by Don Vialoux, Timingthemarket.ca

Observations

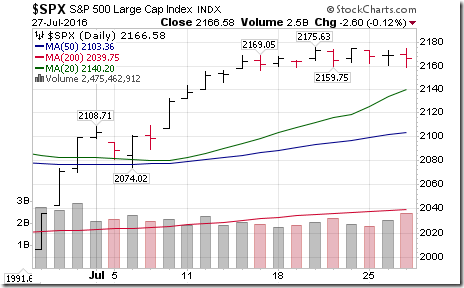

Response to the FOMC meeting announcement at 2:00 PM EDT was surprisingly muted for equities. U.S. equity indices initially moved higher but were virtually unchanged by 4:00PM

Bond prices rallied

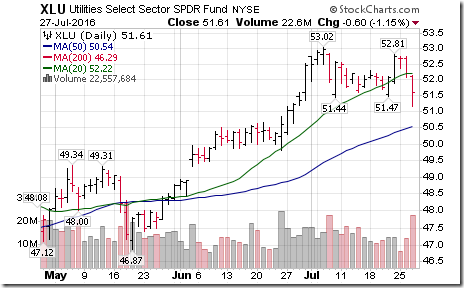

Despite strength in Treasury bond prices, S&P Utilities SPDRs broke below support.

The U.S. Dollar Index ETF plunged.

Gold prices surged on U.S. Dollar Index weakness

Even more impressive was the surge in silver prices.

Responses to second quarter reports have been muted despite a trend to better than expected results: 72% of reporting S&P 500 companies to date have exceeded consensus earnings and 56% of reporting companies have exceeded consensus revenues. Despite the news, the S&P 500 Index is virtually unchanged since start of the reporting season 10 trading days ago.

StockTwits Released Yesterday @EquityClock

Yield on 10 year Treasury notes holds around resistance as investors wait for the FOMC announcement.

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $BbT, $EW, $UHS, $BA, $PBI, $AAPL, $AVGO, $AVY. Breakdowns: $HES, $CHRW, $AKAM, $KO

Editor’s Note: Breakouts after 10:00 AM EDT included Alaska Air and Regeneron Pharmaceutical.

Nice break by Loblaw $L.CA above $72.61 on higher than expected EPS testing all-time high at $74.31.

Molson Coors $TAP completed a double top pattern on a break below $95.57 setting new intermediate downtrend.

