by LPL Research

Today, December 8, 2016, the European Central Bank (ECB) will hold its last meeting of the year and there are a number of issues to address. The ECB’s current quantitative easing program of 80 billion euro in bond purchases per month ends in March 2017. While the ECB could wait another month or two before announcing what, if anything, it will do next, some kind of announcement tomorrow seems likely. The ECB is unlikely to let the market go “cold turkey” and simply end all purchases when the current program expires. More likely, it will “taper” bond purchases, reducing the amount of bonds purchased each month, similar to the Federal Reserve’s (Fed) process as it ended its bond purchase program.

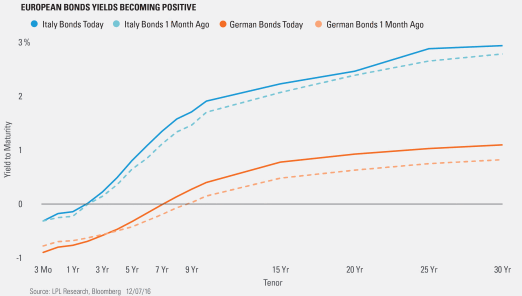

The ECB faces much greater technical hurdles than the Fed did. The ECB can buy bonds from a number of different countries, each with a different degree of creditworthiness. Furthermore, although interest rates have increased in Europe recently [Figure 1], many European government bonds still have negative yields, which could result in the ECB losing money on purchases. The ECB has generated a system of rules regarding which countries it can buy bonds from, and at what yields, to help mitigate its risk of loss. Changes to these rules may be as important as any headline announcements on the size and timing of new bond purchases.

There is also some question regarding how much assistance the European economy needs. Gross domestic product (GDP) growth, which was only marginal in 2016, is higher at 1.2% for 2017. Inflation also has increased, though at 1.5% remains below the ECB’s 2% inflation target. Given that economic growth remains low, if more stable, and that meaningful political uncertainty persists, the ECB will likely remain fairly aggressive in its policy. “As we can see in the recent Italian referendum, European institutions are not very popular with the European electorate,” said Matthew Peterson, LPL Financial Chief Wealth Strategist. “The ECB is conflicted between wanting to stimulate the economy, and being wary of any political backlash.”

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-561975 (Exp. 12/17)

Copyright © LPL Research