I love . . . NYC!

July 18, 2016

For me, last week began on Sunday night at Michael Jordon’s restaurant in Grand Central Station with some portfolio managers (PMs). The conversation was informative as were the investment ideas exchanged (more on those ideas after I have had time to study them). It was more of the same at breakfast the next day with another PM. Around 11:00 a.m., my colleague (Andrew Adams) arrived to accompany me to Jersey City for a three-hour stint with PMs at the venerable firm of Lord Abbett. The first hour was spent with Justin Maurer and Tom Maher, co-PMs of the Lord Abbett Value Opportunities Fund (LVOAX/$19.15), which invests 65% of the fund’s assets in small/mid-capitalization companies believed to be undervalued with the rest of the money able to “go anywhere.” They like to find ways in the portfolio to play the themes they like. A few of the themes discussed were: 1) a shrinking of airline capacity, 2) that fiscal spending is coming, 3) that government spending is going to be a growth industry in 2017, and 4) backdoor plays in the cyber security space. Hereto we swapped investment ideas that I will be sharing in the days ahead. I really liked these guys; I liked the way they think, the way they use a thematic approach, and the way they invest.

The next hour was with Walter Prahl, who along with Joe Graham, manages the Lord Abbett Calibrated Dividend Growth Fund (LAMAX/$14.90). I would classify this fund as an equity income fund that likely will not unpleasantly surprise investors. The final hour was spent with my friend Tom O’Halloran, whose fund I own (Growth Leaders Fund/LGLAX/$22.41). Tom looks for companies that: 1) have attractive business models, 2) are organic entities (management), 3) are benefitting from healthy industry conditions, and 4) have a competitive advantage. Tom told us the tech revolution began with the integrated circuit in the 1960s (my first transistor radio) and has morphed into a race to overcome time, distance, and space. He offered up Grub Hub (GRUB/$29.80/Outperform) as an example. Subsequently, Tom took Andrew and me via water taxi to the NYC’s Union Club, which I had not been in for some 30 years, and we were joined by another friend, namely Eric Kaufman captain of VE Capital and founding member of Friends of Fermentation (a tip of the hat to another friend of Arthur Cashin). Next was dinner with my long-time friend and brilliant small-cap stock picker, Mary Lisanti, manager of the Leventhal/Lisanti Small Cap Growth Fund (ASCGX/$17.08), which I also own. This year has been tough for that asset class, but I think its (and her) time has come again. BTW, I only invest with PMs I know, not just professionally, but personally, like Mary, Tom O’Halloran, Eric, etc. As always, ideas exchanged in these meetings will be featured later in subsequent missives.

Comes Tuesday, the day arrives with another breakfast with PMs, and yet another meeting with PMs, and then it was off to Goldman Sachs’ (GS) world headquarters. I actually love GS and own the Goldman Sach’s Rising Dividend Fund (GSRAX/$21.14), which is managed by another friend of mine, Troy Shaver. That afternoon, Andrew and I met with Goldman PMs, two of which I had never seen before, and I was really impressed with their investment style. They manage the GS U.S. Equity Dividend and Premium Fund (GSPAX/$12.16). They buy dividend payers, the fund is sector neutral, it has a Beta of ~1, they sell away 20/30% of the upside using various strategies that serve somewhat as a downside hedge, the fund has an average annual distribution of ~6%, it has very little “line item” risk, and they are thoughtful about the tax ramifications of their distributions. We also met with Osman Ali, a PM I have met with a few times before. It was intriguing to hear him talk about “crowd sourcing”, “machine learning”, and “informational advantages.” Goldman Sachs has taken, for lack of a better definition, Artificial Intelligence (AI) to an art form. Their computers read 26 million reports/articles/10-Ks a year looking for key words to gain an informational investment advantage. For example, in April of 2015, their AI gleaned that web traffic had exploded for Home Depot and Lowes right before those companies’ share price leaped.

Wednesday started with a “hit” on Fox Business TV with Maria, who I have known for 25 years, followed by lunch with friends and then an interview with the good folks at the Wall Street Journal and Barron’s. That night, we met with some Wall Street types and had dinner at the fabulous Italian restaurant Scalinatella. The next day, it was an early meeting at Deutsche Bank Asset Management with about a dozen folks in attendance. At noon, it was a presentation for high net worth clients at our RJA Rockefeller Center offices, a stint at Bloomberg (great to see you Pimm Fox), and a “hit” for CNBC from the floor of the NYSE. Of course, each night was also accompanied with a confab at Bobby Van’s NYSE bar for libations with other members of Friends of Fermentation (FoF). Arthur Cashin was in rare form regaling his famous stories to my colleague Andrew. However, the most amazing meeting of the week was with my dear friend Craig Drill (Drill Capital), who typically arranges a lunch for my NYC visits.

