by Benjamin Streed, Fixed Income, Raymond James

This version of the weekly commentary is going to focus less on descriptive paragraphs of text and will instead provide core charts/graphs and other visuals. Why? In this environment it seems that a picture is “worth a thousand words” as they say. Below are three charts that give a quick summary of what is influencing the global bond markets and the things investors should pay attention to as we wrap up the year.

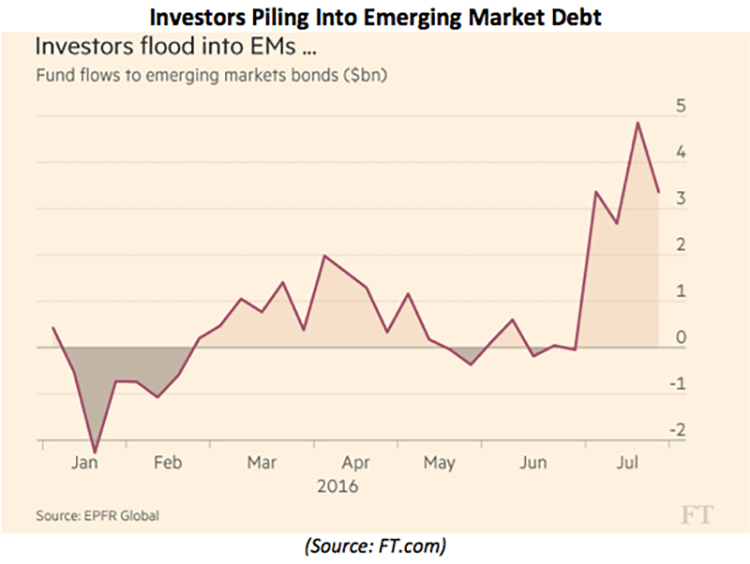

First, let’s confirm the worldwide phenomenon that is the ongoing search for yield. With Europe, Japan and the UK now engaged in historic quantitative easing (QE) programs, investors around the globe are expanding their horizons (quite literally) and putting money wherever they can find yield. The chart below, via The Financial Times shows the massive uptick in fund flows this summer towards emerging market debt. This search for yield makes sense (for those that can accept the additional risk inherent in EM debt): the Bloomberg Developed Markets Sovereign Index yield sat at 110bp a year ago and now rests at a mere 49bp, a sharp move lower. Keep an eye on this trend, should EM flows remain strong it could indicate a global belief that rates could stay “lower for longer” even as the Fed hopes to hike rates sometime in 2016.

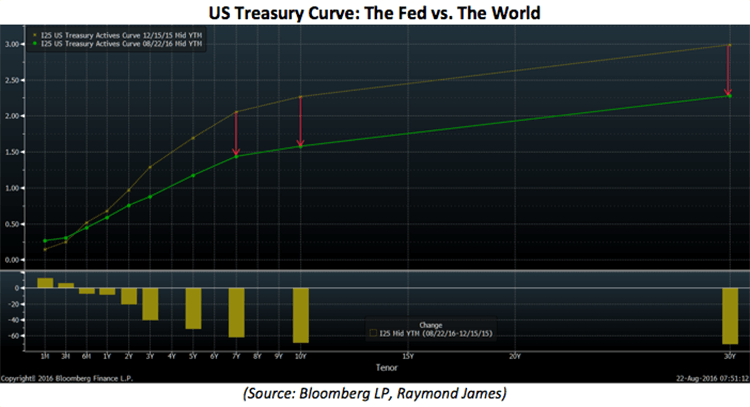

Second, as stated before in previous commentaries, US Treasuries are quickly becoming the proverbial “only game in town” for global investors seeking the combination of safety and positive yield. Could the ongoing bouts of QE overseas help keep a lid on long-term rates here at home? It’s very possible, especially if we look at how this has played out since December. The result of last year’s Fed action/liftoff was minimal, especially considering the global forces at work. Below is a quick visual of the US Treasury curve pre and post “liftoff”; the current curve is in green and the old curve is in yellow for comparison. The curve flattened thanks mostly to the large decline in longer-term rates (yellow bars below) while the front-end was only marginally affected by the Fed. Looking at this significant move lower in yields, one might be surprised to learn the Fed had begun “liftoff” at all.

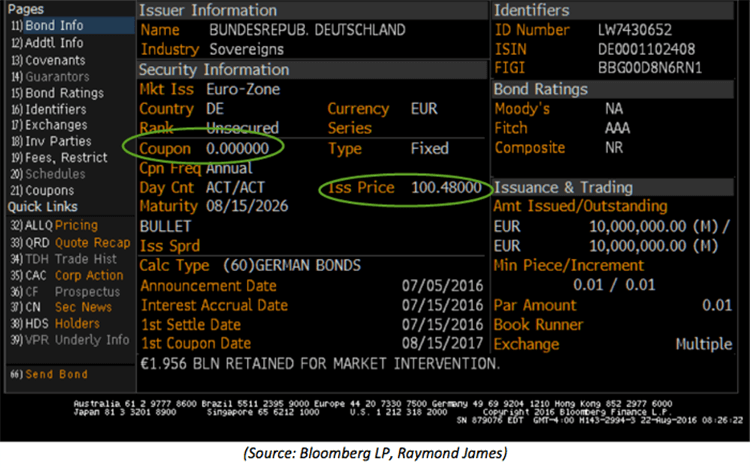

Finally, here’s something to ponder as we consider what the future holds: the German Central Bank recently sold €10 billion of a zero coupon, 10-year bond into the market at a price above par. Think about this for a second, really let it sink in: no income/coupon and the bond costs more than it will return at maturity (issue price > par), sold at a negative yield of ~4 basis points (bp).

Meanwhile, the 10y US Treasury yields ~150bp and continues to see strong demand from overseas buyers who are battling negative yields for the indefinite future. In conclusion, the world faces a robust and ongoing search for yield and safety helping to keep a lid on US rates as international investors find solace in the US market. This is in conflict with the Fed who hopes to raise rates later this year.

Copyright © Raymond James