by James Kochan, Wells Fargo Asset Management

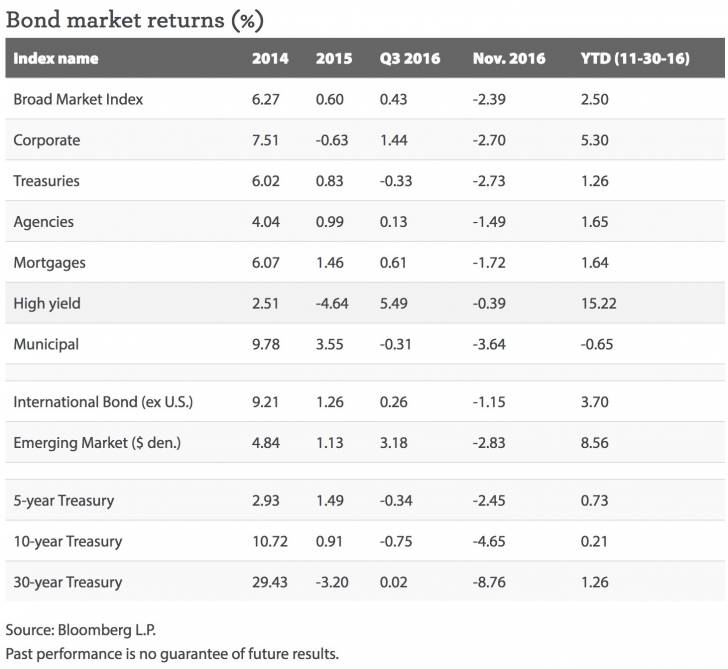

November was one of the cruelest months for the fixed income markets in modern times. The -2.39% total return for the taxable investment grade market index was the poorest since October 2008. Unless the market rallies in December, the fourth quarter return will probably be the worst since the first quarter of 1994, when speculation, excessive leverage, and Federal Reserve rate hikes combined to create one of the worst years for bonds in modern history. The municipal market recorded the poorest monthly return since July 2003. Even the high-yield corporate market had a negative return in November, though not as steep as some months during the 2015-16 energy-related sell-off.

Selling in the longest-duration sectors began in July and turned especially severe in November. The 30-year Treasury yield increased almost 100 basis points (100 bps equals 1.00%) since early July, and the total return since then is -17%. Over that same period, the longer-duration municipal and investment-grade corporate sectors have recorded total returns of -7.1% and -7.8%, respectively. The longest high-yield maturities have positive year-to-date (YTD) returns but recorded a return of -2.5% in November.

The YTD returns are reminders of the importance of interest income in a difficult market environment. Those markets offering the lowest yields have the poorest YTD returns. In the Treasury market, yields have retraced the first-half declines and are very close to the levels of January 1. Interest income comprises their YTD returns. Investment-grade corporate yields are still 20-30 basis points lower than on January 1, so YTD returns have a small amount of price appreciation. There has been considerable price appreciation in the high-yield returns because that market was still correcting on January 1.

The municipal market, where yields were the lowest, experienced the most brutal correction. Yields today are 30-50 bps higher than on January 1. Yields in the 2- to 5-year maturity segment are now well above 2013 peaks. Yields on AAA munis are now equal to or higher than yields on comparable Treasuries. The 10-year AAA muni to 10-year Treasury yield ratio is above 1.0 for the first time in more than a year.

Expectations seem to be driving yields higher, but fears are likely overblown

Expectations of bigger federal deficits, stronger economic growth, more inflation, and more Fed tightening are being cited as reasons why bond yields have increased so sharply and why yields might continue to rise in the weeks ahead. There are several reasons why we feel those fears are overdone.

Any fiscal stimulus initiative will take time to get through Congress. Spending programs would probably not begin for another 12 months. The impact of those initiatives might not be seen in the economic data until well into 2018. Inflation could trend slowly upward, but a spike is, in our view, unlikely. Companies face too much international competition to allow them to raise prices significantly.

Federal Reserve (Fed) policy is also likely to be less threatening than feared. The tapering tantrum of 2013 was made worse by expectations that the Fed would raise rates as much as it did in 2004-06 when the federal funds rate rose 400 basis points. Chair Yellen has emphasized that in this cycle, she expects rate increases to be gradual and moderate. Her recent discussion of a low natural rate of interest and the only moderately stimulative nature of current policy was probably an attempt to remind the markets that a 2013-style tantrum would be inconsistent with today’s economic and financial fundamentals.

Most yields have already increased enough that they have moved into what we regard as fair value ranges. We define fair value as yields that might produce positive returns over a 12-month holding period. Until recently, only the high yield corporate market offered those yields. Now, in our opinion, the 1- to 10-year maturities in the investment-grade markets offer fair value, and high yield again offers good value.

Copyright © Wells Fargo Asset Management