USDCAD and Crude Oil's Near-Term Strength

For this week’s editions of the Equity Leaders Weekly, we are going to update the USDCAD currency relationship in light of the recent Fed minutes as well as give an update on a key commodity, Crude Oil’s recent near-term strength.

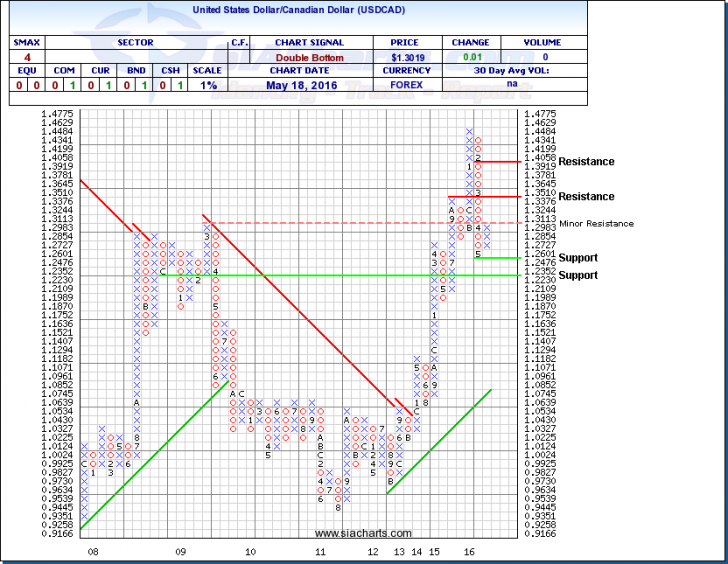

United States Dollar/Canadian Dollar (USDCAD)

The U.S. Dollar has strengthened on Fed rate hike speculation sending the US Dollar 1% higher over the CAD dollar today in trading. This has moved the USDCAD chart into a column of X’s for the first time since January. This has moved the USDCAD up against some minor resistance at $1.3113 with further resistance above found in the ~$1.35 area. Support to the downside is now found at $1.2476 and $1.223. The long-term analysis for the USD/CAD relationship is affected by many factors, but the meeting of the Federal Reserve showing the U.S. central bank was open to raising interest rates in June continues will have a major impact for short-term movement in the currency relationship.

The devaluing of the US dollar earlier this year may have been influenced, according to a new conspiracy theory named the ‘Shanghai Accord’, to help struggling markets and the Chinese economy or other factors in the near-term, but inflationary pressure and a rise of core inflation will also have impacts on key currency relationships going forward for the long-term. If inflationary pressures increase, interest rates could rise impacting certain areas of the market that have more exposure to these effects than others. REITs and utility stocks are some sectors that could be disproportionally impacted by rising rates, because as the cost of capital goes up, investors may have more competitive yield alternatives. This could in turn help the banking sector because higher interest rates tend to widen the spread between what banks charge on loans and what they pay on deposits.

Click on Image to Enlarge

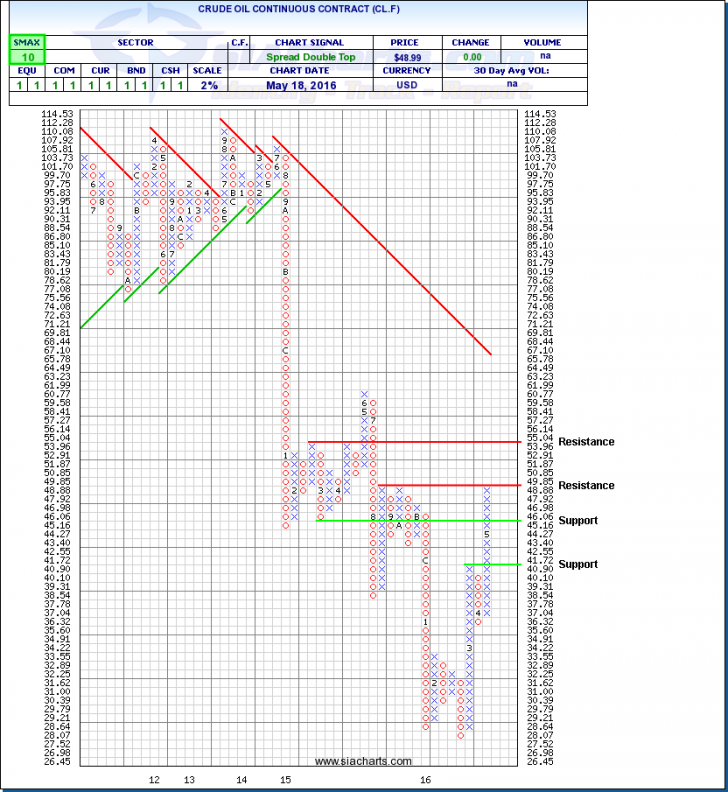

Crude Oil Continuous Contract (CL.F)

Crude Oil Continuous Contract (CL.F) has had a very nice last month moving up almost 19%. It has moved up to the first resistance level at $49.85 that we highlighted during our previous SIA Equity Leaders Weekly commentary that CL.F has struggled to move above during August and September of 2015. If it does move above $50, the next resistance level can be found around $55. To the downside, support is now found above $45.16 and below this at $40.90. With an SMAX score of 10 out of 10, Crude Oil is showing near-term strength against all asset classes.

As mentioned above and in previous commentary, if the USD starts to strengthen again, it could be downward pressure on Commodity prices. The daily correlation between the Canadian dollar and crude oil prices has actually been weakening over the past 5 to 6 weeks as well causing a disconnect that may continue. The Canadian wild fires in Alberta and pipeline attacks in Nigeria have caused some disruptions to production while the supply side has seen Iran increase oil production and exports to 3.56M barrels of oil per day in April 2016 according to a study by the International Energy Agency with Iran not planning to slow down production until pumping over 4M barrels per day.

For a more in-depth analysis on the relative strength of the equity markets, real estate, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or siateam@siacharts.com.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © SIACharts.com