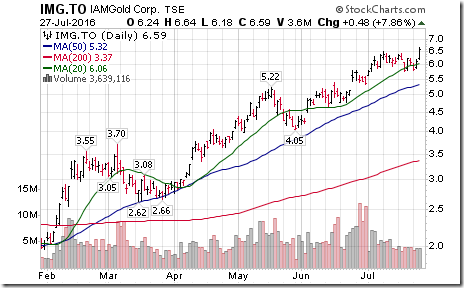

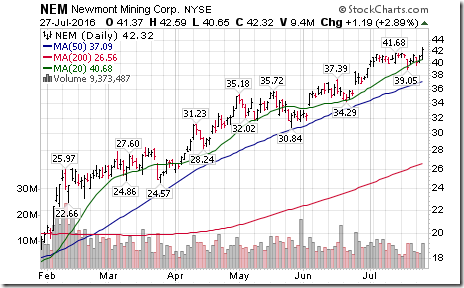

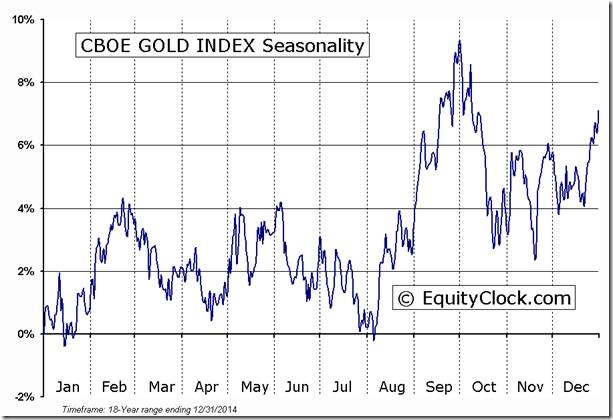

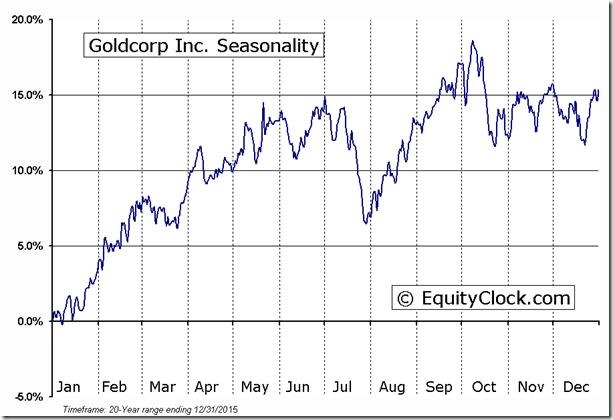

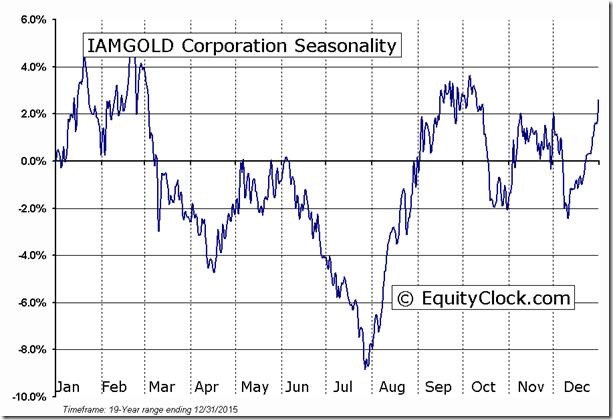

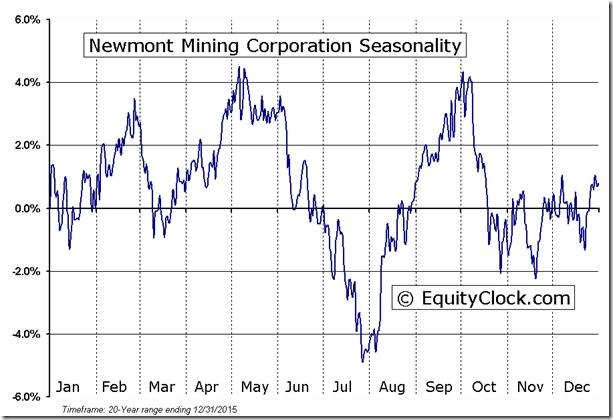

Selected gold stocks $IAG, $NEM are breaking resistance extending intermediate uptrends. ‘Tis the season!

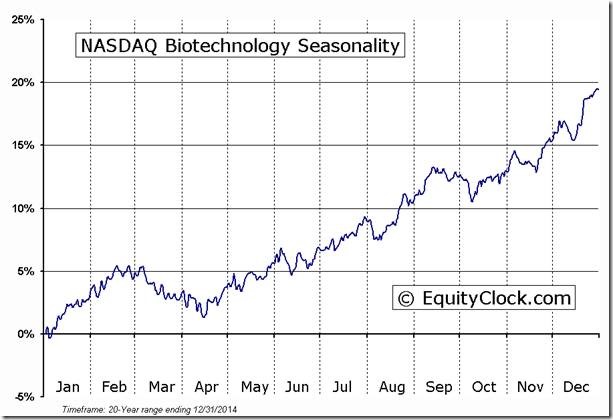

Biotech ETFs $BBH, $IBB, $FBT are breaking above recent trading ranges forming new uptrends.

‘Tis the season for the Biotech sector to move higher until mid-September!

