by Don Vialoux, Timingthemarket.ca

Observations

Evidence of central bank efforts to stabilize equity markets helped world equity markets to recover from short term oversold levels.

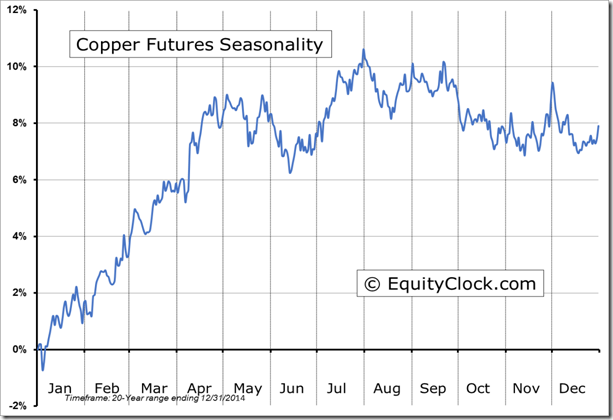

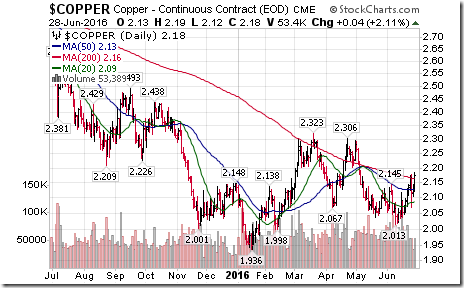

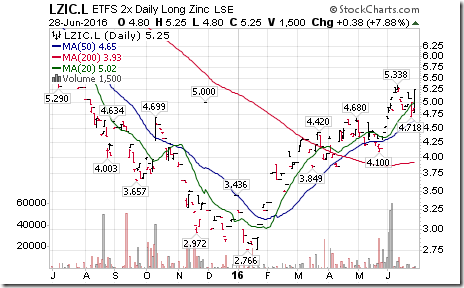

Take a closer look a base metal prices and base metal equity prices. Seasonal influences remain positive until the end of July.

StockTwits Released Yesterday @EquityClock

Equity benchmarks closing in on downside targets of topping targets.

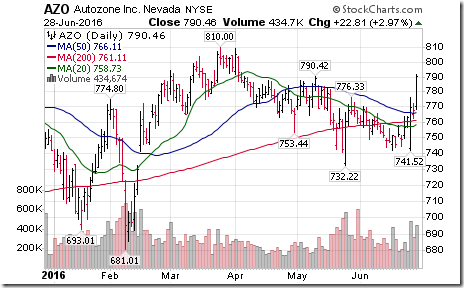

Technical action by S&P 500 stocks to 10:00: Quiet. One breakouts: $AZO. No breakdowns.

Dupont (A DJIA stock) $DD broke support at $62.81 and $61.91 establishing an intermediate downtrend

Metro $MRU.CA moved above resistance at $45.36 to reach an all-time high.

Trader’s Corner

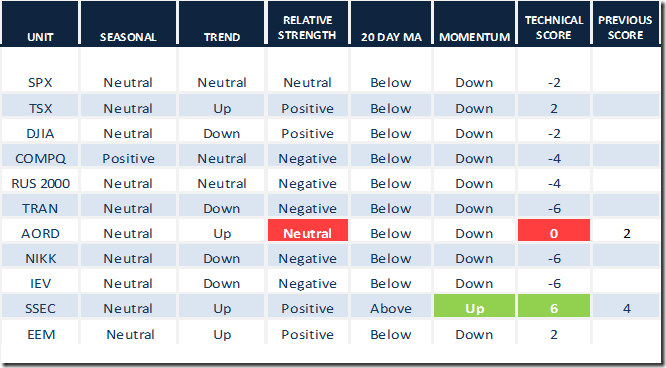

Daily Seasonal/Technical Equity Trends for June 27th 2016

Green: Increase from previous day

Red: Decrease from previous day

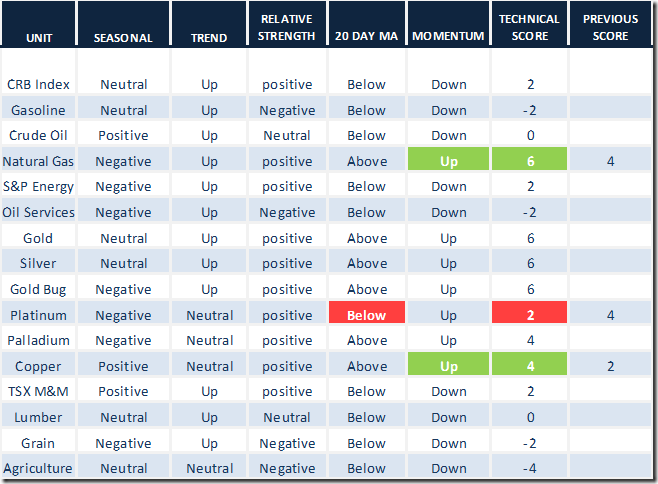

Daily Seasonal/Technical Commodities Trends for June 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

