by Eric Bush, CFA, Gavekal Capital

Regular readers know we have been keeping a watchful eye on the value of the Chinese yuan relative to the US dollar over the past several months (see here, here, here, and here). As the end of last month was approaching, and the inclusion of the yuan in the IMF SDR basket was drawing nearer, Chinese policy makers put a kibosh on the devaluation that has been going on for most of this year.

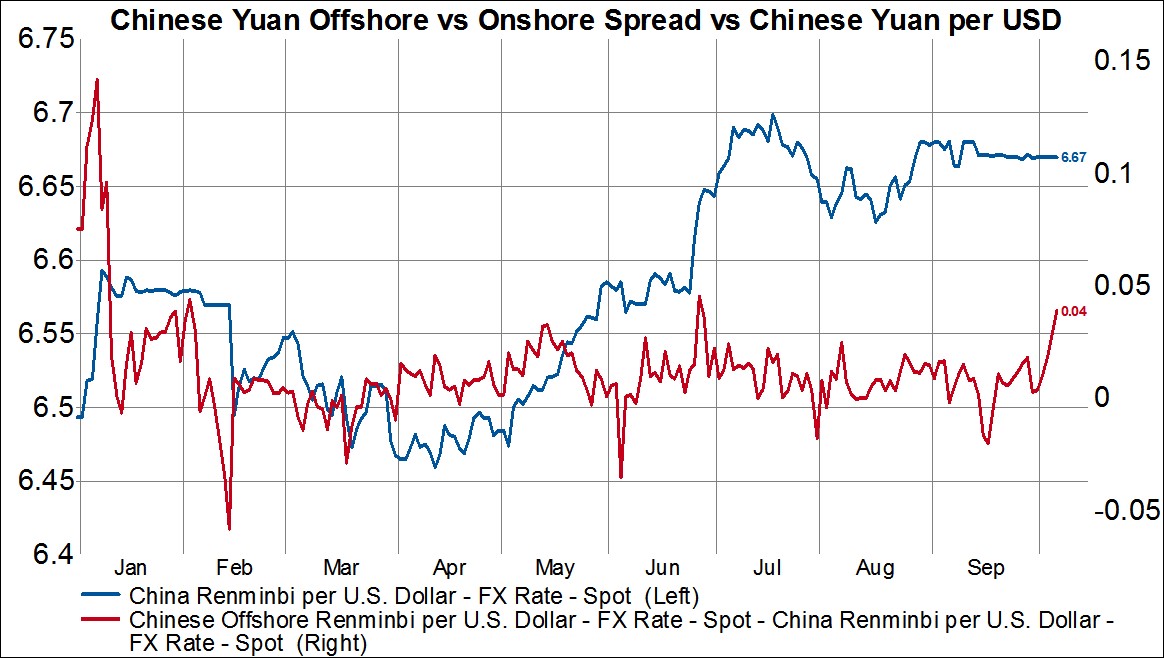

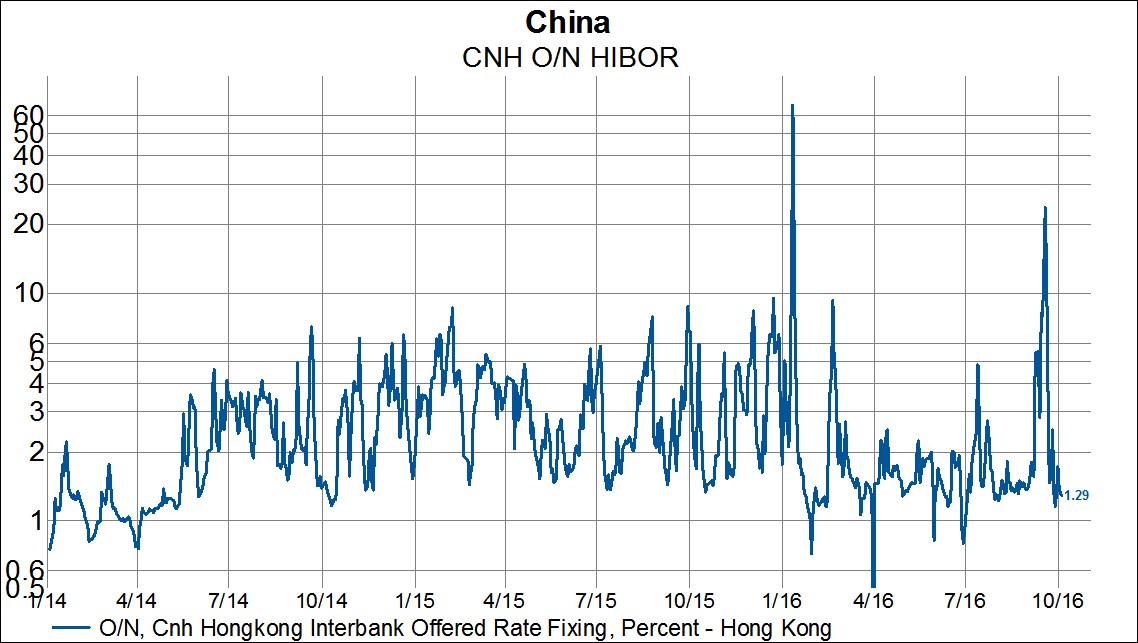

The onshore Chinese yuan exchange rate has been in an extremely tight range around 6.67 per USD since September 14th. This stability occurred thanks to a tried and true method of squashing