by Adam Butler, Resolve Asset Management, via GestaltU.com

“The greatest trick the Devil ever pulled was convincing the world he didn’t exist.”

– Verbal Kint, The Usual Suspects

The investment industry has investors convinced that the only path to better performance is through stock selection. As a result, most investors approach the challenge of portfolio construction exactly backward, and miss out on the most important opportunities to produce differentiated performance. The purpose of this series is to challenge the conventions that lead to misguided asset allocation priorities, and offer compelling reasons for practitioners to reverse their thinking, with the goal of delivering better outcomes for investors.

To review, Part I of this series introduced Grinold’s Fundamental Law of Active Management. Grinold proved that an investor’s opportunity to generate performance depends largely on the number of diverse investments that are available to construct portfolios. All else equal, an investor with more diverse investment choices should outperform an investor with fewer choices.

In Part II, we explained how to determine the number of truly independent sources of return in a portfolio. We used a technique called principal component analysis, and demonstrated how to isolate equity ‘beta’ from the returns of the 30 Dow stocks. We also illustrated why, according to a simple interpretation, the Dow 30 stocks are explained by just 3 independent sources of return.

In Part III, we reviewed seminal analyses on the relative importance of asset allocation and security selection from Grinold and Kahn, as well as Ibbotson and Kaplan. As these original analyses were descriptive studies of institutional returns, they really isolated the way institutions have chosen to apply active management. As such, they are less helpful in quantifying the true size of the opportunity.

Assoe et al. attempted to bridge this gap by performing a simulation study where they varied the allocation across asset classes, and independently across stocks, to determine the range of outcomes. Their analysis led the authors to conclude that individual security decisions and asset allocation decisions provide equal opportunities for differentiated performance. However, they anchored asset allocations to traditional endowment practices, i.e. 60% stocks and 40% bonds, and stock allocations to market capitalizations. As such, their analysis still did not capture the full opportunity set.

Here, in Part IV, we use the framework described in part II, along with some assumptions about the relationships between global asset classes, to illustrate the relative importance of asset allocation relative to security selection for an unconstrained strategy, such as Global Tactical Asset Allocation. We approach the problem from a theoretical perspective in order to capture the full opportunity set that is available to investors who focus in each domain. In addition, we quantify the proportion of global portfolio breadth that is available to active asset allocators versus stock-pickers given a range of correlation assumptions.

Revisiting Principal Component Analysis

Before we begin, we want to ensure that readers have a working grasp of our primary analytical tool, principal component analysis (PCA). Recall that PCA is simply a method to determine the number of independent forces that explain the dynamics of a system. It is used in voice and facial recognition, big data applications, physics, psychology, and almost any other domain you can think of where investigators want to tease out exactly what is happening in a complex process.

A metaphor may help illustrate the concept. Imagine that a man steals five dogs. Each dog is on its own leash, and has a GPS chip embedded in its collar so that it is possible to track its exact movements. As the man walks down the street the dogs move around in a seemingly random pattern, and trace out individual movements in space.

An analyst who works with the company who issues the GPS chips wishes to determine the direction that the man is walking so that the authorities can intercept him. To do so, he finds the positions of each dog, and how their positions vary from one another, at each point in time. He then performs PCA on their co-movements. The PCA reveals that, while the dogs are moving in a random pattern, there is one direction that is common to all dog movement: the movement in the direction that the thief is walking.

It’s easy to see how this concept relates to finding the dominant forces at work in a portfolio. Consider stocks: while each stock in the portfolio is reacting to a multitude of forces at any point in time, the force that dominates the movement of all securities is the direction that the market is moving in aggregate. PCA teases out this dynamic from the covariances or correlations observed between the individual stocks. Of course, the same analysis can be performed on any portfolio, including multi-asset portfolios, to determine the major forces at play.

Now that we understand how PCA works, let’s put this powerful tool to work in determining the relative impact of stocks versus asset allocation in a diversified portfolio.