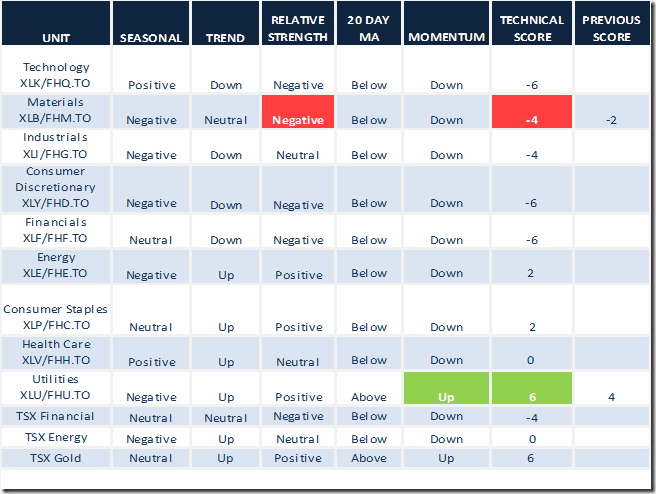

Daily Seasonal/Technical Sector Trends for March June 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

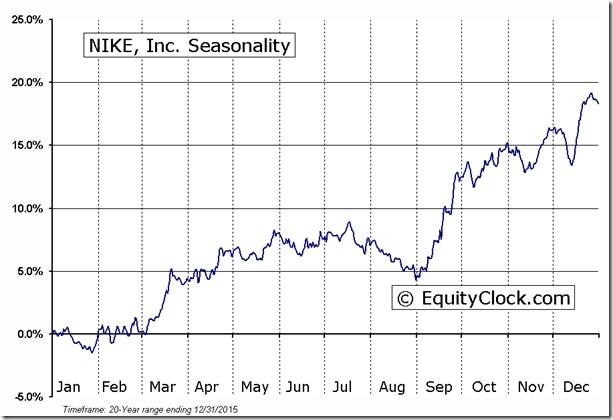

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

Interesting Charts

Base metal prices and related ETFs moved sharply higher yesterday. Seasonal influences remain positive until the end of July

The MoneyShow Toronto

Get Personalized Expert Guidance to Build a Profitable Portfolio!

Join Donald Vialoux and Other Leading Investment and Trading Experts All Under One Roof

The MoneyShow Toronto

September 16-17, 2016 | Metro Toronto Convention Centre

Donald Vialoux invites you to The MoneyShow Toronto, September 16-17, 2016, at the Metro Toronto Convention Centre. Designed specifically for investors and traders looking to create a profitable investment strategy, this free conference features over 50 eminent economists, top-performing money-managers, and successful professional traders who will share their wisdom and experience with you.

With over 50 in-depth expert presentations, you’ll be exposed to varying ways of looking at the markets you may not have previously considered and be introduced to new methods of reading charts and finding opportunities you may have missed in the past.

Don’t miss this opportunity to deepen your understanding of specific investment or trading topics by discovering the insights, strategies, tools, forecasts, and specific recommendations that can turn investment potential into profitable success!

Click here or call 800-970-4355 to register for your free spot at The MoneyShow Toronto! (please mention priority code 041368)

Learn complete details http://goo.gl/6okRkB

Twitter:

1. Get advice from me and 50 other leading investment experts FREE @MoneyShows Toronto #InvestSmarter http://goo.gl/6okRkB

2. Register FREE & get your favorite expert’s tope picks for 2017! @MoneyShows Toronto http://goo.gl/6okRkB #InvestSmarter

3. Register NOW & get expert guidance to build a profitable portfolio FREE @MoneyShows Toronto #InvestSmarter http://goo.gl/6okRkB

Use this link for social media posts:

Use this hashtag to promote show: #InvestSmarter

S&P 500 Momentum Barometer

The S&P Momentum Barometer gained 11.00 (50.00%) yesterday to 33.00. The Barometer remains in an intermediate downtrend despite the short term recovery.

TSX Momentum Barometer

The TSX Momentum Barometer gained 9.83 (25.27%) yesterday to 48.72. The Barometer remains in an intermediate downtrend despite the gain.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca