by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday May 19th

U.S. equity index futures were lower this morning. S&P 500 futures were down 4 points in pre-opening trade.

Index futures slipped slightly following release of the economic news at 8:30 AM EDT. Consensus for Weekly Jobless Claims was a drop to 278,000 from 294,000 last week. Actual was 278,000. Consensus for May Philadelphia Fed Index was an improvement to 2.7 from -1.6 in April. Actual was -1.8

Monsanto gained $7.37 to $104.50 on news that the company is in takeover talks with Bayer. Value of the takeover is estimated at $42 billion.

Wal-Mart jumped $5.01 to $68.16 after reporting higher than consensus first quarter revenues.

The technology sector received favourable news this morning when Salesforce.com and Cisco reported better than expected quarterly revenues and earnings. Salesforce.com gained $4.88 to $82.75. Cisco added $1.33 to $28.05

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/18/stock-market-outlook-for-may-19-2016/

Note seasonality charts on 30 year Treasury Bonds, Financial sector, Crude days of supply and Gasoline days of supply.

Mr. Vialoux on Money Talks with Kim Parlee last night

Following is a link:

http://www.bnn.ca/Video/player.aspx?vid=873325

StockTwits Released Yesterday

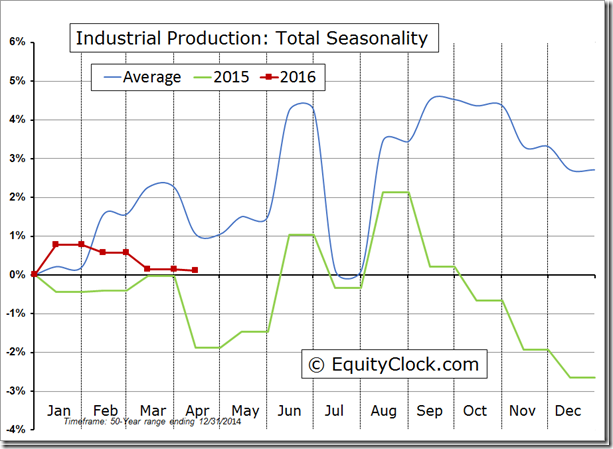

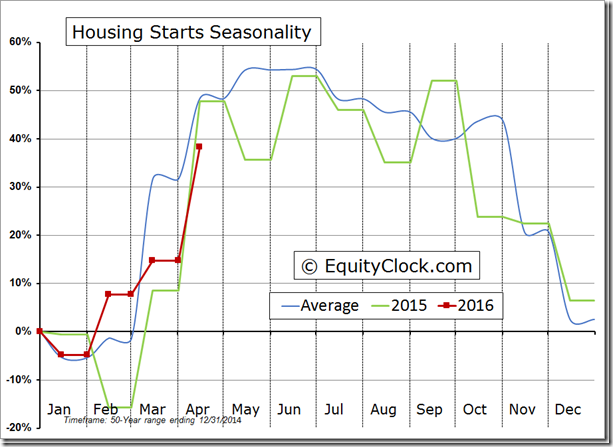

Find out what Industrial Production and Housing Starts have to say about the economy.

Technical action by S&P 500 stocks to 10:30: Bearish. Breakouts: $CMCSA, $LOW, $APA, $LNC, $UNM, $CRM. Breakdowns: $DG, $DISCA, $UA, $HOG, $CCE, $CVS, $HRL

Editor’s Note: After 10:30 AM EDT, MCK and RF broke resistance and PEP, STZ, HCP, KIM, AA, AES, PEG and SO broke support. Most of the breakdowns occurred following release of the FOMC meeting minutes.