At previous lunches icons like David Einhorn (Greenlight Capital), John Hathaway (Tocqueville), Ken Langone, Joe Perella (Perella Weinberg), Mike Price (MFP Investors) – well, you get the idea – were in attendance. Last Friday’s lunch did not disappoint. While I am not going to name the names, I will tell you the ex-director of the CIA was there, the foremost Alzheimer’s doctor in the world was there, folks from Lee Cooperman’s Omega Advisors attended, a Singapore-based PM was there, my friend Eric Kaufman (the best MLP portfolio manager in the biz) sat in, and there was a cast of others present. The CIA guy said that ISIS was “past its high-water mark and that the Muslim community will eventually confront them.” He also suggested, since ISIS is in decline, it makes them more desperate. The gentleman from Omega began, after I spoke, saying, “I didn’t think there was anybody more bullish than me, but I was wrong!” (that would me). He then listed his bear market check list with five key points: 1) accelerating inflation, or problematic inflation (not here); 2) hostile Fed (not here);

3) prospects for a recession (not here); 4) investor exuberance (not here); and 5) expensive valuations (not here given the interest rate environment). His conclusion, “The only way this secular bull ends in the near term is if there is a ‘black Swan’ event” and, I agree. He also spoke about the concept of “molehill to mountains” falsely trumpeted by the media, citing the Greece Gotcha’, the Italian Job, the Crimea Crisis, the Brexit Bashing (we were buyers of stocks on the belief that new all-time highs were in the offing), and the remaining list is legion. The Singapore PM stated the Japanese election assured more monetary stimulus, that Chinese steel companies are trading at two times earnings, and the commodity cycle has bottomed, and hereto a number of long stock ideas were mentioned that I will vet in the days ahead. The Alzheimer doctor was amazing stating that Alzheimer’s is one of the leading causes of death and that it is the greatest unanswered medical need. To make this point, he posited that if five million folks are affected, and it takes $50,000 a month to attempt to treat it, that foots to $250 billion with the government’s total Medicaid spending (excluding admin costs, accounting adjustments, or data for the U.S. territories) of ~500 billion. Given the aging baby boomers, that is a HUGE problem. While he suggested there are new drugs on the way, exercise and the Mediterranean Diet are a step in the right direction for prevention.

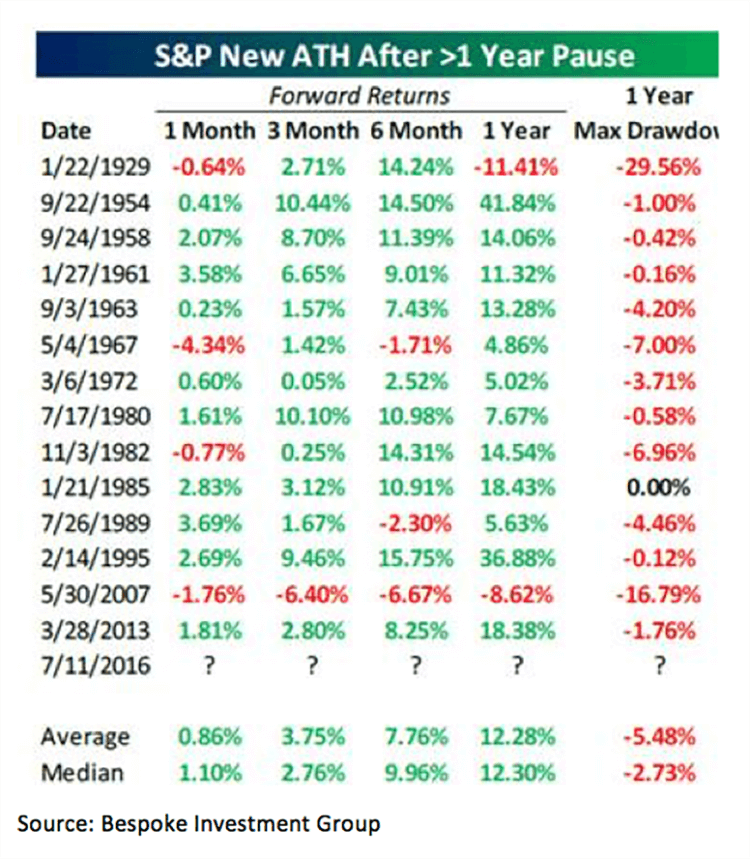

The call for this week: Bespoke points out that, “All ten sectors are overbought for the first time since [last] March” (chart 1). Plainly, we agree given our comments last week about the McClellan Oscillator. However, Bespoke also notes (as paraphrased), “In all the previous times when the S&P 500 has made a new all-time high, following at least 52 weeks below the old high water mark, the average return over the next 12 months has been 12.28% (median +12.30%) with an average pullback of 5.48% (median 2.73%).” Hence, folks waiting for the fabled 20% pullback are likely going to be disappointed. That said, it would not surprise me to see a sell off attempt this week that should not get very far. Meanwhile, while everyone is focused on the major indices at new all-time highs, few are watching the much maligned D-J Transportation Average (TRAN/7985.17) that is breaking out of a downtrend line that has been in effect since March of last year (chart 2). If successful, a new Dow Theory “buy signal” should be enforce. And don’t look now, but last week we experienced the third 90% Upside session in just as many weeks.