by James Paulsen, Chief Investment Strategist, Wells Capital Management, Inc.

Most sovereign bond yields have been rising since early July (e.g., the 10-year U.S. Treasury yield has risen by about 30 basis points, the Japanese 10-year is up by about 25 basis points and the German 10-year bund yield has risen by about 15 basis points) and the U.S. Federal Reserve appears increasingly likely to hike the funds rate again before the year is over. Understandably, stock investors are weighing the potential impact should interest rates finally trend higher.

This short note is a statistical look at the post-war relationship between the stock market and bond yields. Since 1950, the stock market has done fine with rising yields provided the annual growth in earnings per share exceeds the 10-year Treasury yield. Indeed, historically, when yields have risen while earnings growth was above the 10-year yield, the S&P 500 increased by almost 10% per annum. Since the 10-year Treasury yield is currently near a record low of about 1.65%, even extremely modest earnings growth may be sufficient to push the stock market higher as interest rates rise.

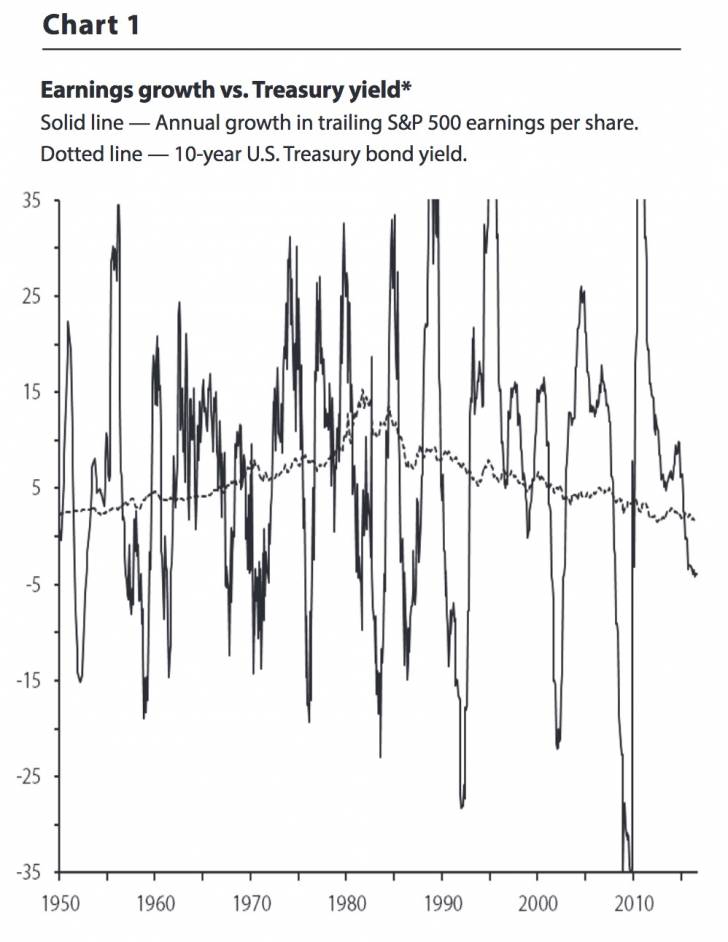

Earnings growth vs. bond yields

Chart 1 compares the annual growth in S&P 500 earnings per share with the 10-year Treasury bond yield. Since 1950, the stock market has responded quite differently to interest rate changes depending on whether earnings growth exceeds or is less than the 10-year bond yield. For example, in the late-1970s and early-1980s, even 10% earnings growth was not necessarily sufficient to propel stocks higher as the 10.year yield rose above 15%. However, in the contemporary recovery, even paltry earnings gains of 3% to 4% may be enough to keep the stock market rising since the 10-year yield has seldom risen above 3%.

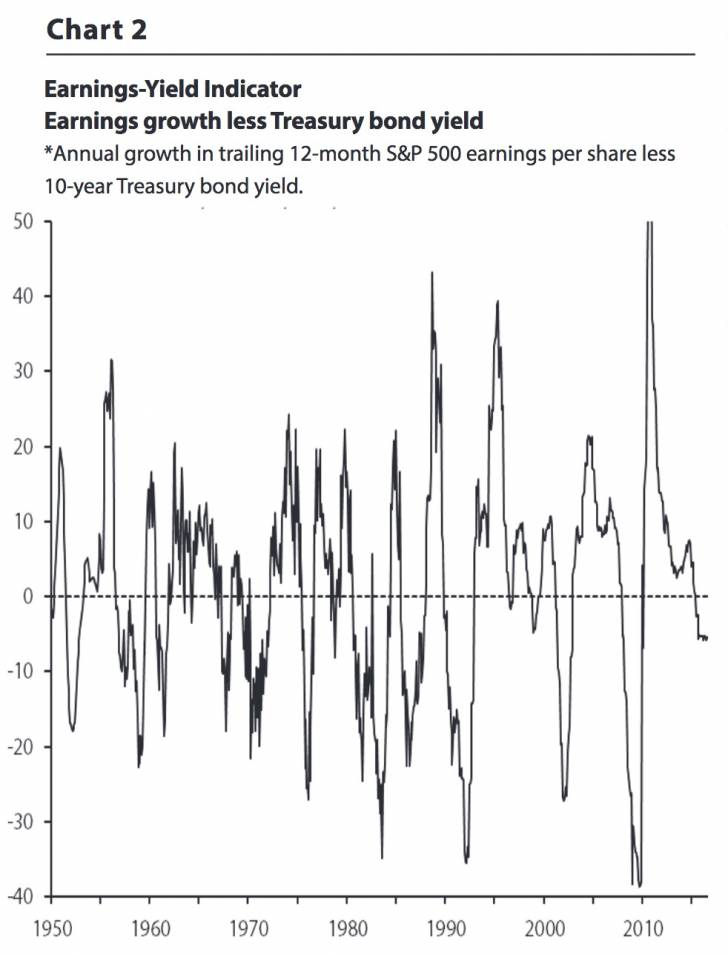

Chart 2 shows the earnings-yield indicator (EYI), which normalizes earnings growth for the 10-year Treasury yield. The dotted line in this chart separates periods when earnings growth exceeded the 10-year yield from periods when earnings growth was slower than the bond yield. As illustrated below, the stock market has historically responded very differently to interest rates depending on whether the EYI was positive or negative. That is, for the stock market, the pace of earnings growth “relative” to the bond yield is of paramount importance.

Earnings Yield Indicator

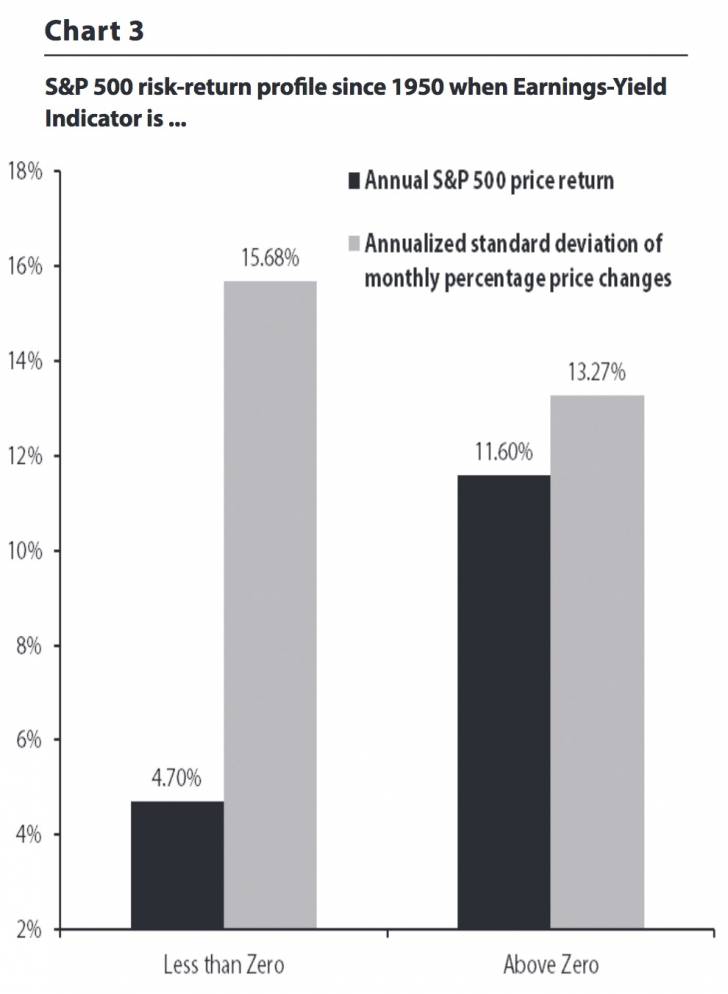

Chart 3 illustrates just how much the S&P 500 risk-return profile changes depending on whether the EYI is positive or negative. Since 1950, when the EYI was above zero, the stock market produced returns more than twice as great as when the EYI was below zero (i.e., an 11.6% annualized return when the EYI>0 versus only a 4.7% return when the EYI<0) and with about 15% less volatility (i.e., 13.27% versus 15.68% standard deviation of returns)! Moreover, when the EYI was above zero, the stock market had positive monthly gains about 62% of the time compared to only about 55% of the time when the EYI was less than zero.

Regardless of the direction of interest rates, the stock market has typically done well in the post-war era whenever earnings growth has exceeded the 10-year Treasury bond yield.

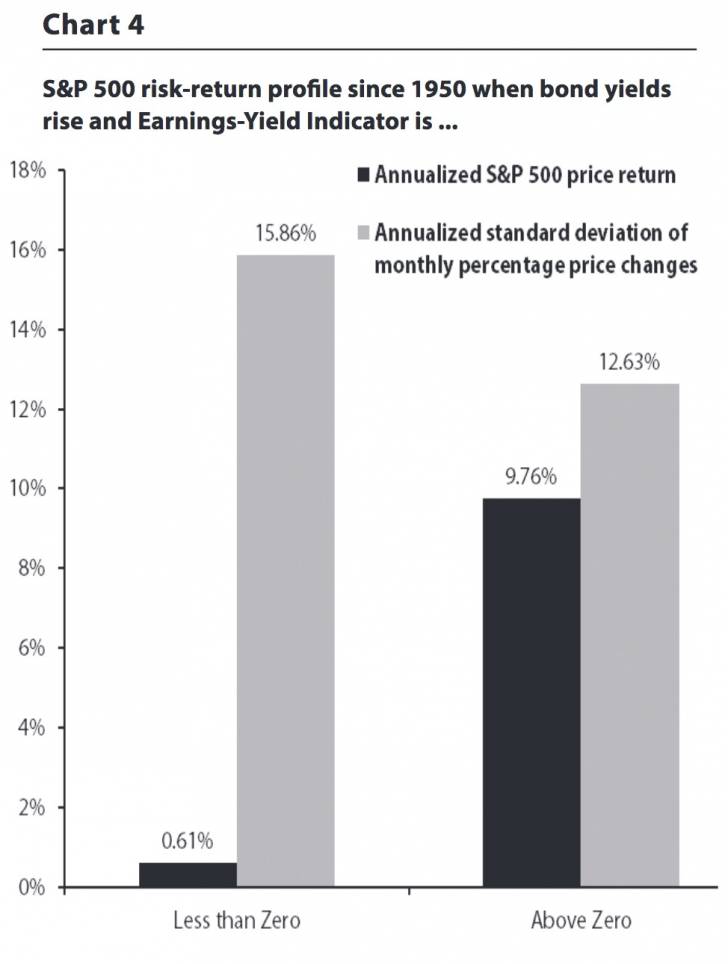

However, as shown in Chart 4, provided the EYI is positive, the stock market has also provided investors with solid returns even when interest rates were rising. Since 1950, for all months when the 10-year bond yield rose and the EYI was positive, the S&P 500 Index increased at almost a 10% annualized pace. By comparison, when yields rose while the EYI was negative, stock gains were only 0.61% annualized.

Moreover, compared to all months since 1950 when the EYI was positive, stock market volatility has actually been less during those months when interest rates increased (i.e., the standard deviation in Chart 4 when the EYI was positive was 12.63% compared to 13.27% in Chart 3).

Don’t sell a rate rise with a positive EYI

Facing the prospect of a rising interest rate trend is always disconcerting for stock investors. However, history shows that as long as earnings performance outpaces the 10-year bond yield, the stock market provides satisfying returns. As shown in Chart 1, during the last couple years, earnings growth has turned negative and accordingly, with a negative EYI, the stock market has struggled.

However, the drag on earnings performance from weak commodity prices has come to an end and we anticipate somewhat improved U.S. and global economic growth in the coming year. This should revive earnings growth and since bond yields remain extraordinary low, even modest earnings growth should soon return the EYI positive. That is, the stock market does not currently require robust 10%+ earnings growth to withstand rising interest rates. Rather, since the 10-year bond yield is so low, even disappointingly slow earnings growth is probably sufficient to keep the stock market rising.

So, stock investors take heart. Check out Chart 4 again and don’t over worry about a Fed hike when the EYI is turning positive again.

Written by James W. Paulsen, Ph.D.

An investment management industry professional since 1983, Jim is nationally recognized for his views on the economy and frequently appears on several CNBC and Bloomberg Television programs, including regular appearances as a guest host on CNBC. BusinessWeek named him Top Economic Forecaster, and BondWeek twice named him Interest Rate Forecaster of the Year. For more than 30 years, Jim has published his own commentary assessing economic and market trends through his newsletter, Economic and Market Perspective, which was named one of “101 Things Every Investor Should Know” by Money magazine.

*****

Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes Affiliated Managers (Galliard Capital Management, Inc.; Golden Capital Management, LLC; and The Rock Creek Group); Wells Capital Management, Inc. (also includes First International Advisors, LLC; and ECM Asset Management Ltd.); Wells Fargo Funds Distributor, LLC; Wells Fargo Asset Management Luxembourg S.A.; and Wells Fargo Funds Management, LLC. Wells Fargo Securities International Limited, First International Advisors, and ECM Asset Management Limited are authorized and regulated by the U.K. Financial Conduct Authority. First International Advisors and ECM Asset Management are also registered with the Securities and Exchange Commission in the U.S.

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000.

Wells Capital Management, Inc. | 525 Market Street | San Francisco, California 94105

Copyright © Wells Capital Management, Inc.