One Commodity Conundrum Despite 2nd Best April Ever

by Jodie Gunzberg, Dow Jones' Indexology

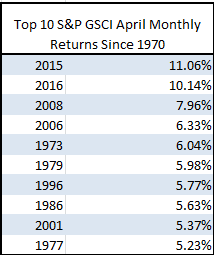

The Dow Jones Commodity Index and S&P GSCI total return indices gained 9.1% and 10.1%, respectively, in April. For the S&P GSCI, it was the best month in a year, and the second best April ever in history since 1970, only after last year’s April, when it gained 11.1%. Further, the S&P GSCI is up 15.5% since Feb 29, 2016, making this the first consecutive positive two months in two years, since Mar-Apr 2014, but marks the biggest consecutive two months in almost seven years since May-Jun 2009 when it gained 20.4%.

Source: S&P Dow Jones Indices.

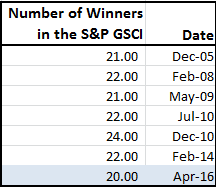

There has never been an April with this many positive commodities, posting 20 of 24 winners (coffee, Kansas wheat, live cattle and feeder cattle lost.) Only six months in history have had more positive commodities and April 2016 had the most winners since Feb. 2014, when 22 commodities were positive.

Source: S&P Dow Jones Indices. May 2004, Feb. 2010 and Sep. 2010 also had 20 winners.

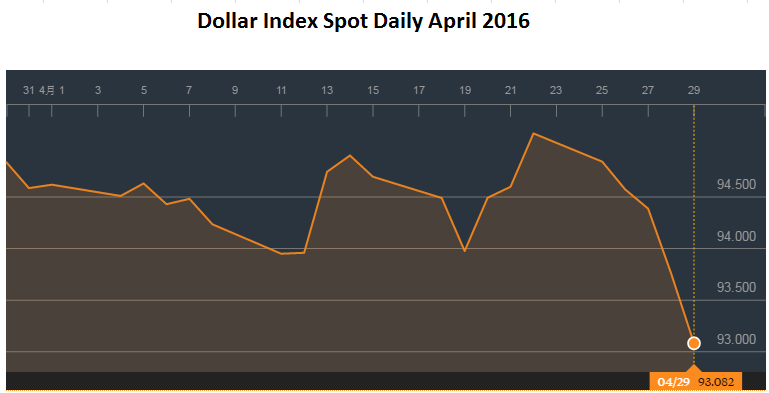

It is not surprising to see the S&P GSCI deliver strong returns in April given that historically on average it is the best month. However, it is concerning that only four commodities (copper, gold, cotton and lean hogs – and the lowest count since November’s Nightmare) are in backwardation, a condition that generally reflects a shortage. There have been 24 months with better returns than in Apr. 2016, but the backwardation count this low concurrently with the high returns hasn’t happened since 1974, when there were only six commodities in the index. What it means is the supply/demand fundamentals may not be in place to support this commodity rally and that it may be driven more by the falling dollar.

Source: Bloomberg

- See more at: http://www.indexologyblog.com/2016/04/30/one-commodity-conundrum-despite-2nd-best-april-ever/#sthash.bxl5sf45.dpuf