by Corey Hoffstein, Newfound Research

Summary

- For its ability to reduce risk without necessarily sacrificing potential reward, diversification is known as the only free lunch on Wall Street.

- Diversification provides investors with the important ability to invest in the face of uncertainty.

- When viewed for its pieces instead of as a whole, a well-diversified portfolio will likely always contain an element that disappoints.

- This has been especially true since 2011, where diversification has been a drag on a traditionally allocated U.S.-centric portfolio.

- The benefit of hindsight will always distort the evaluation of risk management decisions and constant disappointment may actually be the best sign of a well-diversified portfolio.

Diversification is a funny thing.

On the one hand, it is known as the only free lunch on Wall Street. Combining different investments within our portfolio allows us to reduce our exposure to idiosyncratic risks, and even lower overall portfolio risk, without necessarily sacrificing total return potential.

Many of the benefits of diversification, however, exist in a hypothetical probability space where events may happen. In the future, a company may go bankrupt. Or it may not. The U.S. economy may enter into a corporate earnings recession. Or it may not.

Diversification allows us to build a portfolio that is robust to a future that is uncertain.

As time marches on, however, all of the the infinite potential futures converge in the present and become a single past. The probability of an event happening converges to a binary outcome: it either does or does not occur.

This convergence means that our portfolio, which was optimal for the uncertain future, will almost certainly be sub-optimal when viewed retrospectively.

Imagine watching a weather report in the morning that says there is an 90% chance of rain in the afternoon. You make sure to grab your umbrella when you leave the house. The afternoon, however, turns out to be spectacularly sunny and you’re left carrying around the umbrella unnecessarily.

Was the forecast wrong? It is hard to say. Rightness or wrongness is much easier to measure for a prediction than a forecast. A predicting weatherman would have said either “it will rain,” or “it will not rain.” That statement can be objectively determined to be right or wrong based upon what happens. A forecasting weatherman, on the other hand, provides a probability for an event. Since the event will only happen once, converging to a binary outcome, it is difficult to objectively determine if the probability was right or wrong based on a single forecast. Instead, such an evaluation can only be made after observing many forecasts over time (i.e. is the weatherman right approximately 90% of the time when he assigns a 90% probability to an event?).

Yet we must decide, based on these probabilities, how prepared we want to be for certain outcomes. Often our choice will leave us over- or under-prepared for what eventually does happen. Do we carry the umbrella and risk having to carry it around unnecessarily, or forego it and risk getting wet?

A well-diversified portfolio is built upon the foundations of the same problem. The future is uncertain and so we embrace diversification to help mitigate our exposure to a variety of potential risks that can unfold. If those risks are not realized, however – like getting a sunny afternoon on a day with a 90% chance of rain – then in retrospect we’ve missed an opportunity to allocate our capital more efficiently.

Which leads us to the other side of diversification: it will always disappoint you. Or, to steal a phrase I love from Brian Portnoy, “diversification means always having to say you’re sorry.”

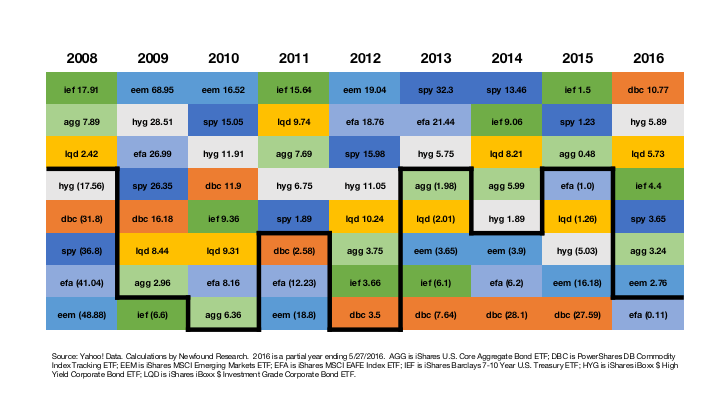

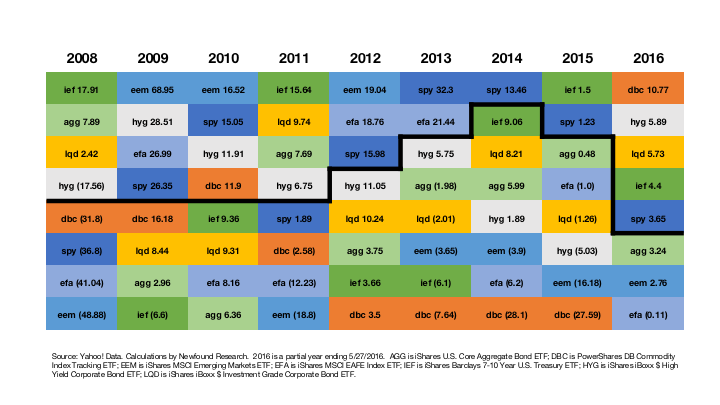

Considering the following periodic table of popular asset class returns. The dark black line divides positive returning assets from negatively returning ones.

Often this table is used to demonstrate the randomness of asset class returns over time: an argument for diversification.

Yet we can also see that at the end of almost every year, we’re going to open our portfolio statement and be disappointed by something we held. Hopefully, if we’re well diversified, what we’re disappointed in is constantly changing.

This disappointment is not simply based on the dividing line between positive and negative, however. Our experience has been that investor expectations differ on an asset class by asset class basis. For example, we have repeatedly observed that investors seem to expect more from asset classes with which they are less familiar or comfortable. The thinking seems to be something along these lines: If I am going to go outside my comfort zone and hold it, I should at least be rewarded for it.

A good dividing line for comfortable seems to be, based upon the home market favoritism most investors exhibit, the returns of a 60%/40% S&P 500 (SPY) / Barclay’s U.S. Core Bond (AGG) portfolio.

If we divide our periodic table of asset class returns this way, we see an interesting phenomenon emerge.

From 2008 through 2011, we can see that a traditional 60/40 portfolio split the universe in half, giving diversification both wins and losses.

From 2012-2015, however, the traditional 60/40 kept setting the bar higher. Going outside of the traditional comfort zone was a drag that left most investors scratching their heads wondering why they even bothered. Remind me again, why do we keep investing in emerging markets?

Viewed with the benefit of hindsight, diversification will always disappoint. To judge the outcome of diversification after the fog of uncertainty has lifted, however, misses the point: diversification provides us the incredibly important ability to admit we don’t know. We can be vaguely right instead of precisely wrong. Constant disappointment, then, might be the greatest indicator that we are well diversified.

Copyright © Newfound Research