speculators: jacking-up short-term HIBOR rates. Overnight HIBOR rates nearly hit 24% on 9/19 and one-week HIBOR rates hit nearly 13% on that same day.

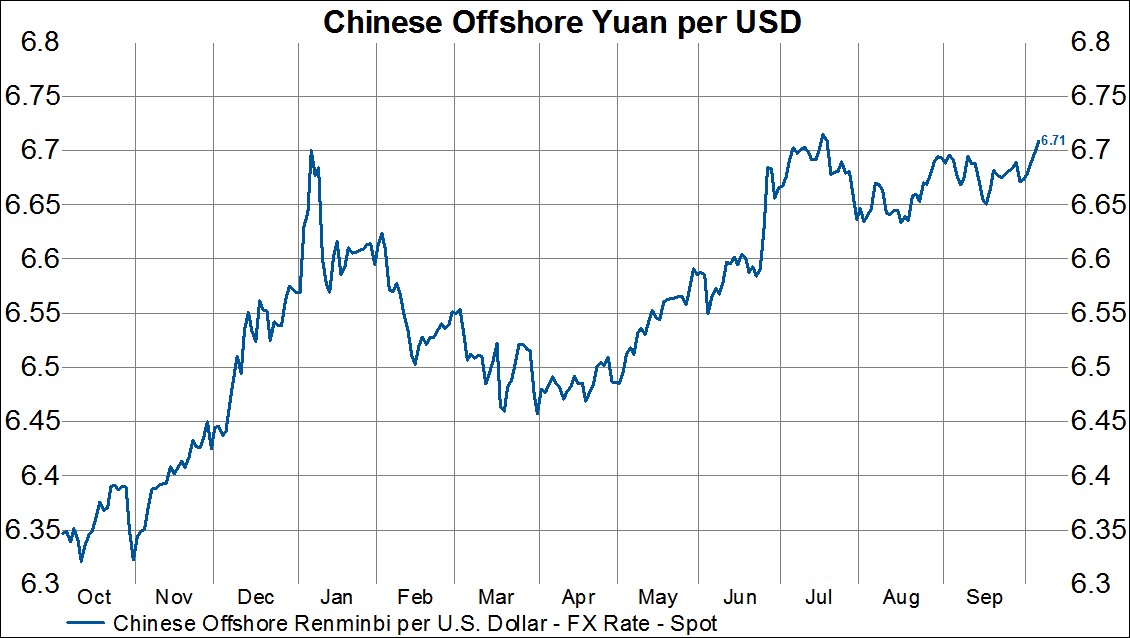

This made it incredibly expensive and painful to stay short. Well, now that the SDR is over it seems the devaluation is about to continue. Overnight HIBOR has dropped back to 1.29% which is the low end of the range for 2016. Additionally, the offshore yuan exchange rate breached 6.70 for the first time July and the spread between offshore and onshore exchange rates is now 0.04. This is the widest spread since June when the Chinese yuan depreciated from 6.58 to 6.70 in about a month.

Copyright © Gavekal Capital