Commodities Continue Hot Streak

by James Picerno, Capital Spectator

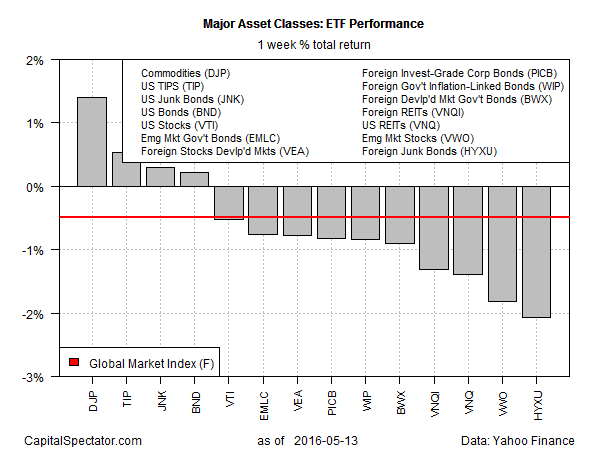

Broadly defined commodities bounced higher last week, topping the performance list for the major asset classes, based on a set of proxy ETFs. iPath Bloomberg Commodity (DFP) increased 1.4% for the five trading days through May 13, delivering a relatively outsized gain vs. the rest of the field.

DJP’s latest weekly gain, the third rise over the past four weeks, stands out amid the renewed weakness in global equities. Dividing the world’s stock markets into US, foreign-developed and emerging-market buckets shows declines across the board last week. The biggest loser, however, is foreign “junk” bonds via iShares International High Yield Bond (HYXU), which shed 2.1% last week.

The downside bias in assets continued to weigh on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F slipped 0.5% for the week through May 13.

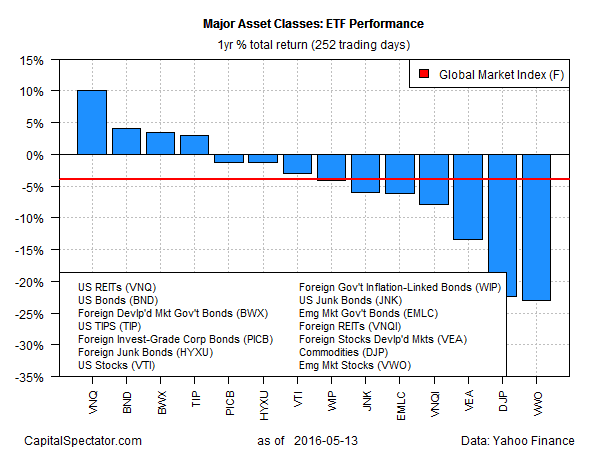

Year-over-year returns are still battling with red-ink syndrome. The handful of winners for trailing 12-month column are led by US REITs, which are ahead by a solid 10% via Vanguard REIT ETF (VNQ), based on the past 252 trading days. But the majority of funds post declines. Note, however, that the worst performer for the trailing one-year period is emerging-market stocks. For the first time in recent memory, commodities are no longer dead last—a distinction that now goes to Vanguard FTSE Emerging Markets (VWO).

Meantime, GMI.F continues to nurse a modest loss for the one-year column. As of May 13, the benchmark is off 3.9%.

Copyright © Capital Spectator