by Blaine Rollins, CFA, 361 Capital

Last week was a big one for the markets. With the end of September and the 3rd quarter approaching, new moves from the Fed and Bank of Japan could have caused much repositioning into the Q4. But both Central Banks delivered a warm cup of tea to the markets along with a flannel blanket to push back that new chill in the air. The Bank of Japan decided to target a fixed interest rate policy which could remove some volatility from their financial markets, while also guaranteeing some steepness to their yield curve. And stateside, the Fed once again waited on raising rates as the recently loud hawks succumbed to the doves cries for more inflationary data. All of the financial markets cheered as the U.S. Dollar was the only major asset class to decline on the week. It was risk-on across the board with global stocks, bonds and commodities gaining.

This week brings with it another set of challenges for the markets. First on deck is Monday’s Presidential Debate. Your guess is as good as mine if the performance will more closely resemble a Wes Anderson film, or one directed by Wes Craven. Oil leader talks will then hit Algiers with all of the top producers in attendance. Anticipate ongoing 3% moves in the daily price of energy this week. Fed speak will flow like a fire hydrant as the governors and presidents are free to talk post last week’s decision. Bond traders will be glued to the wires for more than a dozen talks. The world will also be watching the equity and bond prices of DeutscheBank after Angela Merkel said that there would be no government bailout of the bank. So now the world will find out just how rock solid the top European bank is in the face of the DoJ’s $14 billion fine. So get ready for another interesting week. And, it looks sketchy mid-week, call Bill Belichick because that guy can fix anything.

The September Fed decision in one quote…

“We judged that the case for an increase has strengthened but decided for the time being to wait for further evidence of continued progress toward our objectives.”

Fed Reserve Chair, Janet Yellen

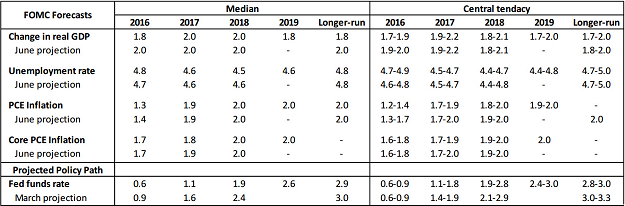

Here are the updated FOMC projections…

Few changes in the growth, jobs and inflation outlook. But a meaningful lowering of their future Fed Funds rate projection.

(RenMac)

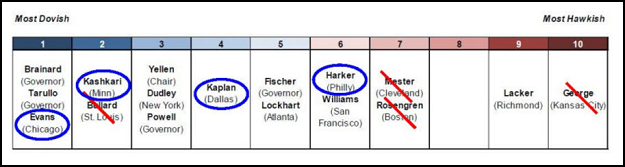

If you look at how the Fed voters will change in 2017, take note of how dovish the vote will shift…

(TimDuy)

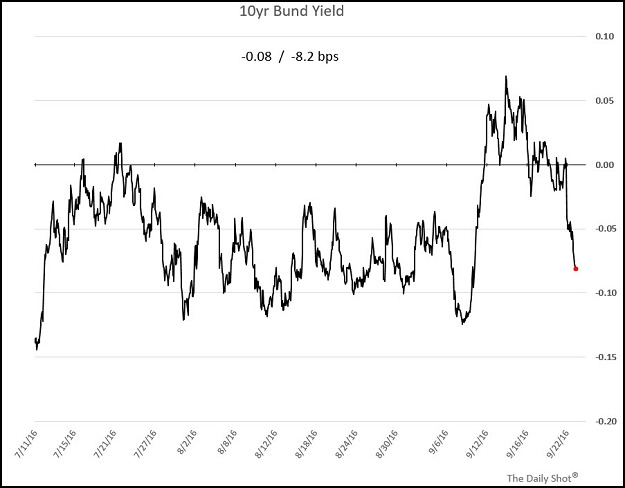

The pop in Euro yields at the beginning of September caused the volatile spike in the markets. But post the BoJ and Fed, Euro interest rates are settling down again as witnessed by this German 10-year Bond chart…

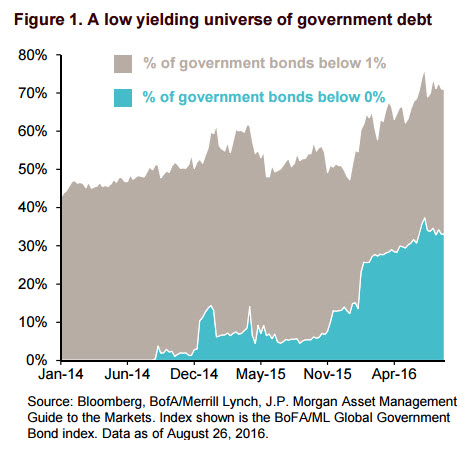

One more reminder of how low global sovereign yields are currently…

More than 70% of developed market government bond yields are trading with yields below 1%.

(JPMorgan)

Onto equities. One of the more meaningful moves last week was the new high in the NYSE Adv/Decline line…

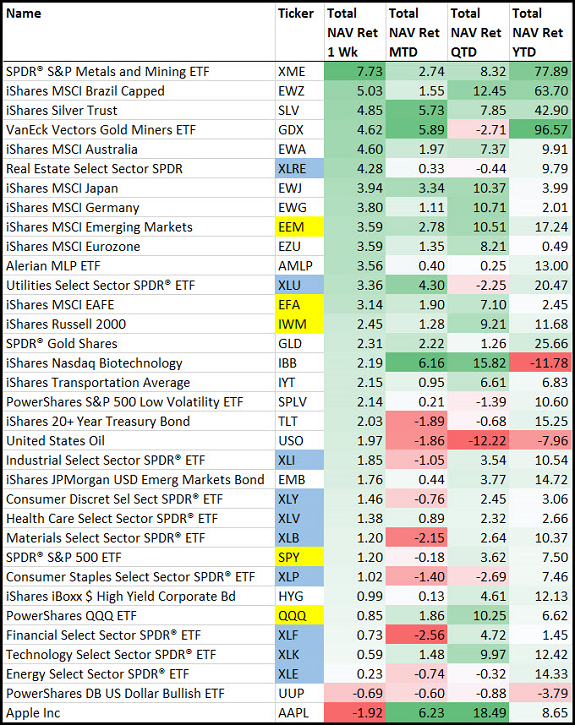

As mentioned at the start, almost every asset class gained last week except for the U.S. Dollar…

The riskier the better. And not a bad start for the newest XL Sector, Real Estate, which led the week after being spun off from the Financial sector last week. Important to note that this is the last trading week of September and the 3rd Quarter, so expect window dressing, asset allocating and rebalancing for the 4th quarter.

(prices as of 9/23/16)