A Basic Market Structure for Analysis

The analysis below is based on a framework first described by Staub and Singer (2011) in an article called “Asset allocation vs. security selection: Their relative importance.” The authors set out to see what proportion of total global breadth, across stock and bond indexes and individual stocks and bonds, is attributable to asset allocation relative to security selection. Note that the decision to invest in risky assets versus cash invokes a decision about what mix of asset classes to hold (in this case, proportion of stocks vs. bonds). Once the stock/bond proportion is chosen, the investor must choose which geographic markets to own, and once that decision is made what individual stocks and/or bonds to hold in those markets. In this way, each incremental layer of portfolio decision has a cascading impact on more granular sets of assets down the chain.

Staub and Singer provide a convincing argument for the use of an estimated correlation matrix as the measure of portfolio risk, in place of the more commonly used covariance matrix. They argue that the magnitude of risk – that is, an asset’s volatility – can largely be managed by scaling exposure to the asset up or down. However, the direction of risk, which is captured in the correlation matrix, is completely out of a manager’s control. As such, it is the purest source of portfolio risk, and contains the only important information about what is driving asset prices.

For their analysis, Staub and Singer created a large correlation matrix to capture the correlation structure among the following levels of grouping:

- The investment decision: invest in risky assets versus holding cash

- Asset classes: stocks or bonds

- Geographic markets within each asset class

- Securities within each geographic market

In addition they assume that:

- There are 20 independent stock markets and 20 independent bond markets

- Each independent market is composed of 100 securities

Each level of grouping contains correlation information about the levels above and below. For example, owning stocks anywhere in the world means you are correlated with the general risk of owning risky assets; more highly correlated yet with the risk of global equities, and; most highly correlated with the geographic equity market the stock is listed on. As such, the authors assume the following:

- Individual stocks in a market have a correlation of 0.5.

- Individual bonds in a market have a correlation of 0.8

- Stock indexes of different national markets have a correlation of 0.4

- Bond indexes of different national markets have a correlation of 0.6

- Stock indexes and bond indexes of the same market have a correlation of 0.3

- Stock indexes and bond indexes of different national markets have a correlation of 0.2

In a general sense, this decision tree describes a significant portion of the opportunity set for most large institutions, and exceeds the scope of decisions for many private investors.

With these assumptions in place, the authors construct a correlation matrix with 4000 rows × 4000 columns (100 stocks × 20 stock indexes + 100 bonds × 20 bond indexes). Each cell in the matrix holds the correlation between one security and another, which depends on the type of security (stock or bond), and the market. They then apply Principal Component Analysis to this structured correlation matrix to identify the proportion of independent portfolio breadth attributable to each level of grouping.

While in practice it is difficult to confidently link latent factors from PCA to real-world factors, Staub and Singer’s creative approach lends itself more concretely to traditional groupings. For example, in their analysis of multiple groupings of assets and stocks, the second factor loads with opposite signs on equities and bonds, and thus by logical extension can be viewed as the asset class (equity versus bonds) decision factor. Given this engineered structure, the authors have confidence in labeling the factor portfolios by the traditional groupings described above. Thus the forces driving all stocks and bonds in our simulation can be identified and quantified for interpretation.

