by Blaine Rollins, CFA, 361 Capital

The equity market’s rate of divergence shifted into a higher gear last week as rising interest rates, the changing winds in Washington and a swift agreement at OPEC caused hundreds of billions of dollars to find new homes. Where you place your chips now may not only impact your year-end bonus, but could also determine whether or not you win or lose clients in 2017. For those of us who do not run Rip Van Winkle portfolios, this continues to be a favorable environment to add alpha. Last week, the event was OPEC whose news turned energy stocks from ‘why own’ to ‘gotta own.’ The mood in energy stocks, combined with the continued increase in interest rates, pushed Cyclicals to further gains over their growth stock arch-rivals as Financials, Materials and Industrials joined in the green column. As we near the seasonally strong second half of December, and year-end window dressing takes hold, it will be very tough for portfolio managers to want to show long bond, healthcare and technology stock overweights in their client portfolios. And, while investors want to fade the current ‘Trump’ rally, I think this is high risk as it will be difficult to slow the momentum of the new Administration. It won’t be until the end of January (at the least) that Congress will even have a chance to vote down some of the currently proposed stimulus. So, if you want to bet against the President-Elect, do your homework now, but keep your fingers off the execute buttons until next year.

Did you feel that earthquake in the stock market last week?

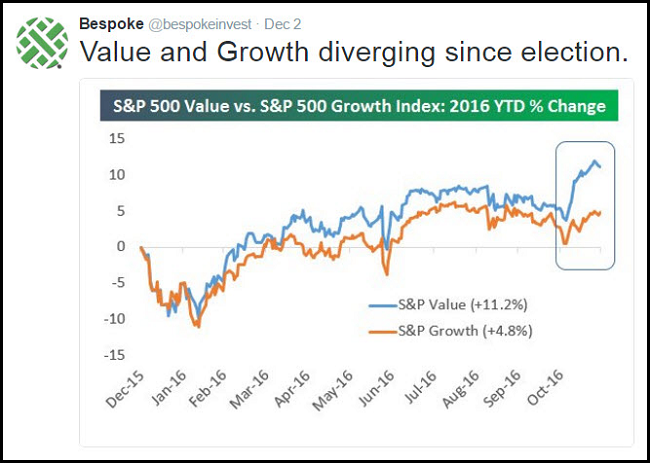

That was a major fracture in many different factors in the market; look at Value vs. Growth or Cyclicals vs. Defensives. They all show the big moves which are continuing to affect investor psychology and repositioning.

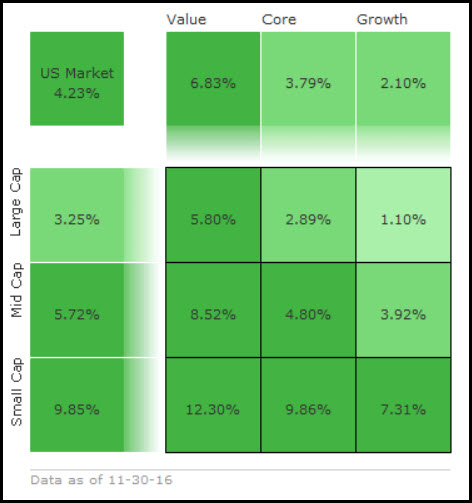

One month returns for November 2016. Look at Small Cap Value vs. Large Cap Growth…

(Morningstar)

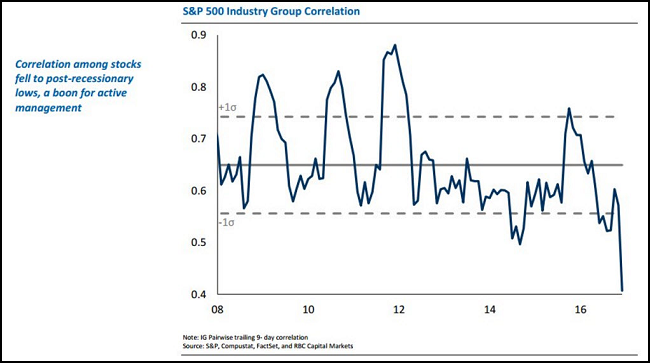

Dispersion is rising!

The good news is this should be one of the best active mgmt. environments that we’ve had in a long time (for both stock pickers and macro investors alike) as relative value will be increasingly more important as correlations fall and central bank intervention moderates. As long as real rates keep grinding higher (i.e. rates rising faster than inflation), gold will remain under pressure and the yield curve is likely to continue to steepen which should keep US banks in the pole position. As for the infrastructure trade, the pain trade still seems like it’s higher and you can look no further than the action in CAT shares as evidence of this, as mgmt. gave cautious earnings commentary this week and the market barely budged.

(AlanGoldman/RenMac)

Correlations between sectors in a freefall…

(@NickatFP)

Goldman calls out active managers who won’t take risk…

Years of weak relative performance and fund outflows have directed investor and media attention to the struggles of active management. We expect 2017 will witness increased return dispersion among fund managers in addition to increased dispersion among stocks. More alpha opportunity does not guarantee better performance if fund managers fail to capture that alpha. Large and growing mutual fund outflows (more than $200 billion from equity mutual funds in 2016) as institutional and retail investors move to passive strategies will only slow if active managers move nimbly to take advantage of the rising dispersion environment.

(Goldman Sachs)

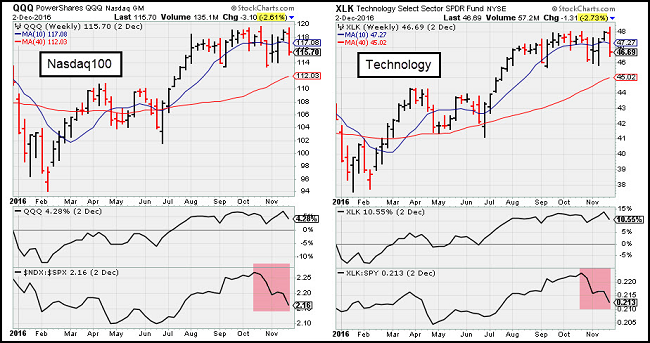

Two areas hit hard last week were the largest 100 Nasdaq stocks and the entire Technology sector…

I’d expect more selling here as portfolios window dress into year end.

The surprise OPEC outcome gave every active investor a reason to cover their shorts and get long Energy…

These buckets should be catching the window dressing dollars into year end.

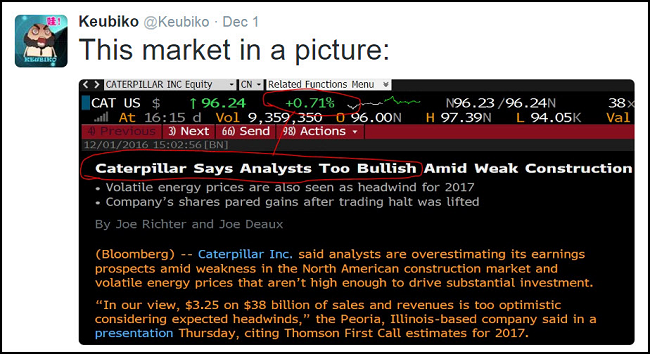

Caterpillar gave us a good example of how bad news does not affect stocks in a hot sector…

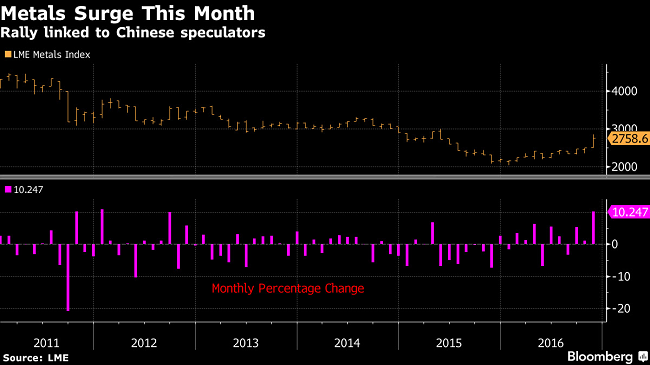

And not just cyclical equities, but base metals have caught the money train and are putting up their best monthly performance in years…

