by Don Vialoux, Timingthemarket.ca

Observations

Continuing weakness in the U.S. Dollar Index bolstered U.S. equity indices and commodity prices yesterday

Notably stronger in commodities were gold, crude oil, zinc and nickel. Precious metal and base metal stocks responded accordingly.

StockTwits Released Yesterday @equityclock

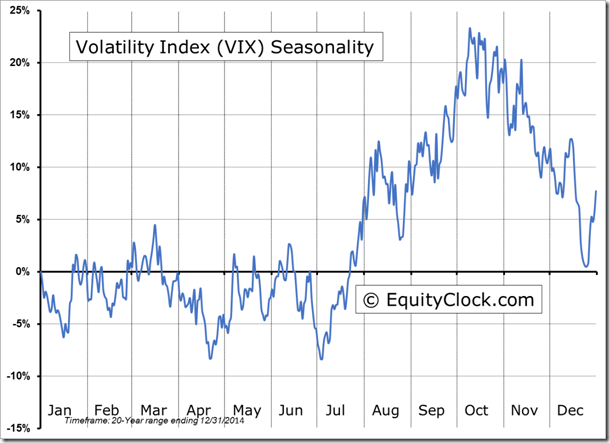

VIX attempts to find support as it closes in on period of seasonal strength.

S&P 500 stocks to 10:30: Bullish: Breakouts:$BF.B,$NBR,$CMI,$ETN,$HON,$LUV,$PWR,$NEM,$NUE,$MRO,$CNC. No breakdowns

Editor’s Note: After 10:30 AM EDT, another 7 stocks broke intermediate resistance levels: BCR,GAS, XRAY, UNP, OMC, IPG and V

Lots of gold/silver stocks/ETFs breaking to new highs: $SIL,$GDX,$GDXJ,$NEM, $SLW,$ABX,$AG,$YRI.CA

S&P Industrial SPDRs broke above $57.18 to reach all-time high.

S&P Industrial stocks dominated list of S&P 500 stocks breaking resistance: $CMI, $HON, $PWR, $LUV

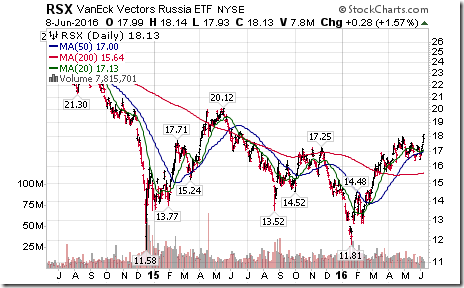

Russia ETF $RSX responding to higher oil prices. Nice breakout above $18.13 to extend an intermediate uptrend.

Higher crude oil prices also helping U.S. coal stocks. Nice breakout by $KOL above $8.80 to extend an uptrend.

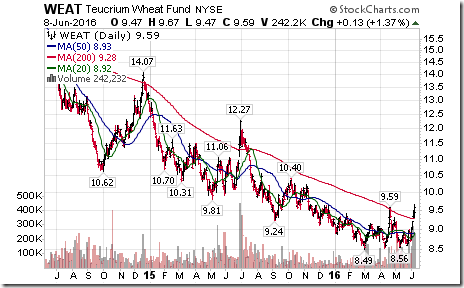

Grain prices continue to move higher. Nice breakout by $WEAT above $9.59 to complete a double bottom pattern.

Nice breakout by Shaw Communications $SJR above $19.42 to extend an intermediate uptrend.

‘Tis the season for Shaw Communications $SJR to move higher until late July.

Visa $V (A Dow Jones Industrial Average stock) broke above $81.59 to an all-time high.

Trader’s Corner

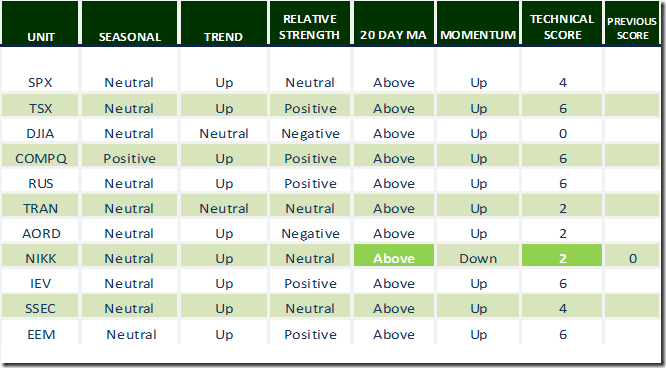

Daily Seasonal/Technical Equity Trends for June 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