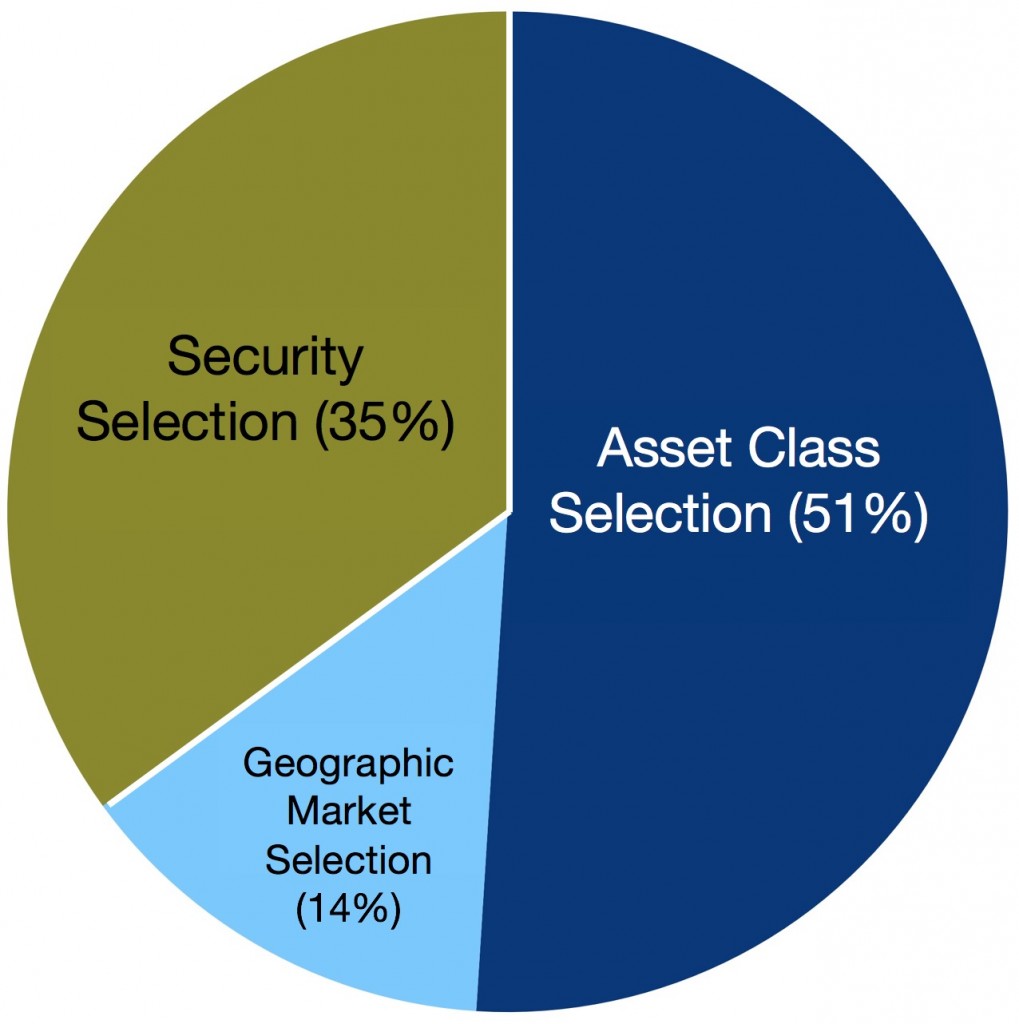

According to their analysis Factor 1 explains 37% of standardized variance, and captures the broadest decision to invest in capital markets in general. This is inferred because all securities – stocks and bonds – load on Factor 1 in the same direction. Factor 2 explains a further 14%, and since stocks and bonds load in different directions, it captures the stock/bond decision. As such, a total of 51% of total standardized variance is explained by these two asset-allocation decisions alone.

Adding the 40 factors related to geographic market allocation adds another 14% of explained variance and completes the ‘asset allocation’ dimension, bringing the total proportion of explained variance to 65%. The remaining dynamics in the system – 35% of explained variance – can thus be attributed to security selection, as described in Figure 4.

Figure 1. Proportion of standardized variance (implied breadth) available from opportunities in asset allocation versus security selection.

Source: Staub and Singer (2011)

How might one interpret this analysis? The broadest interpretation is that when you choose a stock for investment you are actually making several choices at once. You are choosing:

- To invest in capital markets in general

- To invest in stocks as an asset class instead of bonds

- To invest in stocks in a certain country or region

These are all choices related to asset allocation. Moreover, the three implied decisions above are likely to have a much larger impact on portfolio outcomes than your choice of specific stock. In fact, they explain about 65% of what happens to your stock under normal conditions. As such, it doesn’t really matter if you choose a good stock if it is a poor time to invest in capital markets in general (i.e. during extremely volatile crisis periods); if it is a poor time to invest in stocks vs. bonds, or; if it is a poor time to invest in the stock’s country or region.

If asset allocation choices have a more meaningful impact on portfolio results than one’s choice of individual securities, where should an investor spend his time to produce better results? Obviously, investors would be better off focusing on asset allocation.