Trader’s Corner

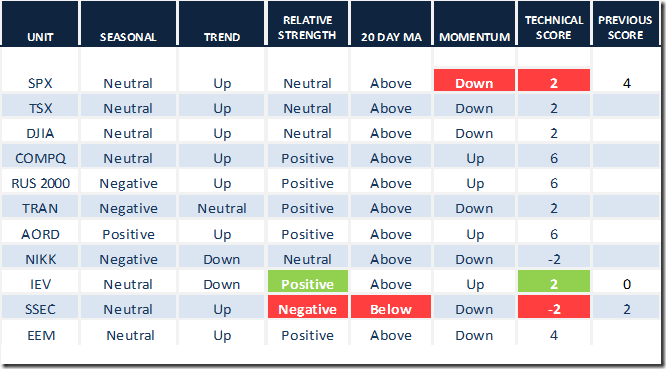

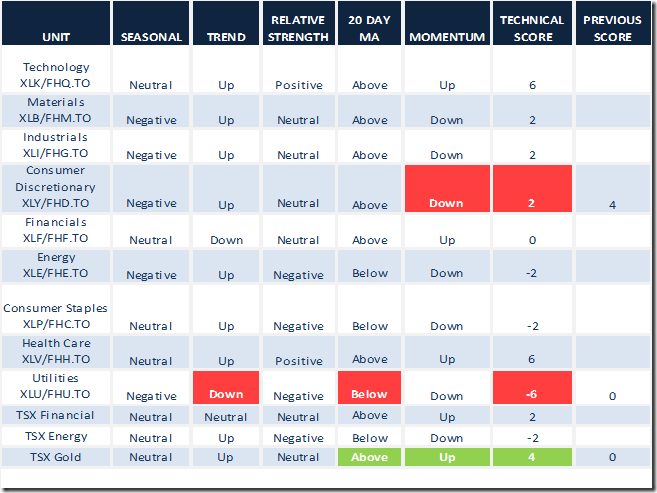

Daily Seasonal/Technical Equity Trends for July 27th 2016

Green: Increase from previous day

Red: Decrease from previous day

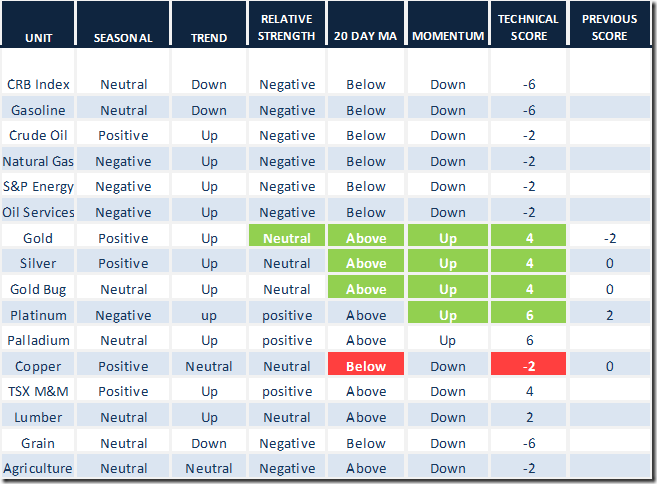

Daily Seasonal/Technical Commodities Trends for July 27th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March July 27th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following are examples:

Editor’s Note: Technical evidence yesterday confirmed that the period of seasonal strength in gold stocks has started. All of the above have outperformed the S&P 500 Index and TSX Composite Index during the past 6 trading days.

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Keeping on Track

By Adrienne Toghraie, Trader’s Success Coach

www.TradingOnTarget.com

It is easy for a trader to get off track and head for a crash in trading. The good news is that it is also easy to stay on track and enjoy the benefits of a smooth ride towards consistent profits.

What it takes to stay on track

· Pre-planning for what will bring you back to a top performance state when you are off balance physically, emotionally and mentally

· Recognizing interruptions in your trading day that could throw you off balance

· Being aware of your state of mind before taking a trading opportunity and having exercises that will bring you back on track when you are off

· Giving permission to someone to gently let you know when you are not at your best

· Continuously monitoring world news that could affect the markets and particularly your strategy

· Knowing all changes in your life, whether good or bad, will have an effect on your trading performance and knowing when to back off or take smaller risk

· Realizing that you need four vacations a year of three to four days or more without monitoring your trading on those breaks

· Knowing to ease into trading after any absence

· Keeping up with all of the duties, relationships, and maintenances in your life

Off track Tony

Tony has been an exceptional trader except for a year when his life was in chaos. He was obsessed with trading and put in long hours. He felt that the way he would show love to his family was to give them a grand lifestyle.

Tony did not recognize the warning signs that his family was drifting apart until it was too late. His wife, Charlotte, found the company of Tony’s best friend too enticing and so did his two children. After they left, Tony went on a drinking and womanizing binge that destroyed him as a top performer in trading. From bad it became worse until he lost all of his trading capital.

Tony had a trader friend by the name of Joe, who he accidentally ran into at a bar. Years before he had helped Joe to get started in trading. Joe attributed his success to Tony. When he saw and listened to Tony’s story, he decided to help him. It took a year until Tony came back to being the successful trader he was before. This time, however, he learned the lesson of keeping his life in balance.

On track Oliver

Oliver grew up in a loving and supportive family where he learned the importance of balance for having a happy life. When Oliver started trading, he remembered his life lesson and made sure that every part of his life was given the needed attention.

He stopped trading when he lost his parents in a car accident. When Oliver’s little girl broke her tooth at the playground, he stopped his trading for the day. And so it was with all of life’s interruptions and changes. Oliver knew how to flow with each hurdle.

Now Oliver is in his sixties and still enjoys a good income from trading only working two hours a day.

Conclusion

Each part of a trader’s life will affect his performance. Once a trader understands this and maintains a balanced, healthy life, he will stay on track to earning consistent profits.

Adrienne’s Free Webinars

Adrienne presents free webinars on the discipline of trading

Email Adrienne@TradingOnTarget.com

S&P 500 Momentum Barometer

More technical evidence that the barometer has rolled over from an intermediate overbought level! It dropped another 7.60 (9.18%) to 75.20 yesterday.

TSX Composite Momentum Barometer

More technical evidence that the barometer has rolled over from an intermediate overbought level! It dropped another 3.43 (4.79%) to 68.24 yesterday.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca