by Don Vialoux, Timingthemarket.ca

Observations

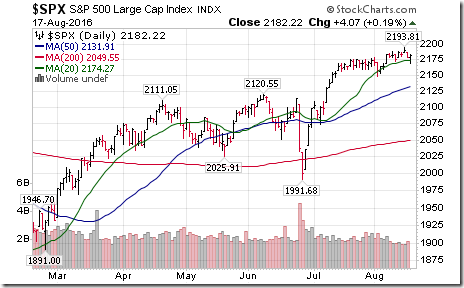

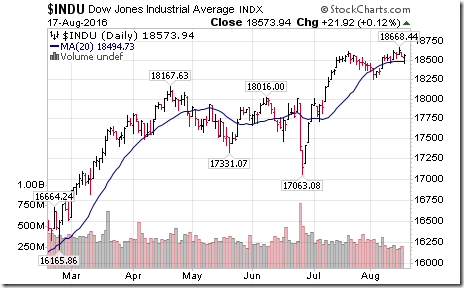

U.S. equity indices moved slightly higher, Treasury bond prices moved slightly higher, commodity prices (mainly energy) moved slightly higher and the U.S. Dollar moved slightly lower following release of the FOMC’s minutes for the July 27th meeting. Moves indicated an increasing likelihood that the Fed will not increase the Fed Fund rate until the December meeting. More hints likely will be provided at the Jackson Hole Fed conference next week.

StockTwits Released Yesterday @EquityClock

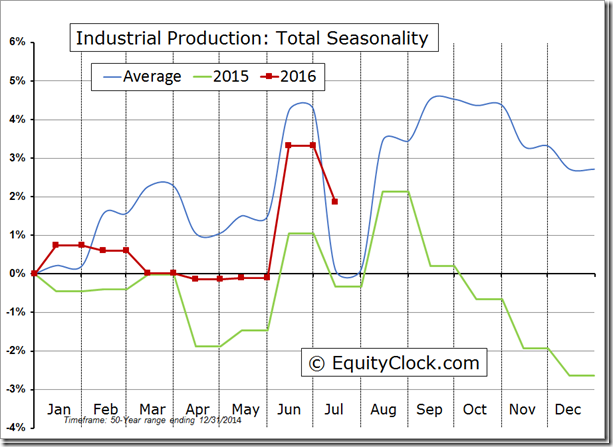

Strongest surge ever in electric power generation helped lift industrial production above seasonal norms.

Technical action by S&P 500 stocks to 10:00 AM: Bearish: Breakdowns: $LOW, $HRL, $T. No breakouts.

Editor’s Note: After 10:00 AM EDT, one stock broke resistance: BRKB and 10 stocks broke support: $SPLS, $EQR, $HCA, $MLM, $VMC, $AVB, $AZO, $PDCO, $CTSH, $LMT

$LOW completed a double top pattern on a break below $79.67 following negative guidance.

AT&T $T completed a double top pattern on a break below $41.70.

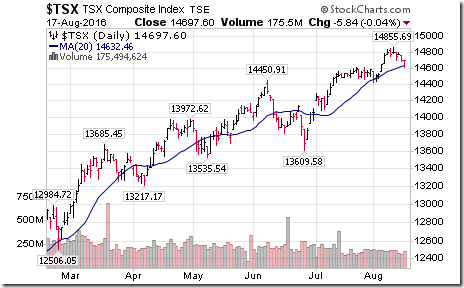

Dow Jones Industrial Average, S&P 500 Index and TSX Composite Index dropped below their 20 day moving average.

Editor’s Note: All recovered after the Fed’s release at 2:00 PM to close above their 20 day moving average

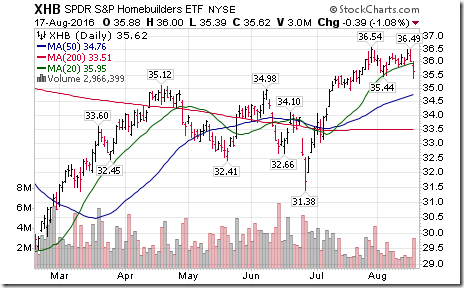

Homebuilders SPDRs $XHB completed a short term double top pattern on a break below $35.44

Trader’s Corner

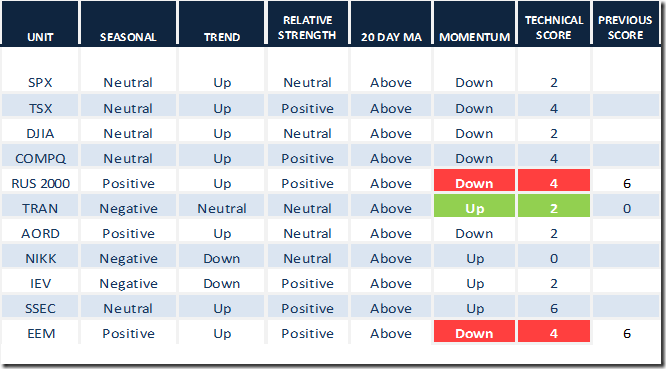

Daily Seasonal/Technical Equity Trends for August 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

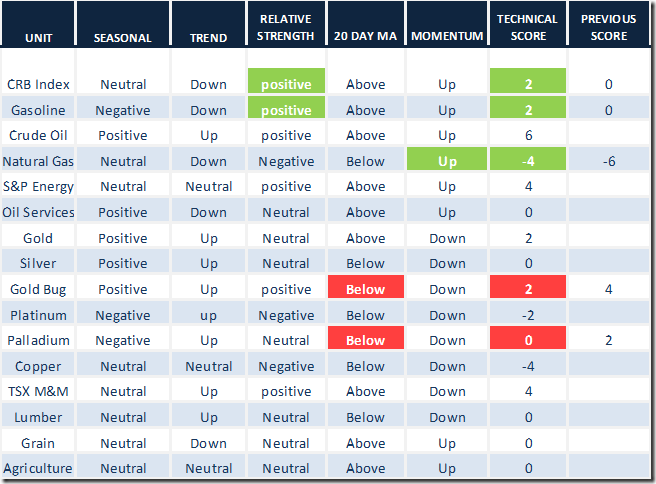

Daily Seasonal/Technical Commodities Trends for August 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