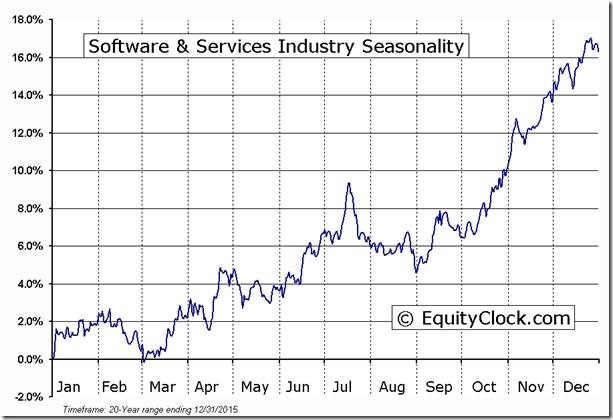

Selected software stocks are breaking out. $CRM broke above $77.82 to extend an intermediate uptrend.

‘Tis the season for Software stocks to move higher until mid-July.

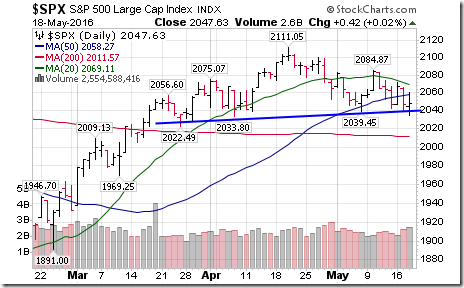

S&P 500 Index broke below 2,039.45 to complete a Head & Shoulders pattern implying downside risk to 1,967.

Editor’s Note: The Index subsequently recovered to above the neckline.

Trader’s Corner

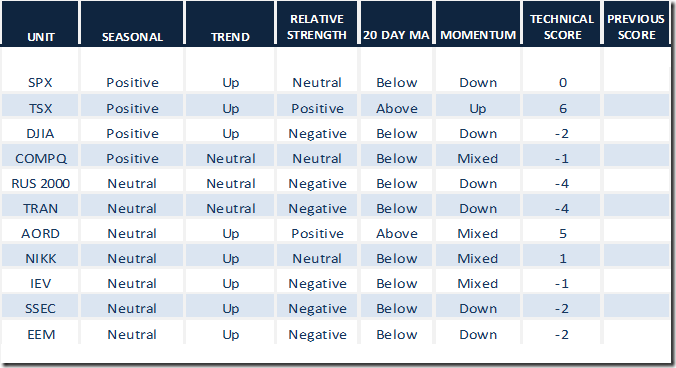

Daily Seasonal/Technical Equity Trends for May 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

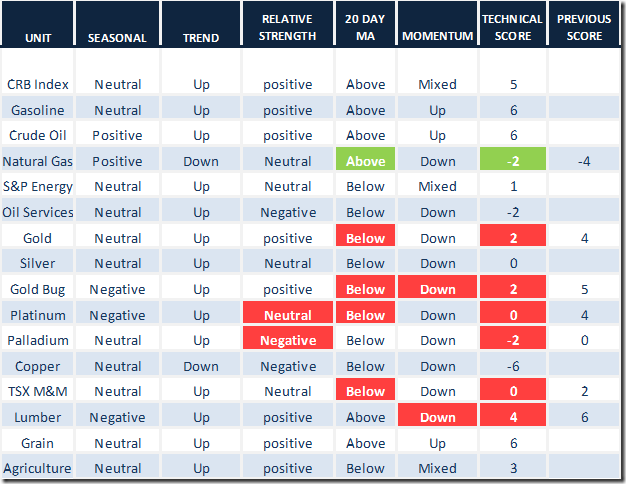

Daily Seasonal/Technical Commodities Trends for May 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

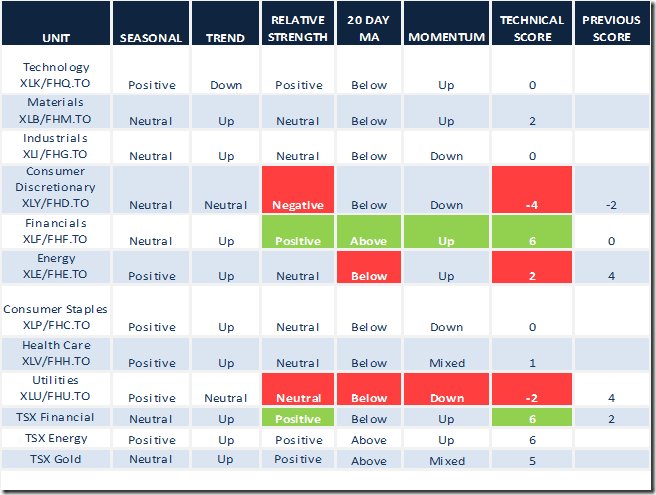

Daily Seasonal/Technical Sector Trends for March May 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Getting Back Your Trading Mojo

