by Eddy Elfenbein, Crossing Wall Street

Last quarter was another good one for dividends. It was the 27th quarter in a row of dividend growth for the S&P 500. Quarterly dividends rose 5.95%. Interestingly, Q4 had the fastest growth rate of the year.

For all of 2016, dividends rose 5.53%. It was the seventh calendar year in a row of rising dividends. Over the last seven years, dividends have grown at an average rate of 10.72% per year. That’s not bad.

Investors sometimes overlook the importance of dividends. Consider these stats: From the market’s closing low on March 9, 2009 until yesterday’s close, the S&P 500 gained 233.74%. But the S&P 500 Total Return Index, which includes dividends, gained 294.06%. That’s a nice boost.

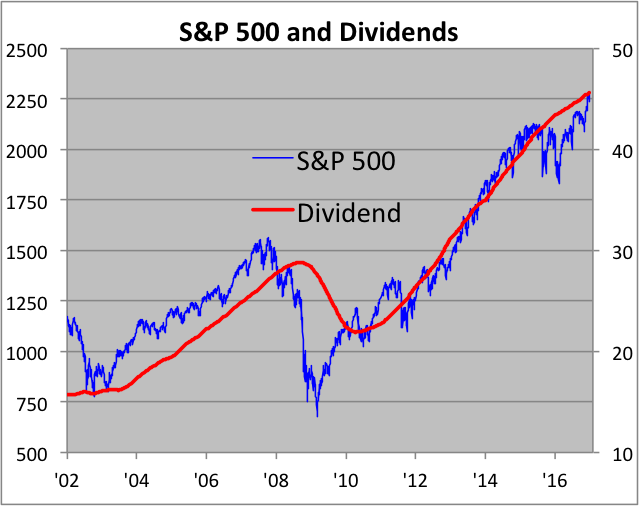

Something that has surprised me is how closely, over the last 15 years, the S&P 500 has tracked a 2% dividend yield. Here’s a chart of the S&P 500 (blue line, left scale) along with the S&P 500’s trailing four-quarter dividends (red line, right scale).

I’ve scaled the two lines at a ratio of 50-to-1 which means the S&P 500’s dividend yield is exactly 2% whenever the lines cross. Except for the worst of the Financial Crisis, the market has generally stayed close to having a yield of 2%. For a very simple valuation metric, it’s worked pretty well.

Copyright © Crossing Wall Street