by Richard Rosso, Clarity Financial

I find stock market history fascinating.

Financial professionals seek a Holy Grail by matching current market behavior perfectly to years past. It’s 1937. No, it’s 1987. Frankly, current markets are comprised of multiple personalities of decades of market history. If you can maintain perspective and keep overconfidence at bay

Study of the past allows me to be less of a deer in the headlines through market cycles and provide clear, concise guidance to clients. It allows me to say confidently – “This time is NOT that different.” Sure, it feels different to you because you haven’t lived through a similar cycle – Investors before you have gone through this. Something like it.

Or worse.

We crave patterns. In everything. It makes us feel smarter. Finding (or creating) patterns creates a comforting illusion of control. I guess when humans were hunting for food, uncovering patterns was the way to find a food source (and avoid becoming a hearty meal). When investing, overconfidence in a perceived trend is a certain path to lost money.

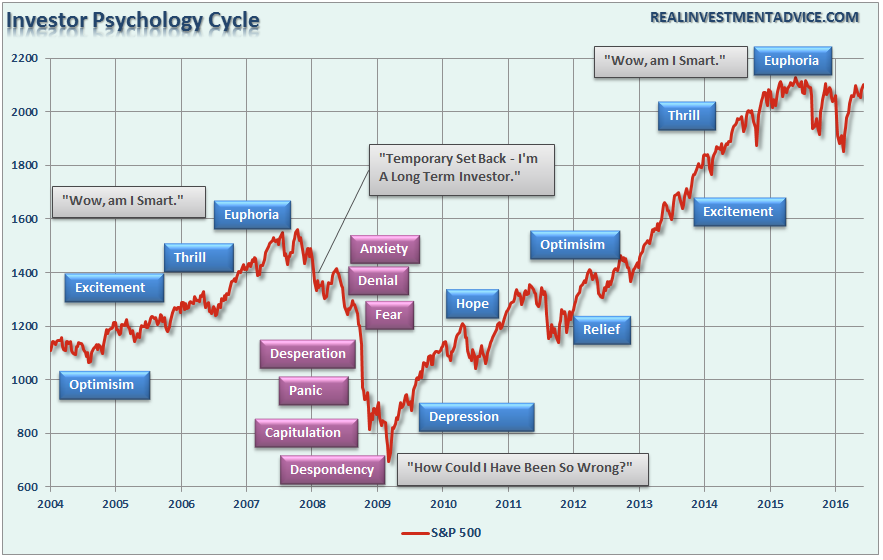

What stands out throughout my detective work, is the predictability of our emotional behavior when facing investment decisions. The same mistakes are made, repeatedly.

Did you know that a majority of retail investors lost money during the greatest stock bull market in history? Seriously. How? Oh, by getting in to the markets late in the cycle – only to suffer great losses from the tech bubble in 2000.

Investors commit capital at Euphoria, Thrill, Excitement, even though they claim to seek “value.” Let’s face it – we are addicts to chasing performance. There’s enough household financial carnage to prove the fact. You can’t time market entry/exit perfectly, however many investors bailed out big time at the market bottom in March 2009 – specifically at the Point of Maximum Financial Opportunity or despondency.

Smarter investors had the common sense to avoid an “all or none” decision. In other words, they didn’t sell out of stocks completely, they just buffered their portfolios by raising more cash to weather the storm yet they remained invested and took advantage of the market’s cyclical bull now going on five years. Successful investors and traders maintain buy and exit rules and don’t allow their emotions to choose how they adhere to them.

Years ago, I came across a first edition of a classic from 1896 titled “Ten Years In Wall Street” by William Worthington Fowler.

A chapter – “How To Make Money In Stocks” outlines common mistakes of the “Wall Street Operator.” The lessons are worth repeating and stand the test of time. Not surprising we are making the same mistakes over 100 years later!

I’ll list them straight from the mouth of dead muses, along with ways to avoid these mistakes.

- Time fights on the side of the man who buys stock at a fair price and pays for it, inasmuch as the material interests of our country are steadily advancing.

Owning companies at attractive or cheap price levels based on fundamentals and paying cash, not margin, places greater odds of success on your side. Time. Let’s just say for those who can hold a stock position longer than a week.

