by Don Vialoux, Timingthemarket.ca

Observations

Technical action by equity indices, commodities and sectors was relatively quiet yesterday. Traders are waiting for comments by the Fed following news from the FOMC meeting today at 2:00 PM EDT. No change in the Fed Fund rate at 0.25%-0.50% is anticipated. However, news could provide guidance on the next increase following future FOMC meetings (September 21st, November 2nd , December 14th)

StockTwits released yesterday @EquityClock

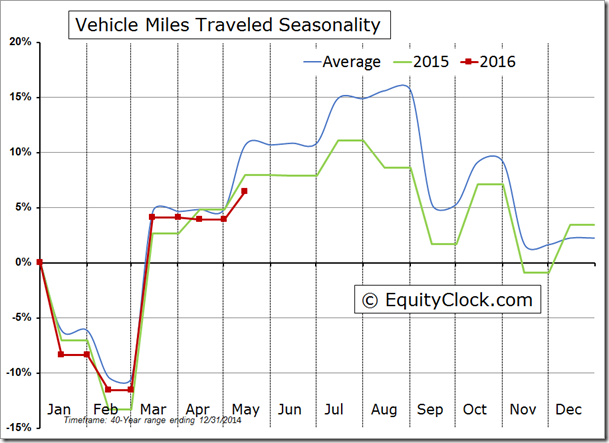

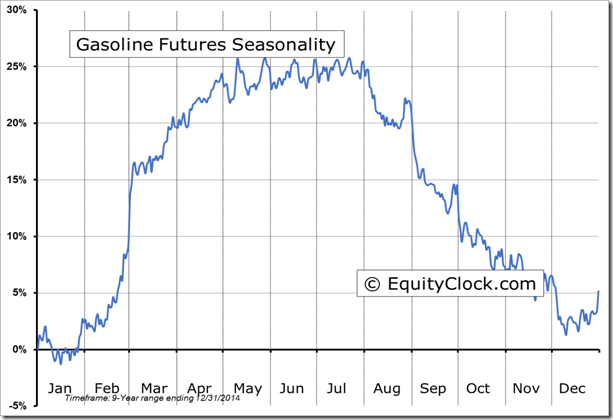

Weaker than average vehicle miles travelled may be contributing to increasing gasoline supplies

Technical action to 10:10: Bullish. Breakouts: $PCAR, $CTXS, $FFIV, $JNPR, $DD, $DOW. No breakdowns

Editor’s Comment: After 10:10 AM EDT, Newell Brands, Global Payment and Western Union broke resistance and Darden Restaurants broke support.

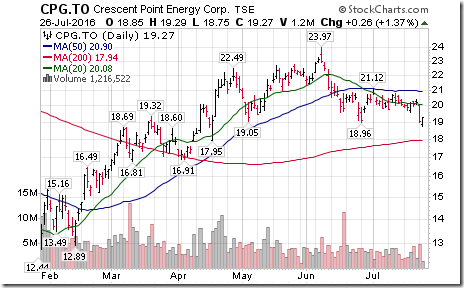

Crescent Point Energy $CPG.CA broke support at $18.96 completing a Head & Shoulders pattern.

The Lumber ETF $WOOD broke above $48.64 to an 8 month high on greater than expected new home sales.

Nice breakout by BlackBerry $BB.CA above $9.61 on launch of its second Android cellphone!

