by JC Parets, All Star Charts

With all the noise surrounding U.S. elections this month, we have seen very little coverage about the recent surge in base metal prices. Sure, everyone is talking about gold hitting a monthly high, but don’t let the shiny metal blind you to what is happening with such base metals as aluminum, nickel and tin. You don’t have to travel too far back in history to see what has happened to U.S. stocks when those base metals start making some noise.

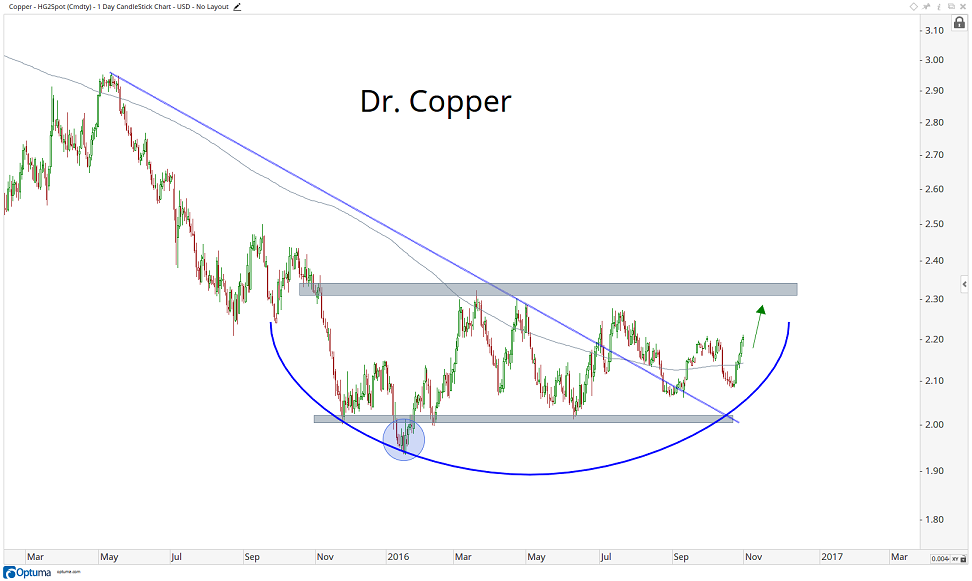

Copper tends to be the most popular gauge of strength in this space, hence its nickname “Dr. Copper.” Although copper touched its low in January of this year, prices have not rallied much. Instead, prices continued to form a nice base:

But when I look at the base metals complex, it’s not copper that gets my attention. What the rest of them have been doing really stands out to me. Here is aluminum breaking out and leading the troops higher:

Nickel is doing the same thing:

Lead is breaking out of a nine-year downtrend:

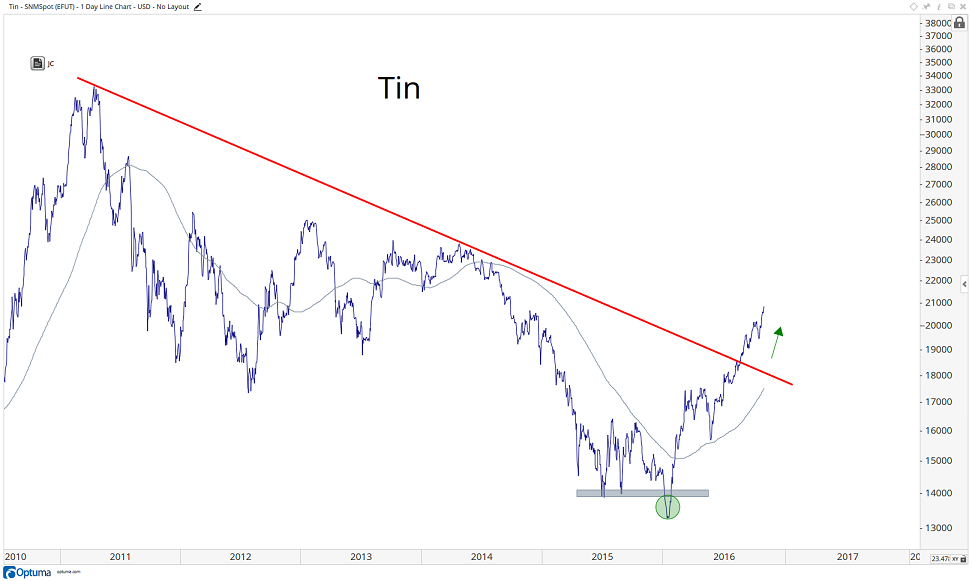

Tin is already making two-year highs:

Zinc is making five-year highs:

Here is gold vs. an equally-weighted basket of base metals: copper, aluminum, zinc, lead, tin and nickel:

Notice where the peak in the spread stood in late February 2009, a week before the S&P 500 reached its historic bottom. Look again at the summer of 2012, when the S&P 500 and European banks bottomed out and started to rally. These were two major bottoms in equities over the past decade.

The most recent peak was on February 11 of this year, the day the S&P 500 bottomed. I would argue that this trend is down and even lower prices would suggest there is risk appetite out there for stocks around the world, not just in the U.S.

Copyright © All Star Charts