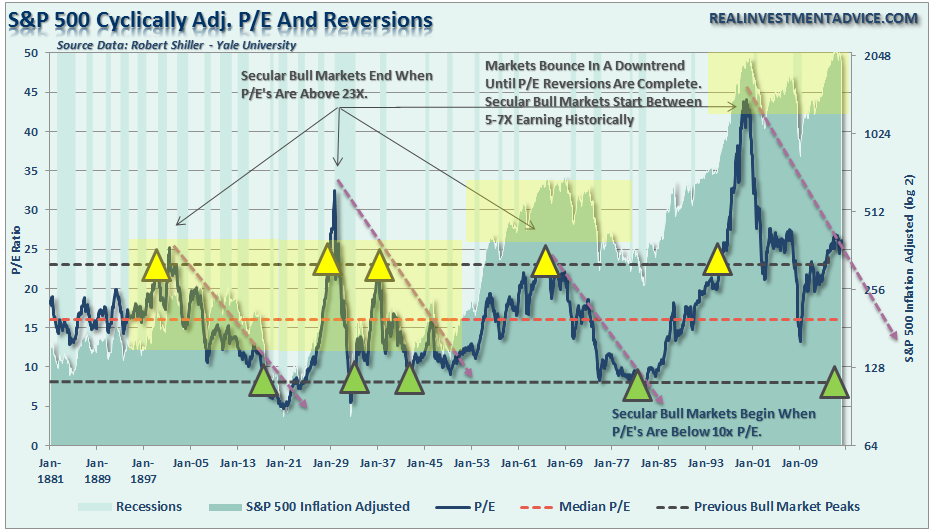

Currently, sentiment and momentum wins out over valuation. No matter what I examine – a Gordon growth model, CAPE, Q-Ratio: Stocks aren’t cheap.

Recently, I heard a “pundit” from a major discount brokerage house lament casually that we were in a secular, or long-term bull market.

Despite hope that the current breakout of the markets is the beginning of a new secular bull, economic and fundamental metrics suggest a different thesis.

Valuations and sentiment are elevated; interest rates, inflation, wages and savings rates are all at historically low levels. These are the variables which are normally seen closer to the end of secular bull markets, not beginnings.

You make the call.

In the long run, valuations as represented by historical “real” earnings, ostensibly weigh down or lift returns. However it can take years for these long-term valuation metrics to adjust stock prices accordingly. It’s not a matter of if, it’s when.

From experience, it’s when retail investors convince themselves en masse that this cycle is different, give up and chase returns that the blood of wealth begins to run. The ‘TINA’ (there is no alternative) effect is fresh, and may last as long as accommodative Fed policies remain in force and bond yields remain unattractive.

Per analysis at realinvestmentadvice.com secular bulls choke up above 23X earnings as we examine rolling-decade periods of realized earnings.

But who cares about the long term, anymore, right?

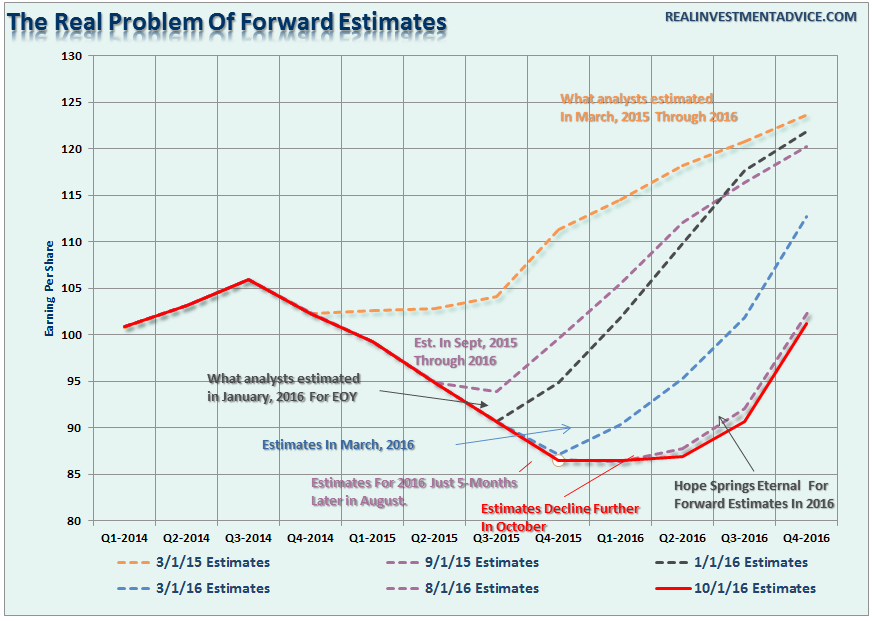

In the short term, stock market participants focus on forward guidance and estimates.