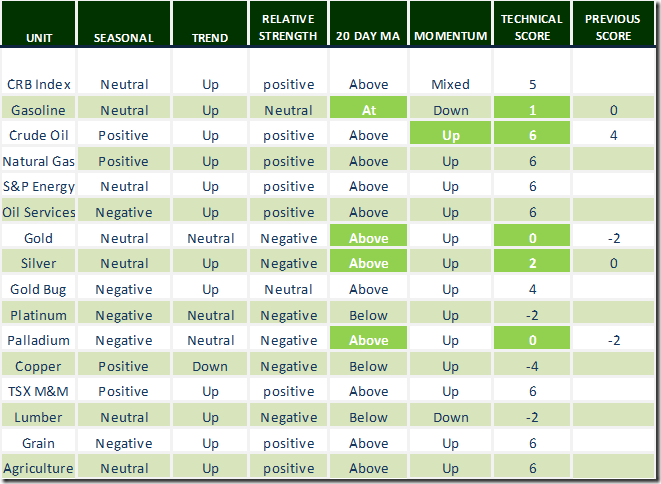

Daily Seasonal/Technical Commodities Trends for June 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

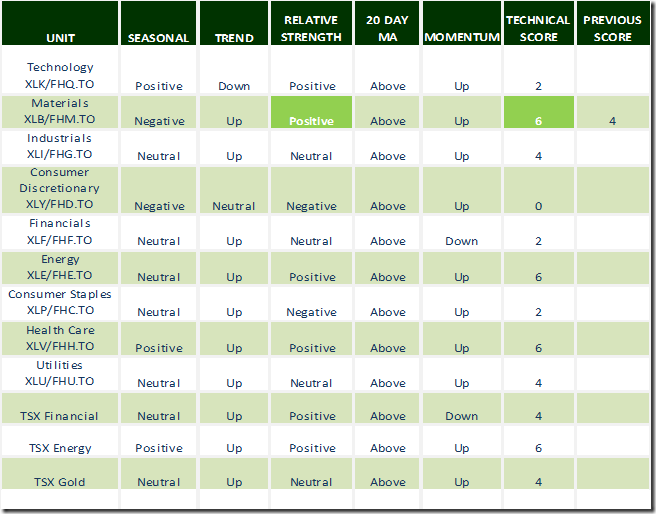

Daily Seasonal/Technical Sector Trends for March June 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Accepting Losses

By Adrienne Toghraie, Trader’s Success Coach

· Not wanting to be wrong

· Seeing the profits they have earned shrink

· Being emotionally attached to their money

· Being afraid to reveal their failure to someone else

· Getting angry at their strategy not working

· Seeing the situation as a competition between them and the markets

What they do to create a larger loss is:

· Not have a physical stop

· Move their stops

· Double down on the trade

· Bet against themselves

Sacrifices to losses

Johnny was told from the time he was a little boy that he had to save half of what he earned. This meant that Johnny had to make many sacrifices of pleasure in order to maintain his parents’ demands. Johnny did see the merit of this when he was one of the few of his classmates without debt after college. But he was also one of the few that did not derive the social pleasures that go along with being a college student.

When Johnny went out into the business world, he continued to put half of his income into his savings. Over ten years Johnny saved several hundred thousand dollars. He did not marry until he found a woman who he knew was frugal and would accept his commitment to savings.

Johnny worked for a bank that wanted to teach him to be a trader. He was an excellent student until it came to trading real money. Johnny could not handle any loss of money even though it was the money of the bank. One day he let a small loss turn into a loss of over one hundred thousand dollars. Eventually he lost his job and could not find anyone in the banking business that would hire him.

Johnny decided to become a trader on his own. This time he was risking his own money that he had made so many sacrifices to earn. He could not get past simulation.

I met Johnny at a Trader’s Expo when he attended a workshop I was giving called, “All About Losses.” Naturally, he related to everything I said. He decided to take my Top Performance Seminar and I’m happy to report he is steadily building on his profits in trading. I told him that he had to put half of his earnings in a separate savings account. This made him very happy.

Focus on the larger picture

One of the reasons traders with loss issues find it difficult accepting a loss is that they look at each individual loss in a day of trading as a setback.

What I suggest to traders is that they see a larger time frame when it comes to profits. Assuming they have a profitable strategy, if they end the week or month with a total picture of how they performed, they are less likely to be upset about losses.

Conclusion

Losses in individual trades are inevitable. If a trader does not handle his problem with losses, he will most likely blow up his account. If a trader is willing to be reconditioned and transformed, he can overcome this issue and go on to be highly successful.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

S&P 500 Momentum Barometer

The Barometer gained another 3.40 to 77.20 yesterday. The Barometer remains intermediate overbought, but has yet to show short term signs of peaking.

TSX Composite Momentum Barometer

The Barometer slipped 2.16 to 82.33 yesterday. The Barometer remains intermediate overbought and showing early signs of peaking.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/5c4f3c2718e6d5057088f8e0b5820fc7.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/83c1336ab9a73f1610889bd2cd840fe1.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/7529027c6a1c34b9efa4797e5468eaf4.png)

![clip_image005[5] clip_image005[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/2e3dce72843f3aa9203edd7e6986c66f.png)