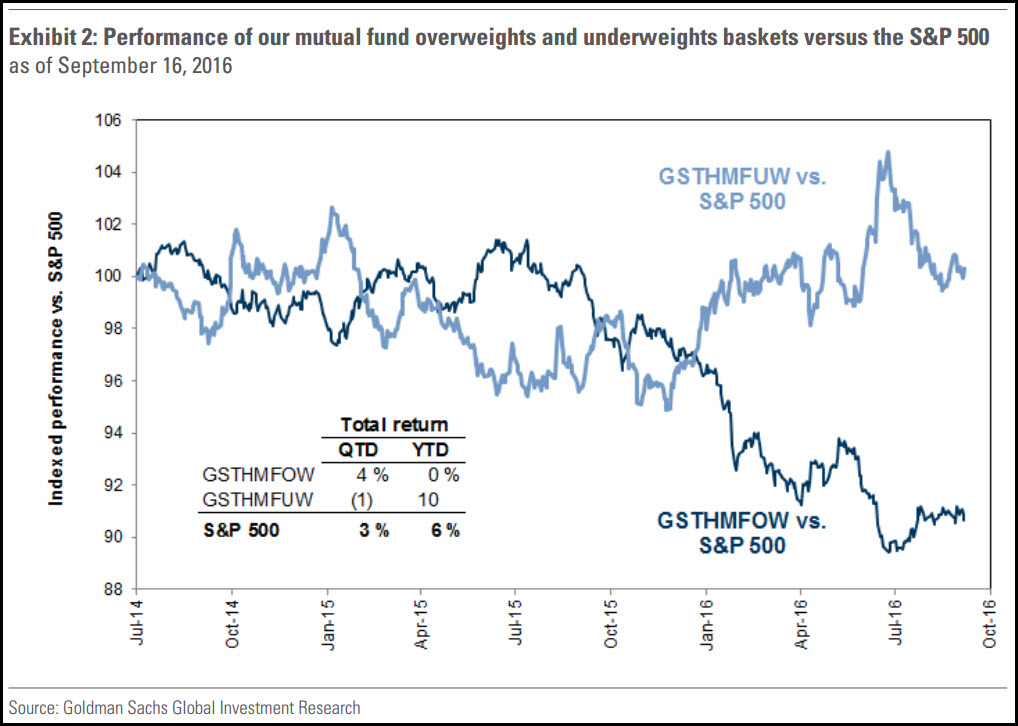

It has been a tough year for Mutual Fund managers as their best ideas have underperformed…

They are hoping the trend change in Q3 continues through year end to help them close the performance gap.

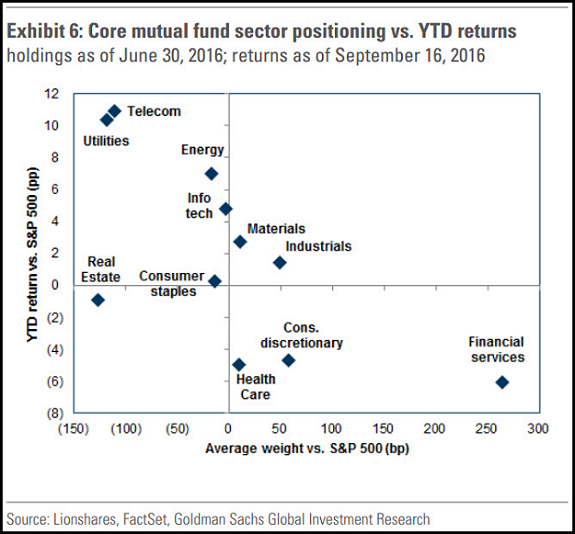

Where do Mutual Fund managers need help? Financial Stocks!

Think Banks, Brokers and Insurance Companies. A rate boost by the Fed would have been more helpful last week, so watch to see if PMs cut their financials this week. The Wells Fargo fiasco could not have happened at a worse time for mutual funds as the taint has impacted the entire bank group.

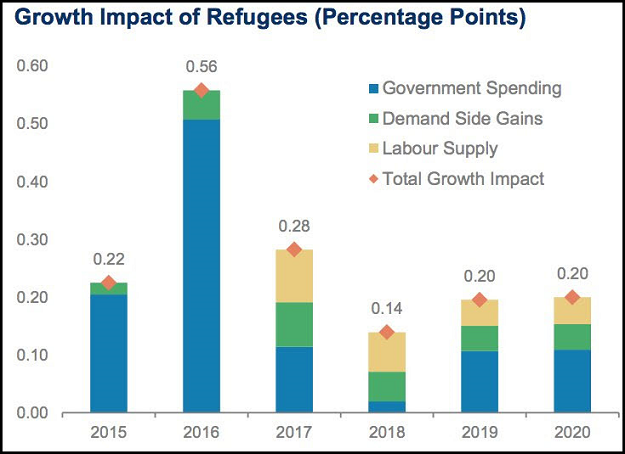

Morgan Stanley shows how Germany’s absorption of refugees will be a significant positive to their GDP growth in the next several years…

Germany is short low-skilled labor so the new population growth will help companies and keep a lid on wage inflation.

(@joshdigga)

A pickup in German GDP would be a warm welcome to Deutsche Bank which is in need of anything positive right now…

On Friday, Fitch ratings noted:

“The key challenges for the [German banking] sector remain ultra-low interest rates weighing on profitability, regulatory pressures, intense competition, and in the case of Deutsche Bank, misconduct and litigation charges.”