Unfortunately, forward or estimated earnings appear to be intelligent ‘best guesstimates.’

We consider forward estimates a panacea. A “hope springs eternal,” which keeps alive the ongoing story that the stock market is an endless, tireless bull.

S&P 500 companies are projected to report another quarterly earnings decline so it’s an opportune time to lower expectations, ostensibly allowing companies to exceed those expectations or report numbers that are ‘less bad’ thus keeping the bull market intact.

In the chart above, analyst expectations for S&P 500 estimates have varied widely from the beginning of the year. It makes sense that analysts are befuddled. The global economy, long in the grip of below average GDP growth is experiencing several unprecedented events mostly driven by experimental monetary policy.

In fact, our research shows that earnings estimates are consistently overstated by roughly 33%.

Per Lance Roberts – If investors held Wall Street analysts to their estimates from the beginning of the year, 100% of companies would have missed earnings during the second quarter. In the past three months, analysts have ratcheted down their estimates for the third quarter to their lowest levels yet.

It’s all a big game and retirement savings is the ball.

We’ll see if companies yet to report, can ‘jump the low hurdles.’ So far, it’s been tenuous. Alcoa, symbol: AA, did not establish a positive tone.

Several large banks recently beat basement-level estimates and the full impact of earnings seasons will overtake financial news, soon.

2) The man who can keep his position in spite of the temporary condition of prices, is the man who, in the end, wins.

If I pay a reasonable price for the risk taken, the short-term gyration of the market is not going to concern me.

Unfortunately, investor timeframes have grown increasingly short – if you can call the players who drive markets, investors. Central banks as unwitting protectors of risk asset prices, momentum traders, the algorithms, all far disconnect stock valuations from fundamentals, making price discovery increasingly difficult.

It’s easy today to be shaken out of a position, regardless of the homework a long-term investor undertakes.

In 1886-1896, speculators existed. Some flourished. Many witnessed their fortunes dwindle. Today, it’s a challenge for even the most die-hard market participants to comprehend how quickly sector rotations occur or losses are generated.

Specific buy and sell rules are crucial through this cycle, especially as we are closer to the top of a market than the bottom.

Meet with an objective financial professional to help you create portfolio risk management guidelines or hire a registered investment advisor to do it for you.

3) The frequency of operations is another fruitful cause of losses. Frequent trading for most, is an unsuccessful venture.

Brad M. Barber from the University of California, Davis and Terry Odean finance professor out of Berkeley conducted a study of active traders back in 2000 which still proves timeless.

Individual investors who hold common stocks directly pay a tremendous performance penalty for active trading. Of 66,465 households with accounts at a large discount broker during 1991 to 1996, those that traded most earned an annual return of 11.4 percent, while the market returned 17.9 percent. The average household earned an annual return of 16.4 percent, tilted its common stock investment toward high-beta, small, value stocks, and turned over 75 percent of its portfolio annually. Overconfidence can explain high trading levels and the resulting poor performance of individual investors. Our central message is that trading is hazardous to your wealth.

Trading is Hazardous to Your Wealth.

If you’re compelled to trade actively, isolate a small portion of your cash in a separate account designated solely for trading. I have nothing against trading especially if you can use it to gain knowledge about stocks.

You need to do your homework and study technical analysis. One of the best books to read is “Technical Analysis for Dummies,” available on Amazon.

4) The practice of selling stocks short will be found, in the end, to be invariably a losing business.

Decent short sellers make headlines. Professionals can hold out longer when they’re on the wrong side of the trade. The rest of the population should stay away from this hot mess.

Want to protect your portfolio? Keep it simple.

- Raise cash.

- Cut short your losses and let your profits run.

Investors tend to do the opposite. They’ll hold on to losers “hoping” they’ll come back and sell winners too soon. Keep in mind the dog doesn’t always return home. It’s better to face the fact and move on.

Since we hate losses twice as much as we appreciate gains, I understand the burning desire to get even. It’s a losing strategy. Before you purchase a stock, have a sell discipline in place.

The everlasting words of muses remain wise.

Old lessons are still profitable ones.

These ghosts of Wall Street made the mistakes first.

Learn from them.

Richard Rosso, MS, CFP, CIMA

Richard Rosso is the Head of Financial Planning for Clarity Financial. He is also a contributing editor to the “Real Investment Advice” website and published author of “Random Thoughts Of A Money Muse.” Follow Richard on Twitter.