By Adrienne Toghraie, Trader’s Success Coach

The definition of “mojo” is: A magic power or magic spell. My own definition as it applies to traders is: Having the passion for enjoying the process of becoming a successful trader. This is an important ingredient for a trader because without trading mojo you may never start to trade or reach your full potential.

Losing your mojo

If someone were to put a work related activity in your in-box and say, “This is important,” you most likely would stop what you are doing and attend to that matter. What if, however, someone else were to say while handing you another assignment that it takes priority over what you are doing. Through the day the stack to complete priority assignments would grow to the point that the original assignment would now be at the bottom of the pile. Because of too many priorities in life, many people get emotionally weighed down and lose their mojo for trading

Lewis, a trader buried in life’s priorities

Lewis had the passion, the ability, the resources and the support to become a trader. Many traders could get hung up on not trading because they do not have any one of these necessary ingredients to become a trader, but Lewis had them all.

Just as Lewis started his first week as a professional trader, he received a call that his father had passed away. Naturally, he had to rush to his family’s side. Later in the week at the reading of the will, he was to find out his father left everything to him with the particular instructions that his brother and sister were to not receive anything. Lewis realized that this would be contested and cause problems between himself and his siblings. He agreed with his father’s choice with the caveat that he would share the wealth with his brother and sister if they were to change their negative choices for their lives. He let them know that he would spend any amount they needed to rehabilitate and educate them in order for them to have a good life. What this meant was that they would have to overcome their addiction to drugs and a generally depraved life. This met with violent anger on his brother’s part and depression on his sister’s part.

Lewis found his home ransacked by thugs hired by his brother. The violence kept escalating until Lewis’ children’s lives were threatened. One dramatic incident took precedent over the other. This ended with his brother being jailed, his sister going into rehab and his wife leaving with the children. Now, he had to contend with a divorce and losing his children. With all of this Lewis lost his trading mojo and his trading was at the bottom of the pile of his priorities in life.

Time gremlins

A trader does not have to have the drama of Lewis’ story to take away his mojo. It can be as unearth-shattering as priorities of time. Joe’s wife had to go out of town on business for a week leaving Joe with homemaker duties. The time gremlins started to accumulate from there. Joe’s church asked if he would take the place of the usher’s duty on Sunday. His mom asked him to take her to the doctor during trading hours and on top of all of this he caught a cold from one of his children. I think you get the picture.

Getting back your trading mojo

You will not be able to take control over your life until you make trading your priority. Yes, in Lewis’ case that was nearly impossible, but in most situations a trader becomes his own saboteur of time. In Joe’s case, he perhaps could have hired someone to take over the duties of the household, said “no” to his church and hired a taxi for his mom. Ideally, these contingencies should have been handled in his business plan.

Whatever your reason to side-step your trading and lose your mojo, here are some tips for getting it back:

· At the beginning of every week, and perhaps every day, review what trading means to you and the benefits that you receive from being a trader

· Focus on the positive part of life and particularly your life

· Read inspiring stories of traders and other high achievers

· Attend a seminar that focuses on the psychology of trading

· Plan for as many contingencies that could interfere with your trading

· Make sure that all the significant people in your life are on board with

helping you by not being time grabbers

· Keep a journal to learn from your mistakes

· If you are not profitable, go back and revise your plan, find a mentor

· If you cannot follow your rules, hire a coach

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

S&P 500 Momentum Barometer

The Barometer dropped another 3.00 to 47.60. Intermediate trend remains down.

TSX Composite Momentum Barometer

The Barometer slipped 2.55 to 67.23. The Barometer remains in an intermediate downtrend.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca