by LPL Research

The London interbank offered rate (commonly known as Libor) is an interbank lending rate and is also used as a short-term interest rate benchmark. Libor is a popular benchmark and used as a reference rate on an estimated $350 trillion of debt worldwide, including adjustable rate mortgages and floating rate bonds.

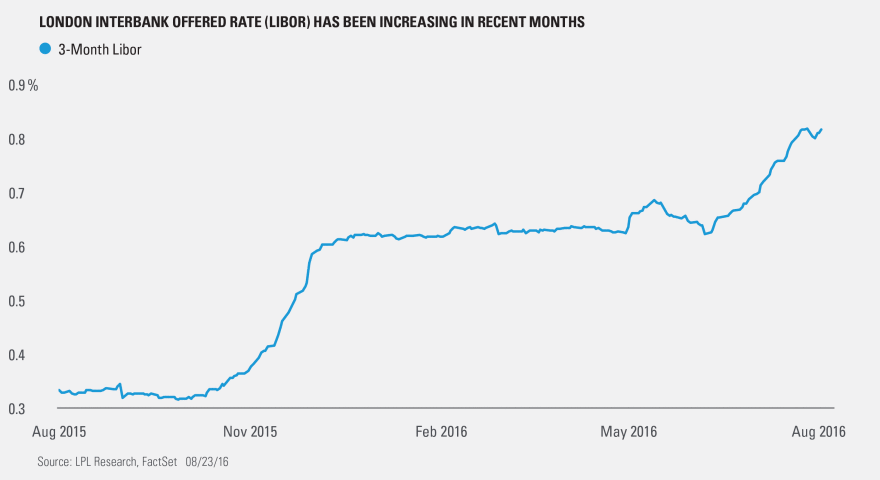

As shown in the figure below, Libor has been increasing in recent months, raising the fear that banks are becoming uneasy about trading with one another; but a rise in interbank lending fears is not the driver, in our view. Other measures of bank fears, such as corporate bond yield spreads and credit default swap (CDS) spreads in particular, do not corroborate concerns. A more likely driver is regulation—specifically, upcoming money market reform.

Upcoming money market reform is the primary driver of the recent Libor increase. The SEC’s new money market rules go into effect on October 14, 2016. After that date, institutional prime money markets will move to a floating net asset value (NAV), while government money markets will be allowed to retain a fixed NAV. This decision has led institutional investors to sell approximately $293 billion of prime money market holdings year to date (according to ICI data), with approximately $280 billion moving into government money markets. The movement of assets has decreased demand for common holdings of prime money markets, such as commercial paper and CDs, leading to higher rates for these short-term instruments that influence Libor.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

The London interbank offered rate (Libor) is an interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. The Libor is fixed on a daily basis by the British Bankers’ Association. The Libor is derived from a filtered average of the world’s most creditworthy banks’ interbank deposit rates for larger loans with maturities between overnight and one full year.

A credit default swap (CDS) is designed to transfer the credit exposure of fixed income products between parties. The buyer of a credit swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the product. By doing this, the risk of default is transferred from the holder of the fixed income security to the seller of the swap.

The money market is where financial instruments with high liquidity and very short maturities are traded. It is used by participants as a means for borrowing and lending in the short term, with maturities that usually range from overnight to just under a year. Among the most common money market instruments are Eurodollar deposits, negotiable certificates of deposit (CDs), bankers acceptances, U.S. Treasury bills, commercial paper, municipal notes, federal funds and repurchase agreements (repos).

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-529176 (Exp. 08/17)