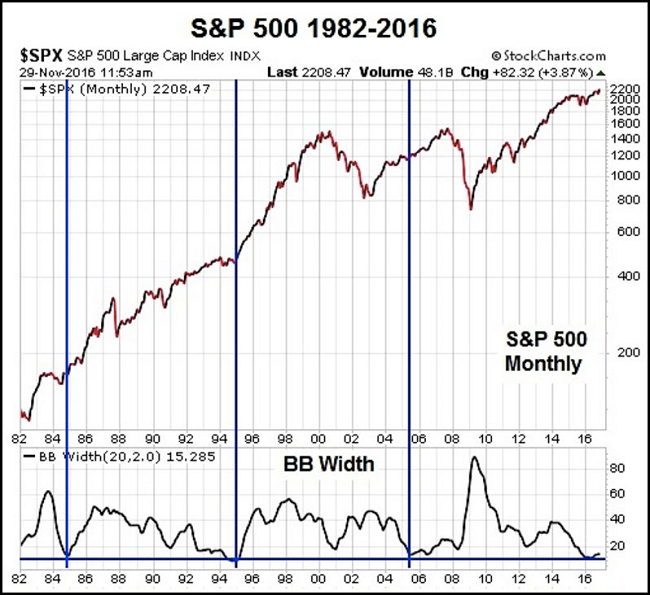

From periods of boredom come big moves. Could the S&P 500 be winding up?

So besides strong-arming Carrier into keeping jobs in Indiana, the President-Elect also wants to hit you in the bottom line if you are going to move any jobs overseas…

President-elect Donald Trump on Sunday issued a dramatic warning to companies that they would face “retribution” in the form of tariffs if they move American jobs overseas, setting up a collision with corporate America and the free-market wing of the Republican Party.

In a string of early-morning tweets, Trump said he intends to keep jobs in the United States by lowering taxes for companies and slashing regulations, two key components of his economic agenda. But he also warned that companies that send jobs offshore would face a 35 percent tariff on goods sold back to the United States.

“Any business that leaves our country for another country, fires its employees, builds a new factory or plant in the other country, and then thinks it will sell its product back into the U.S. . . . without retribution or consequence, is WRONG!” Trump wrote on Twitter.

Goldman also wants you to double check your portfolio for any businesses that buy goods or raw materials from overseas…

One proposal deserving of special attention is the border-adjusted corporate income tax that is contained in the House Republican blueprint. Under this scheme, a firm’s spending on imports would no longer be deductible from the corporate income tax base; by contrast, export revenue would be tax-free. This would be a step in the direction of a consumption tax, a long-standing goal of many public finance economists, and would greatly reduce the incentive for tax-driven relocation decisions as well as other forms of corporate tax arbitrage. However, it would undoubtedly be disruptive for many industries in the short run, in a positive sense for exporters and a highly negative one for many retailers.

(Goldman Sachs)

There was a big election in Italy over the weekend. The markets digested the results quickly…

“After Brexit, it took three days for markets to shake it off, with Trump it took three hours, with Italy it took three minutes,” said Guillermo Hernandez Sampere, head of trading at MPPM EK in Eppstein, Germany. His firm oversees $260 million. “The outcome was not as much of a surprise as many expected it to be — markets learned their lesson.”

Who would have thought four of the five will be out of office in 2017?

Friday’s jobs data was in line with expectations…

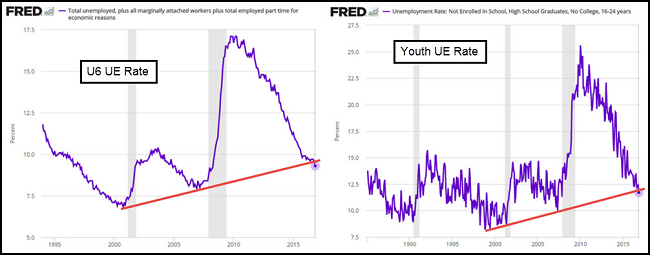

Good news in the U-6 and the Youth data which continued to break sharply lower.

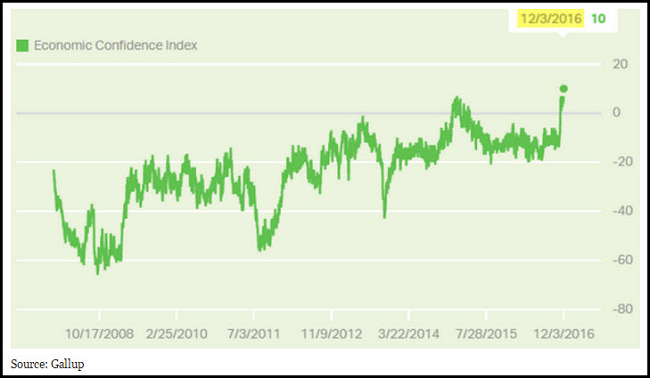

Gallup’s consumer survey data is spiking post election which could bode very well for holiday shopping…

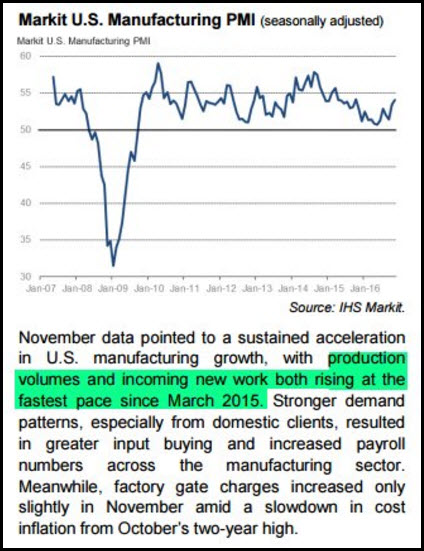

And the Manufacturing PMI data is also showing a rising tide…

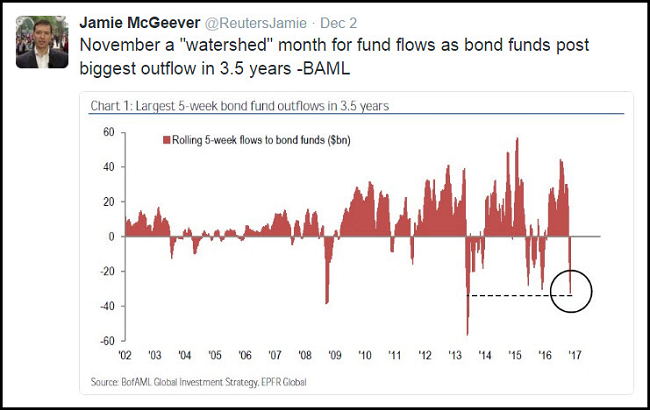

“Run to the hills, run for your lives.”

As a result of the strong data and promises of economic growth, Fixed Income investors were channeling Steve Harris of Iron Maiden during November…

And not just taxable bonds, but Munis are also seeing aggressive selling taking YTD returns negative…

Here are the three largest muni bond ETFs with a combined $12b in AUM.