Some advisors were asking me about Gold versus Bonds last week at our conference. Here is a good chart showing the shift in sentiment which looks to be near a tipping point…

@allstarcharts: Gold vs US Treasury Bonds (10s) $GC_F $GLD $ZN_F $IEF

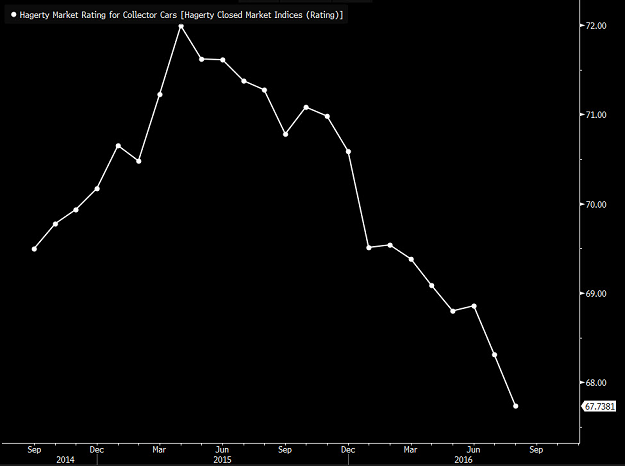

First Aspen, then Greenwich and now the Collectible Car Market…

The Hagerty Collector Car Market Index, which gauges the overall health of the market, fell to 67.7 in August, marking its third consecutive monthly drop.

Given its population of less than 40,000, I am upgrading the rating on Panama City, Florida debt. Probably a good time to look for some other assets in which to invest…

PANAMA CITY — Eastern Shipbuilding Group on Thursday landed a $10.5 billion contract — the largest in U.S. Coast Guard history — to build the first series of nine offshore patrol cutters, topping the biggest and best boatyards in the country in the process…

Eastern, which has two shipyards in Bay County, was one of three finalists vying for the $10.5 billion contract to build 25 next-generation offshore patrol cutters — at about $484 million each — and one of eight shipyards that originally submitted proposals for the project…

While the company was vying for the contract, D’Isernia said winning it would mean adding between 750 and 800 employees to the company’s payroll, which currently has about 1,500 people. It will be determined later when those jobs will be needed, as the contract includes design as well as construction. But D’Isernia said Thursday it likely will include 1,000 craftsmen jobs and more than 100 engineering and administrative staff to fulfill the contract requirements while still conducting the company’s normal business.

An incredibly good read on the man working to save bees…

Hayes was good at the job. Florida beekeepers came to see him and his 14 inspectors as allies rather than adversaries. “I didn’t want us to be the bee police,” he says. In 2006, Hayes was elected president of the Apiary Inspectors of America.

That same year, a commercial beekeeper in Florida named David Hackenberg discovered that his apparently healthy bees had disappeared and reported it to Hayes. Other beekeepers had similar accounts. Late one night, as the losses mounted—the nation would lose a third of its bees that winter—Hayes got on the phone with a group of alarmed entomologists. “We didn’t know what this was,” Hayes says, “but we felt we had to give it a name.” They called it colony collapse disorder.

By early the next year, the Internet was abuzz with theories about CCD. It offered a litany of dystopian ecological conspiracies: cell phones interfering with bee navigation, or genetically modified corn syrup, or neonicotinoid pesticides. But no one really knew.

(Wired)

(Wired)

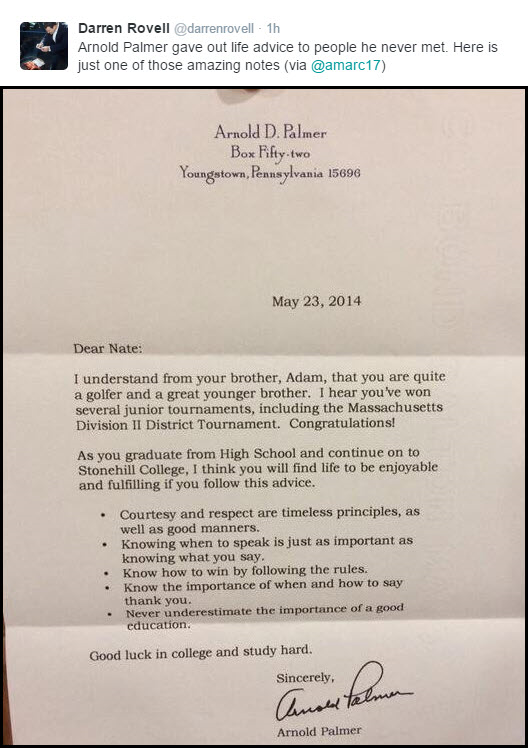

Finally, just good advice given unselfishly…

Copyright © 361 Capital