Asset allocation vs. security selection under different correlation assumptions.

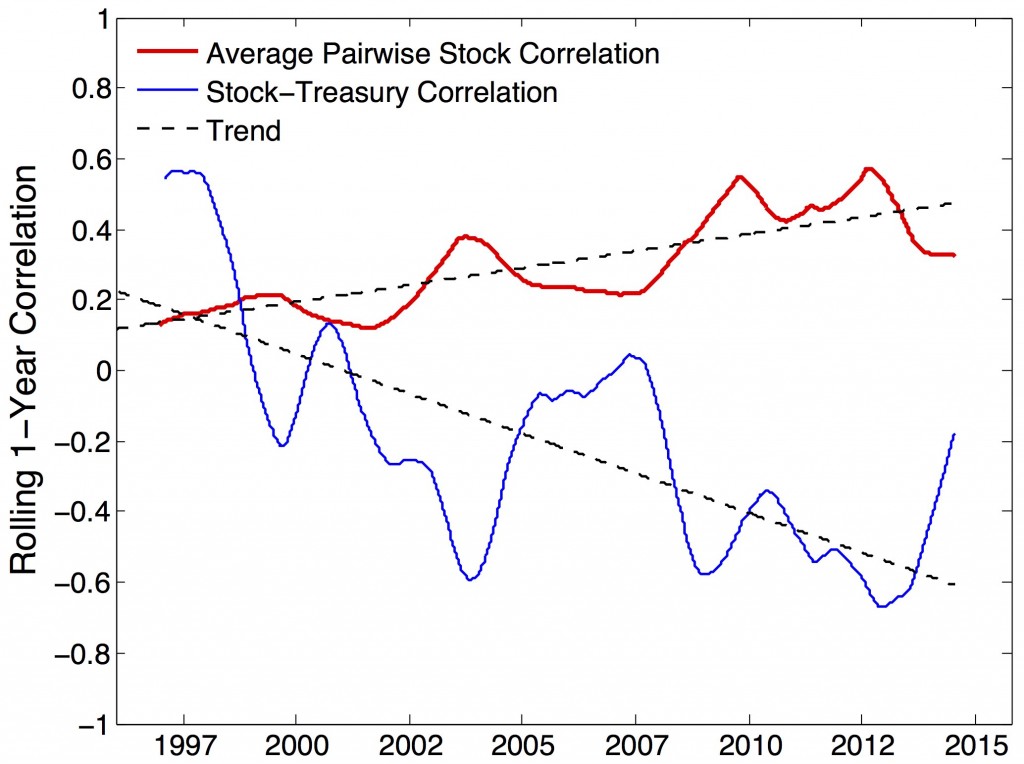

The Staub and Singer analysis made reasonable assumptions about the correlations between stocks and bonds of different markets under typical market conditions. But ‘typical’ conditions can change materially over time as markets move through different economic regimes and states. Figure 2. illustrates how correlations between individual stocks, and between stocks and bonds, have evolved over the past two decades.

Figure 2. Average Pairwise 252 Day Rolling Correlations for S&P500 Stocks and for S&P500 vs. U.S. Treasuries.

Source: ReSolve Asset Management. Data from CSI and Global Financial Data.

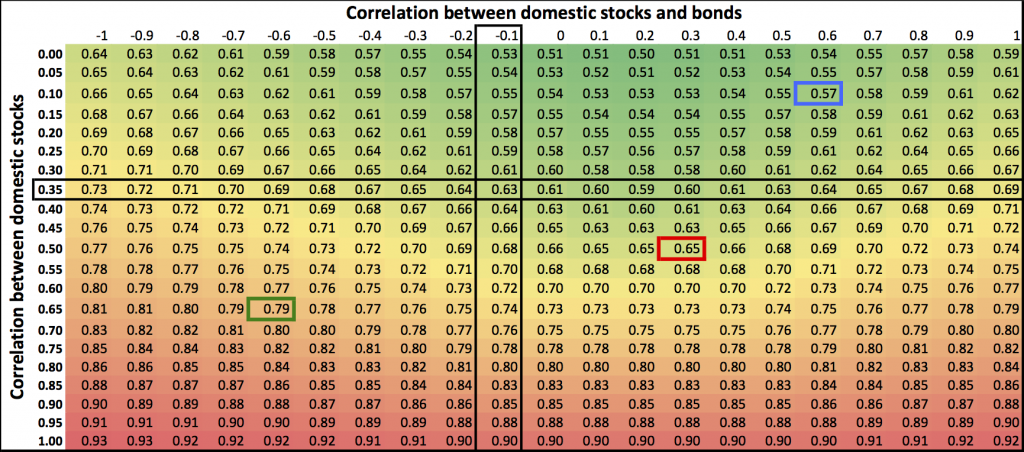

Under normal conditions, Staub and Singer demonstrated that the asset allocation related decisions dominate portfolio outcomes. But if correlations change through time, are there periods where this relationship is reversed? To answer this question, we performed the same analysis as Staub and Singer, but varied the correlation assumptions. Specifically, we varied the stock/bond correlation between -1 and 1, and pairwise correlations between individual stocks between 0 and 1. Figure 3. presents the results of this analysis. Specifically, it quantifies the proportional influence of asset allocation decisions on portfolio outcomes under each set of correlation assumptions.

Figure 3. Proportional influence of asset allocation decisions on portfolio outcomes.

Source: ReSolve Asset Management

Some examples might help tease out the salient information from Figure 3. First off, the black border around the vertical column at -0.1 highlights the average correlation between the S&P 500 and U.S. Intermediate Treasuries over the past 20+ year period from Figure 2. The horizontal black borders at 0.35 on the y-axis highlight the average value for pairwise U.S. individual stock correlations over the same period. Where they intersect at a value of 0.63, we can infer that asset allocation dominates 63% of portfolio decisions under this specific set of correlation assumptions. Note then that the amount available from security selection is simply 1-0.63, or 37%. So under average conditions, most of the available opportunity for active management is derived from asset allocation decisions, not security selection decisions.

A few other values are highlighted because they are of particular interest. First, the red bordered value of 0.65 corresponds to the assumptions used by Staub and Singer of correlations of 0.5 between domestic stocks, and 0.3 between domestic stock indexes and domestic bond indexes. Note that our analysis confirms their conclusions.

In addition, the blue bordered value of 0.57 represents the intersection of the 95th percentile stock/bond correlation (when stocks and bonds are highly correlated) and the 5th percentile average pairwise stock correlation (when individual stocks are not highly correlated), which identifies the most favourable times for stock pickers. Incredibly, even at peak times for stock pickers they still have at their disposal less than half of the opportunity set that would be available to them if they expanded their scope into active asset allocation.

Lastly, we highlight the proportional breadth during periods of market stress like 2008, when pair- wise stock correlations have historically converged towards 1, and stock-bond correlations have often been highly negative. As such, the green bordered value represents the intersection of 95th percentile average pairwise stock correlation with the 5th percentile stock / bond correlation, a period which clearly favours asset allocation decisions. You can see that at such times of market stress the active asset allocation opportunity may dominate security selection by almost a factor of 4 to 1.

Conclusion

In The Usual Suspects Verbal Kint made the case that global criminal mastermind Keyser Söze had pulled a great trick by convincing the world that he didn’t exist. It seems the asset management industry has pulled a great trick of their own: they’ve convinced millions of investors for many decades to focus on the domain of investing with the least impact on long-term results. That is, investors have been overwhelmingly convinced to focus on stock selection for active returns and ignore the more meaningful opportunities in active asset allocation.

Investors can, perhaps, be forgiven for falling for this trick in years past because there were few options available to express asset allocation decisions directly. But this excuse is no longer valid. Investors now have over 4000 Exchange Traded Funds (ETFs) representing every conceivable asset class, geography, sector, or risk factor imaginable. Of course, just because all the pieces are present doesn’t mean you know how to put the puzzle together. That’s where we come in.

Download the Adaptive Asset Allocation whitepaper here.

Copyright © GestaltU.com