Trader’s Corner

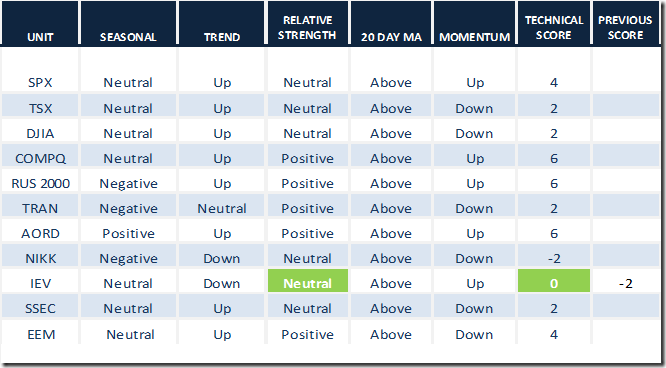

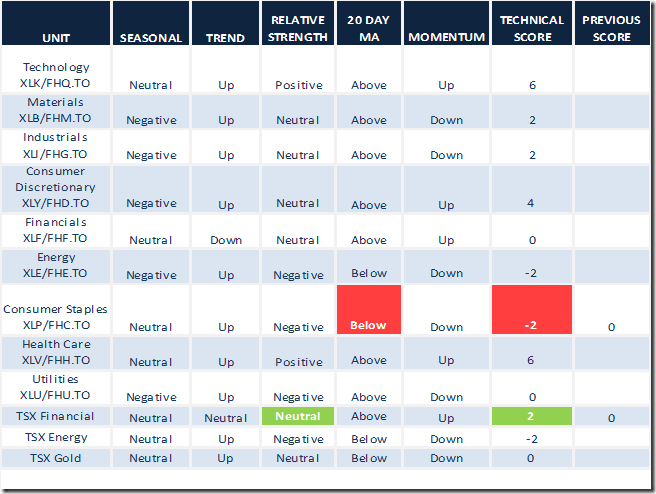

Daily Seasonal/Technical Equity Trends for July 26th 2016

Green: Increase from previous day

Red: Decrease from previous day

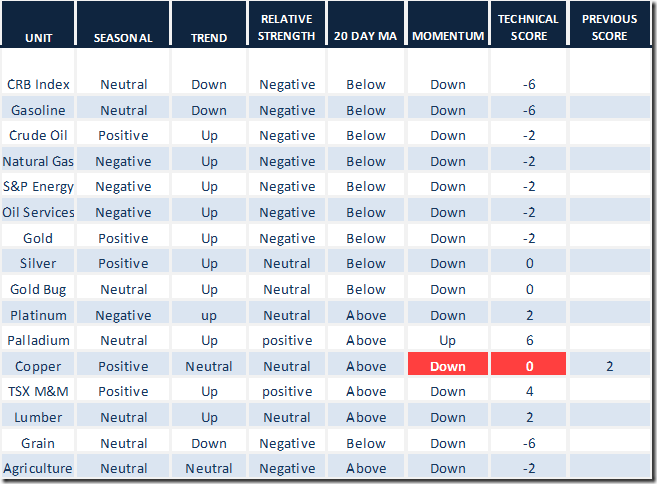

Daily Seasonal/Technical Commodities Trends for July 26th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March July 26th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

Editor’s Note: The change is seasonality in Gasoline from Neutral to Negative at the end of July is another example of an inflection point for many equity markets, sectors and commodities that occurs at the end of July. A complete list will be offered in Friday’s Tech Talk.

Accountability Report

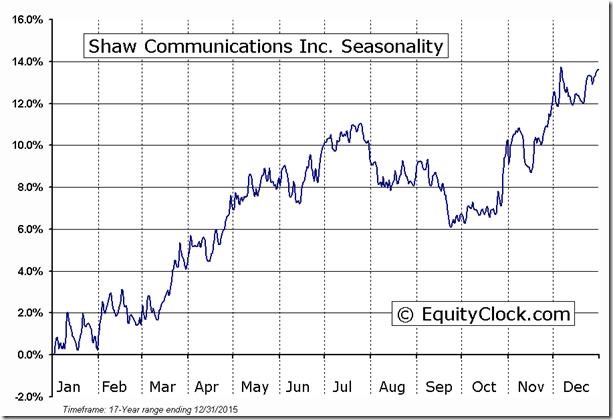

Nice breakout by Shaw Communications above US $19.86 extending an intermediate uptrend! The stock’s favourable technical and seasonal prospects initially were mentioned favourably on June 23rd. Favourable seasonal influences expire at the end of this week. Continue to hold as long as short term momentum indicators are trending up.

S&P 500 Momentum Barometer

The Barometer slipped 0.40 (0.48%) yesterday to 82.80. It remains intermediate overbought and has started to trend down.

TSX Composite Momentum Barometer

The Barometer added 1.72 (2.45%) yesterday to 71.67. It remains intermediate overbought and showing early signs of trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/66519ee9e17e60644060ac8666773e6b.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/40acc9093df985d3c2261f2e263f6217.png)