. We estimate the prospective positive EPS revisions leave pro-forma 2018 P/E multiples at 11.5x and 10.1x, respectively, 10% and 20% below the group’s 25-year average P/E of 12.7x. (Wells Fargo)

(h/t)

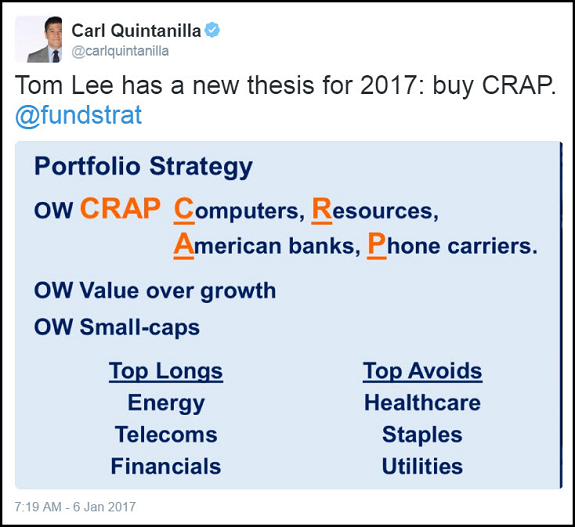

Hopefully Tom Lee’s hot hand will continue given the large overlap with my models…

I am not sure about his acronym, but I do want to be overweight his top ideas: Value, Small Caps, Energy and Financials.

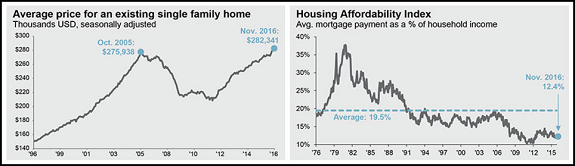

Home prices are higher. Mortgage rates are moving higher…

But housing is still very affordable given the low absolute level of interest rates combined with rising wages. We will have to watch if the psychology of rising rates plus the fears of 2008 pause housing more than the Affordability Index suggests that it should.

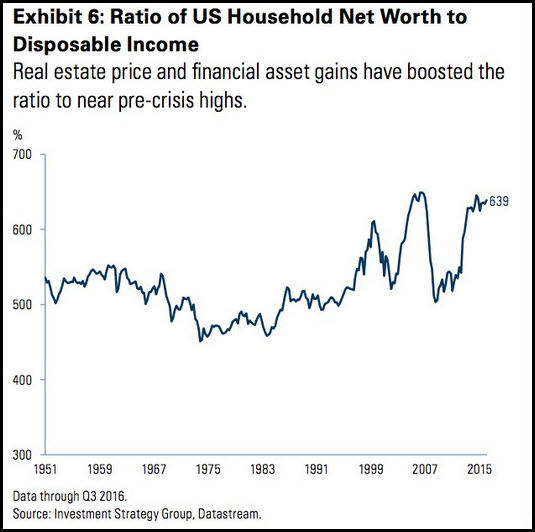

Consumers should be feeling very warm about their net worth given the rise in home prices and the markets…

The U.S. consumer may be rocking, but restaurants are no longer making money…

You can blame the bite of rising costs, shortage of workers and too much capital investing into the industry. If you have some favorites, you might want to concentrate your business with them or else you could lose them.

And now opening a sit-down restaurant is like walking into one of those machines in roller rinks where you have 30 seconds to grab as much money as you can, except all the money is fake, minus one lottery ticket taped to the bottom of one of those dollars. And that one lottery ticket is a restaurant unicorn like State Bird Provisions or Momofuku Ssäm Bar or Rose’s Luxury or Au Cheval.

And if you happen to be the lucky owner of that ticket, you cash it in and head back to the restaurant casino and buy more chips and take them to a higher-limit table and keep betting on yourself and your food and your people and you hope that your wherewithal and previous luck and skill keep it all going, and you become a place like Zuni Cafe or The Spotted Pig or, hell, Commander’s Palace and you’re able to last into paying off investors and actually making a living and becoming the nostalgia pick, the place everyone goes to recall that feeling they had when they walked in and discovered that the food you make is art, and you are a national treasure.

And then your lease runs out, your landlord sells to a developer, and they triple your rent.

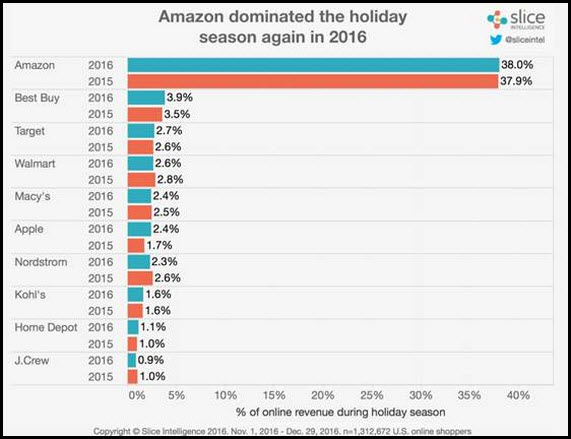

As if you didn’t guess, Amazon crushed it over the holidays…

You didn’t know Santa was bald and had a barking laugh?

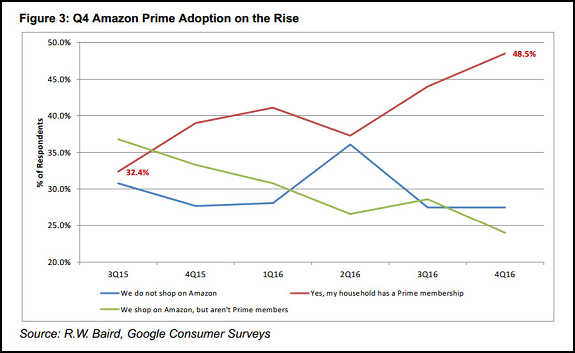

Would you have guessed that Amazon Prime is now touching nearly half of U.S. households? Great survey by Baird…

Latest consumer survey highlights increasing Prime penetration. Our quarterly survey of ~1,000 US households showed a significant increase in Y/Y Prime adoption (48.5% in 4Q16 vs. 39% in 4Q15 and 44% in 3Q16). With an estimated ~125M US households, we estimate domestic Prime membership (paid + unpaid) now stands at ~55-60M, and remains the biggest driver of Amazon’s retail flywheel (global membership could be >70M). As Amazon adds selection in historically under-indexed categories such as Apparel, Office/Industrial, and Home/Kitchen, the value proposition of Prime should become even more compelling, in our view expanding Amazon’s competitive moat over traditional retailers and sub-scale e-commerce platforms.

(RWBaird)

Always love to see Byron Wien’s annual surprises. These three are my favorite bets…

– The combination of tax cuts on corporations and individuals, more constructive trade agreements, dismantling regulation of financial and energy companies, and infrastructure tax incentives pushes the 2017 real growth rate above 3% for the U.S. economy. Productivity improves for the first time since 2014

– Increased economic growth, inflation moving toward 3%, and renewed demand for capital push interest rates higher across the board. The 10-year U.S. Treasury yield approaches 4

– The Standard & Poor’s 500 operating earnings are $130 in 2017 and the index rises to 2500 as investors become convinced the U.S. economy is back on a long-term growth path. Fears about a ballooning budget deficit are kept in the background. Will dynamic scoring reducing the budget deficit actually kick in?