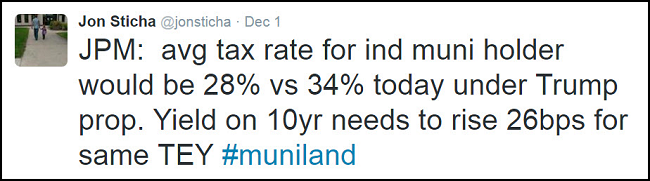

But it makes sense. Less demand for Munis under a Trump-government 1040 tax form…

The steepening yield curve is music to the ears of bank stock investors…

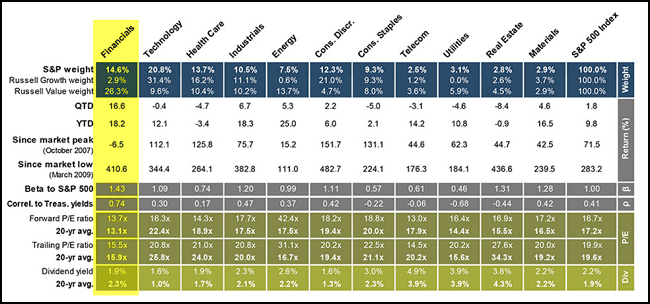

Meanwhile, Financials are still cheaper than the market…

Even before the gains in lending, rates and reduced regulatory costs.

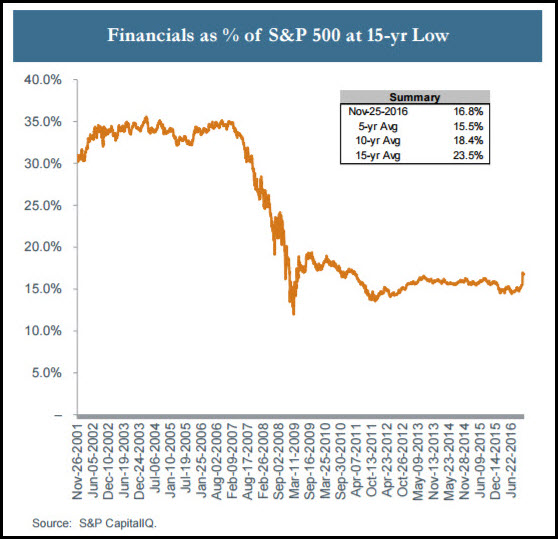

Financials are also half the weight in the S&P 500 index that they were 10-15 years ago…

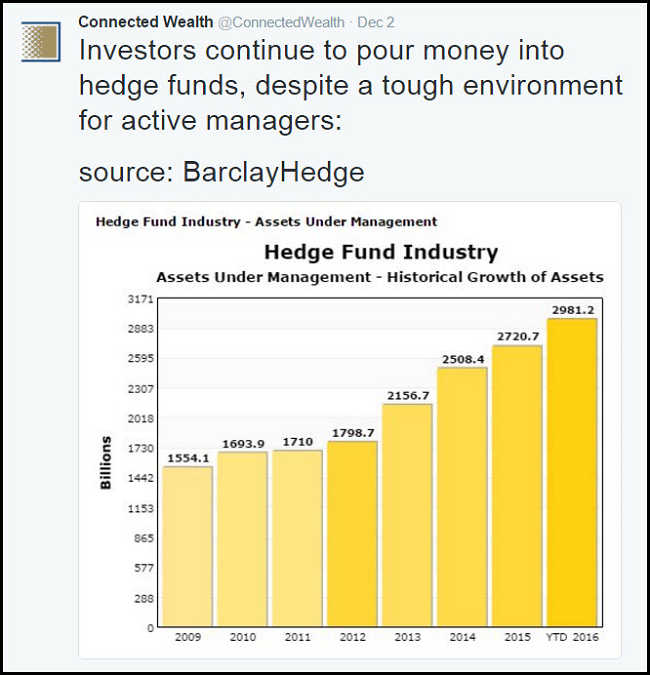

Given all the negative publicity, one would think that hedge fund assets would be headed toward zero…

Finally, did the Amazon Echo overhear my wife complaining about the grocery store checkout last week?

The first Amazon Go location is at 2131 Seventh Avenue in Seattle, Amazon’s home town. It will open early next year.

(Recode)