by LPL Research

Looking back over the last 20 years, October has, on average, been a good month for the S&P 500. In addition to this broad seasonal pattern, there have also been sectors and industries that have exhibited a seasonal tendency to outperform the S&P 500 in October, notably, the information technology sector.

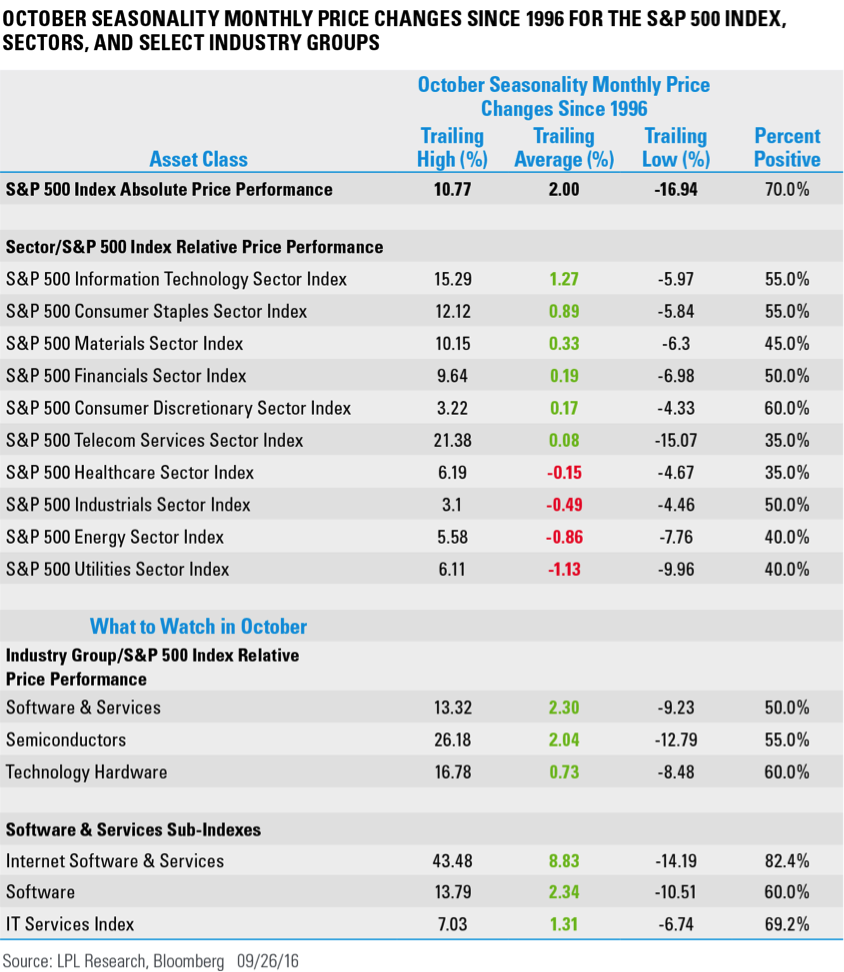

Since 1996, the S&P 500’s average price change for October has been 2.00%, with a best return of 10.77% and a worst return of -19.94%. One way to attempt to capture the bullish October seasonal effects for stocks, should they persist, would be to invest in the overall equities markets; there are, however, other potential seasonal opportunities, such as investing in sectors or industry groups within the S&P 500 that have historically outperformed the index in October. Comparing the price performance of an underlying sector or industry group to the broad-based index over a specific time period can help find the strongest seasonal performers compared to the overall market.

Going back to 1996, the sectors and industry groups that, on average, outperformed the S&P 500 in October are highlighted in green in the table below, and those that underperformed the index are highlighted in red.

Since 1996, the information technology sector’s average price change for October (based on the S&P 500 GICS sector index) has outperformed the S&P 500 by 1.27%, with a high of 15.29% and a low of -5.97%. Going a little deeper, the software and services sub-industry index has outperformed the S&P 500 Index, on average, by 2.30% in October, with a high of 13.32% and a low of -9.23%. Even deeper, within the software and services sub-industry index, the internet software and services sub-industry index has outperformed the S&P 500 Index, on average, by 8.83% in October, with a high of 43.48% and a low of -14.19%.

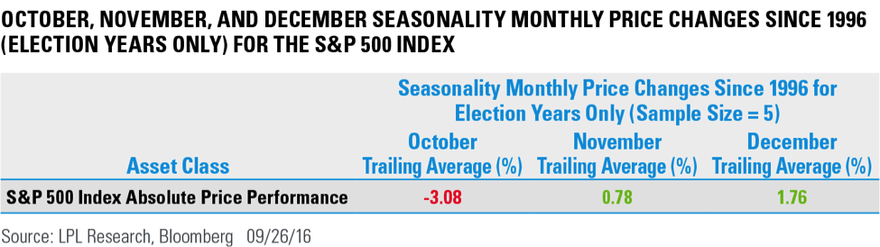

Do we think the chances of the S&P 500 posting a positive return this October will be consistent with the past? Well, one caveat is that this year is an election year. Since 1996, during election years, the S&P 500’s average price change for October has been -3.08%. But even if October is a weak month, the effect may be short-lived. Looking at the seasonal price data for those same election years, the S&P 500’s average price change for November has been 0.78%, and 1.76% for December, which indicates steady improvement in the price trend throughout the fourth quarter (see the table below).

Looking at the October seasonal patterns over the past 20 years, the bulk of the data suggest that stocks may continue higher; and on balance, the S&P 500 information technology sector index historically has outperformed broad-based equities during this time period. However, during an election year, there is an increased risk that price returns in October may become volatile. But this could present an opportunity. Looking at seasonal historical data for the election years since 1996, November and December have generated positive returns, which helps support the case to buy any October weakness in stocks on a dip.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Because of its narrow focus, specialty sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-539551 (Exp. 09/17)

Copyright © LPL Research