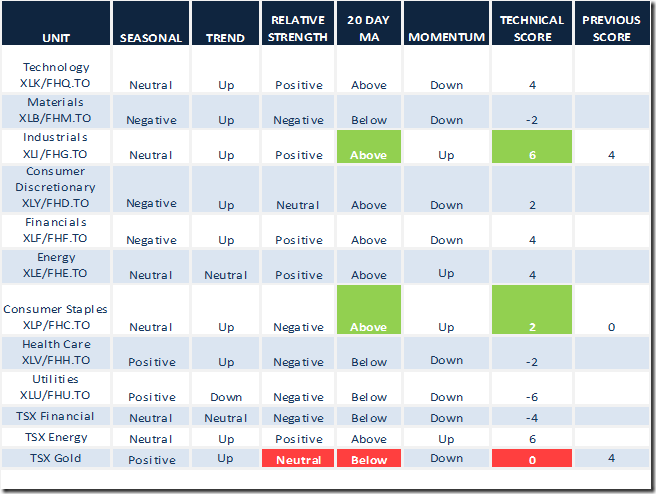

Daily Seasonal/Technical Sector Trends for August 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Trader Blow Up

By Adrienne Toghraie, Trader’s Success Coach

Let’s look at some of the reasons traders blow up their account and lose their passion for trading.

Playing catch up

While it is important to have a plan, the plan has to be realistic. What happens to some traders is that their enthusiasm and their desire for earning money overtakes their common sense about what is possible for their circumstances. Here are some of the things that must me considered when you are planning:

Time

Let’s say you have to give at least a nine hour day to your full time job with traveling. With sleep, exercise, time for meals, grooming, relaxation and other family responsibilities you add another thirteen hours. This means that you have an average of two hours per day for your trading. The only problem is that each one of those activities can ask or demand more of your time.

Here is an example of how your life can overtake your trading:

You see that it is necessary to work at your job an extra two hours. You take the time away from family responsibilities and create tension in that part of your life. Perhaps, you rush home only to find that you get a ticket for speeding. Exercise, sleep and relaxation could lose out on your time and you wind up feeling more stressed. You can see by this example that a combination of life activities can overwhelm you and result in bad trading decisions or no trading decisions. An accumulation of time issues lays the foundation for a blow up in trading.

Energy

Many traders make bad choices, which result in less energy:

· Eating simple carbohydrates instead of protein for breakfast and lunch

· Unhealthy choices of snacks and sugar drinks throughout the day

· All addictions – alcohol, caffeine, drugs

· Choosing to sleep less

· Ignoring stress levels

· Negative interactions with people

· Not taking care of psychological issues before they blow out of proportion

Making up the difference

If your trading is on target for the profits that you have predetermined you would earn, you are going to feel good about yourself and your trading. Suppose then that there is a down turn, maybe through no fault of your own. Then stress starts to build. You want to make up the losses so you start to take on more trades and risk. Instead of earning more profits you wind up losing and repeat the cycle again and again. You are now on a path of blowing up your account.

Getting bored

You have been a consistently profitable trader and now the challenge that excited you about trading in the first place is no longer there. Perhaps, you should try another strategy, another time frame, work longer hours, work less hours, or take more risk. For some traders these can be good choices, but for others it can mean the beginning of the end of their trading. Ultimately, a trader who has not prepared himself for these changes with a new strategy and tested the new parameters is setting himself up for a blow up in the markets.

Follow the pre-determined contingencies of your business plan

Major issues that can interfere with profitable trading can come up at any given moment. It is not only important to plan for these events, but it is also important that you follow your plan with the best actions to take during these times. Major issues such as a death in the family, a divorce, having a new baby or moving to a new apartment will have an effect on your trading performance. Those who think it will not, could find themselves blowing up their trading account.

Conclusion

To be a consistently profitable trader you must monitor your stress levels whenever there are any changes in your normal activities. Stress upon stress will lead you to a blow up in your profits and take a toll on your passion for being a trader.

Free Newsletter

More Articles by Adrienne Toghraie, Trader’s Coach

Sign up at – www.TradingOnTarget.com

Special Free Services available through www.equityclock.com

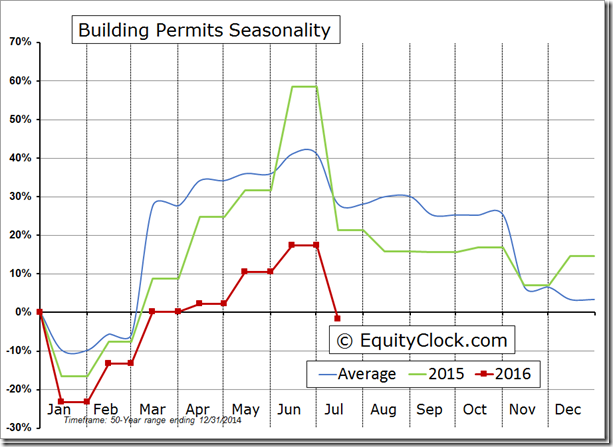

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

S&P 500 Momentum Barometer

The Barometer gained 0.80 to 68.20. It remains intermediate overbought and trending down.

TSX Composite Momentum Barometer

The Barometer slipped 0.43 to 69.23. It remains intermediate overbought and continues to roll over.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca