by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Wednesday May 18th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade. Investors are waiting for release of FOMC Meeting Minutes from the April 27th meeting.

Goldman Sachs downgraded its call on global equities from Overweight to Neutral.

Lowe’s added $0.73 to $76.80 after reporting higher than consensus first quarter earnings.

Tesla gained $4.22 to $208.88 after Goldman Sachs upgraded the stock to Buy from Neutral.

Target fell $5.76 to $67.85 after reporting lower than consensus first quarter earnings.

TJX (TJX $75.07) is expected to open higher after announcing plans to expand its number of stores. RBC Capital raised its target on the stock to $84 from $82.

JP Morgan (JPM $61.60) is expected to open higher after increasing its quarterly dividend to $0.48 from $0.44 per share.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/05/17/stock-market-outlook-for-may-18-2016/

Note seasonality charts on Consumer Staples, Industrial Production, Housing Starts and Building Permits

Another Milestone

Number of StockTwits followers exceeded 22,000 yesterday. Previous milestone at 21,000 followers was reached on April 28th.

Mr. Vialoux on BNN’s Market Call Tonight

Following are links:

http://www.bnn.ca/Video/player.aspx?vid=872533 Market comment

http://www.bnn.ca/Video/player.aspx?vid=872552

http://www.bnn.ca/Video/player.aspx?vid=872558

http://www.bnn.ca/Video/player.aspx?vid=872559 Past Picks

http://www.bnn.ca/Video/player.aspx?vid=872579

http://www.bnn.ca/Video/player.aspx?vid=872591

http://www.bnn.ca/Video/player.aspx?vid=872593

http://www.bnn.ca/Video/player.aspx?vid=872598 Top Picks

Observations

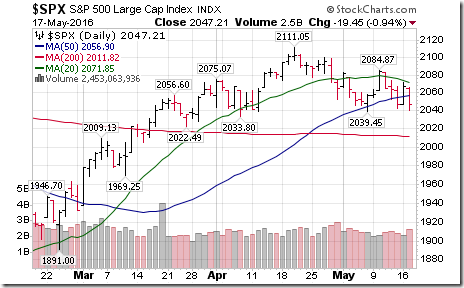

The S&P 500 Index tested the 2,039.45 level, but held. A break below this level completes a short term Head & Shoulders pattern and will attract technical selling.

Notable technical weakness was recorded yesterday by the S&P Consumer Staples Index

Grain prices continue to soar.

StockTwits Released Yesterday

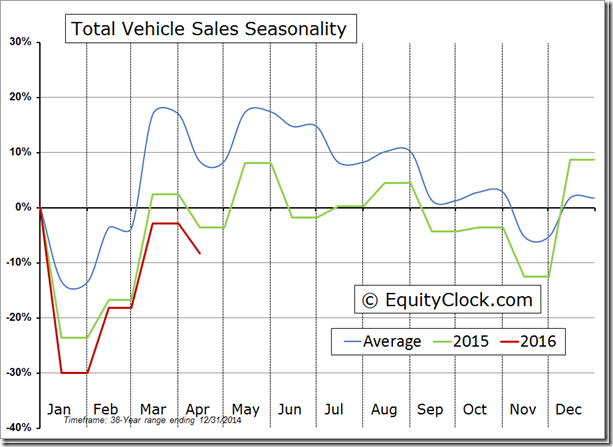

Auto sales lagging seasonal norms, taking a toll on the stocks in the industry

Technical action by S&P 500 stocks to 10:00 AM: Quiet. Breakouts: $TJX, $LLY, $SNA. Breakdown: $HD

Editor’s Note: After 10:00 AM, technical action by S&P 500 stocks was mixed. Breakouts: JCI, ROP. Breakdowns: GPC, DLPH, SBUX

Gold and silver equity ETFs are breaking above short term trading ranges and extending uptrends: $SIL, $GDXJ, XGD.CA

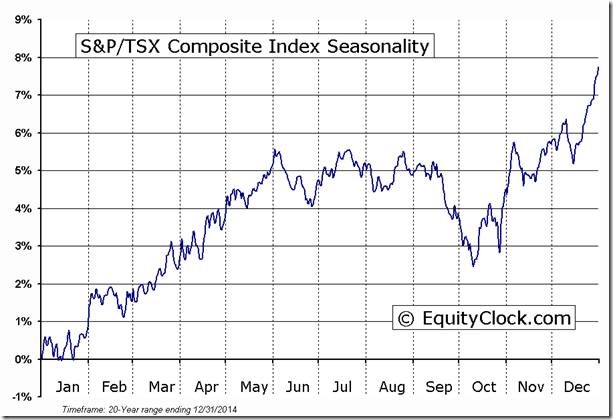

TSX Composite Index $TSX.CA briefly moved above 13,972.62 to reach a six month high.

‘Tis the season for the TSX Composite Index to move higher until June 5th on average.

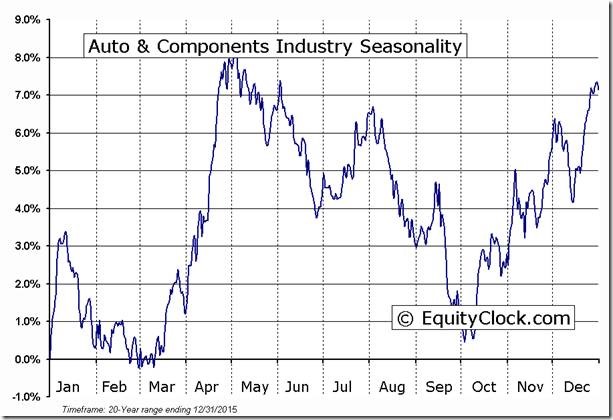

Auto and auto parts stocks are under technical pressure: $F, $GM and $DLPH broke support.

‘Tis the season for weakness in auto and auto parts stocks!

Trader’s Corner

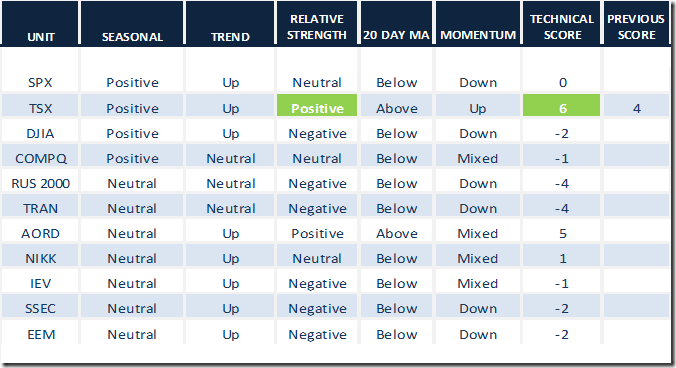

Daily Seasonal/Technical Equity Trends for May 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

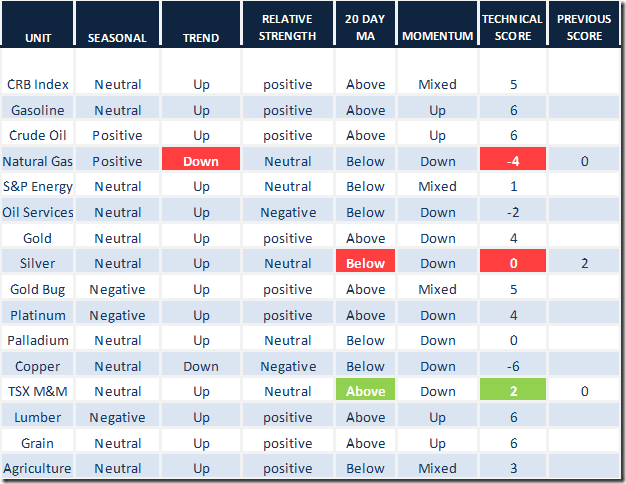

Daily Seasonal/Technical Commodities Trends for May 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

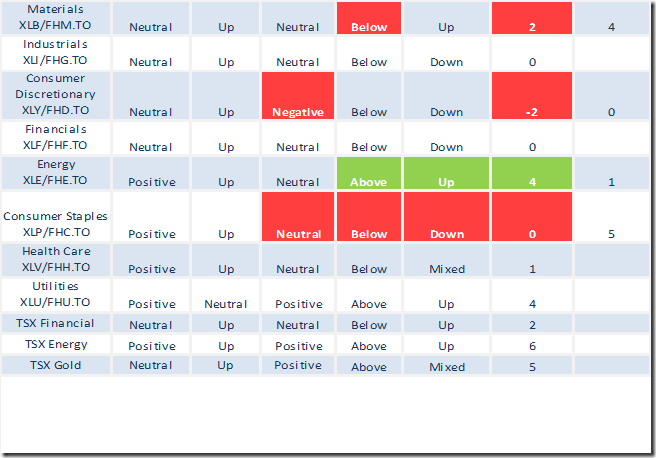

Daily Seasonal/Technical Sector Trends for March May 17th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

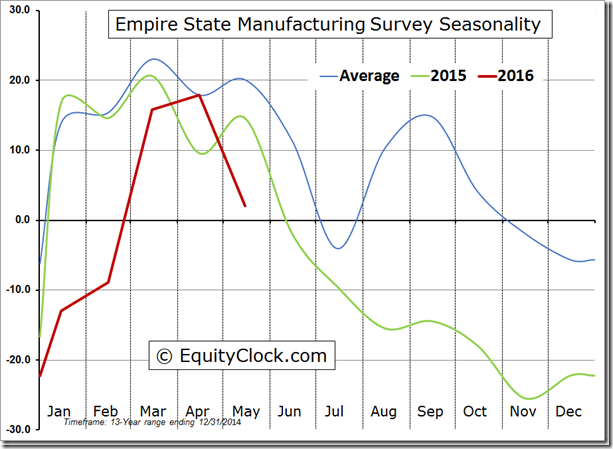

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

S&P 500 Momentum Barometer

The Barometer continues to move lower, down another 7.80 to 50.60. The Barometer remains intermediate overbought.

TSX Momentum Barometer

The Barometer slipped 2.13 to 69.79. The Barometer remains intermediate overbought and trending down despite gains by the TSX Composite Index.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca