Post-Brexit: Tools to Reset Your Narrative

by Will Ortel, CFA, CFA Institute

Things happen.

You expect some of them, not all. And indeed clients are served in our industry through acts of judgment and discipline amid uncertainty, not just miracles of prophecy.

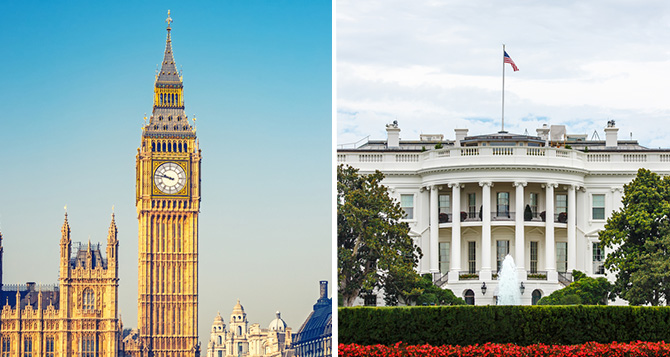

I am going to wager that you, or at least someone at your firm, was in the office this past weekend. The United Kingdom voted to leave the European Union (EU). There will be other agitations and indeed other elections along the same lines in the months and years to come.

If you haven’t already, I suggest you take a look at Geopolitics for Investors, a recent publication of the CFA Institute Research Foundation and authored by Pippa Malmgren, a former adviser to President George W. Bush and an advocate for Brexit.

An invitation to consider the thought processes of a reputable person who is cheering the Brexit should be interesting regardless of your level of pre-existing knowledge. It’s always neat to look at the radar of someone who thinks differently than you. And Malmgren thinks differently than many of us, if recent market behavior is any indication.

But to navigate the changing contours of the world productively, you’ll need to do more than just peek over someone’s shoulder. Successful active managers create their own context on a continuous basis. They take facts, relate them to possible futures, and construct rigorous understandings that are robust enough to survive surprise developments. The combination of analytical rigor and imagination produces an edge.

Assuming You Add Effort

To put it mildly, there is nothing easy about developing a valuable viewpoint. It is the strong form of a hard thing: You won’t know if you have succeeded for a long time, and it takes tremendous judgment to even choose how you spend your day.

We have done some things that we hope will make it easier for you though, and the purpose of this post is to summarize and present them in a practical form.

The first and most holistically useful is the Investment Idea Generation Guide that Jason Voss, CFA, and I authored late last year. It is meant to be helpful in general, but you may find it to be of particular value if you were caught by surprise last week.

Jason introduced me to a technique called scenario planning, which is a little bit different than you might expect on first look. It has more in common with a vision quest than a financial model that combines base, aggressive, and adverse cases to derive an expectation of value.

Be Ready to Get Weird

The goal of investment research is to produce a viewpoint that is fundamentally different from what others believe and yet is still correct. Think different, but be right, in other words. The challenge we collectively face is not how to organically reach the same conclusion as others, but how to stick out in useful and forward-looking ways.

We don’t live in a world that is short on risks, so it will pay to get ahead of the curve a little bit here. The World Economic Forum’s 2016 risks report may be valuable at a time like this. As you read it, consider which of the issues it raises you haven’t thought about in a week, a month, or more. Study those.

But Stay Focused, Rational, and Upbeat

There is a deep tragedy to some outcomes that we are forced by fiduciary duty to contemplate.

If you are doing your scenario planning correctly, you will consider things like the possibility of all-out war in Europe, sectarian violence that scales globally, and weaponized diseases.

You will also do well to remember that, in general, the world is a good place to live. There are few alternatives. Elon Musk has said that he’d like to die on Mars, but he might need a little something more in the way of cash flow to get there. When economic winds change, some dreams are blown away.

But the long-term trends that form the basis of a broadly improving human condition are still intact. Whatever happens in politics, life expectancy is up sharply. We can now edit DNA, which promises to remake the fabric of the human condition. There is never a bad time to start an innovative business. Macro trends have no bearing on entrepreneurial ambition.

However bad you think a given development is, it is worth remembering that the productive step is to put your focus in a positive place. Real businesses were built during the Great Depression. People made money during the financial crisis. Despite myriad predictions to the contrary, the sun still rises every day in the east.

This thing, whatever it is, will be fine in the long term. Don’t let it keep you from hunting for opportunity.

Copyright © CFA Institute