Myth: A flat yield curve means a recession may be coming

by James Kochan, Wells Fargo Asset Management

Now that the Treasury yield curve has flattened substantially from 2014’s very steep configuration, some economists and other impressionable types are worried about a recession in the next 12 months. They are citing the fact that a flat yield curve has heralded each of the previous recessions. However, they have forgotten one of the first things they learned in statistics class—never confuse correlation with causation. In past cycles, flat yield curves emerged after short-term rates moved sharply higher. In turn, they often pushed up bond yields and mortgage rates enough to create a turndown in the housing sector. That is not happening now.

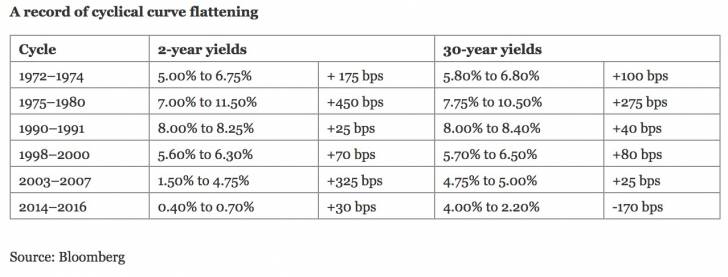

The following table shows how yield curves behaved prior to the past five recessions:

In three of those cycles, short-term rates rose significantly, as did the yield on the 2-year Treasury note. Those rate and yield increases were quite large in 1972–1974, 1975–1980, and 2003–2007. They were much smaller in 1998–2000. Bond yields also rose sharply as curves flattened in 1973–1974 and 1976–1980. The curve was already flat in 1998, and the subsequent rise in short-term rates caused bond yields to rise by approximately 80 basis points (bps; 100 bps equals 1.00%) in that cycle. In each of those cycles, the recession was preceded by a downturn in the housing sector.

The 1990–1991 and 2003–2007 cycles were more unusual. The yield curve actually steepened in 1990–1991 and yield increases were relatively small, which might be why those recessions were quite mild. In 2003–2007, short-term rates increased substantially but bond yields did not. The rise in short–term rates pushed up rates on adjustable-rate mortgages (ARMS) and that started a severe recession in the market for condos and, eventually, in the entire housing sector. The current situation is much different:

- Short-term rates have increased only slightly and are still at exceptionally low levels.

- Rates on ARMs are lower now than at the start of this cyclical expansion.

- Bond yields and, therefore, rates for 30-year mortgages have declined, not increased, as the curve flattened.

- Low mortgage rates are contributing to a gradual strengthening in housing activity, not a decline.

The fact that the yield curve has flattened now does not have the same implications for the economic outlook as it did in previous cycles.