The Plaza Accord Cannot Be Reincarnated

by Carl Tannenbaum and Asha Bangalore, Northern Trust

The Plaza Hotel in Manhattan is a landmark property. Standing at the foot of Central Park for more than 100 years, the Plaza has hosted presidents, kings, and entertainment's leading lights. The hotel was featured in The Great Gatsby, and was the setting for films ranging from North by Northwest to Home Alone II. Donald Trump was married there in 1993.

Despite what "The Donald" would tell you, that was not the most significant gathering in the hotel's history. Thirty-one years ago, the finance ministers from Japan, France, West Germany, Britain and the United States met to synchronize economic policy in support of global objectives. The "Plaza Accord" set the stage for significant shifts in world markets.

Today, some are calling for a new Plaza Accord. Countries acting in isolation are not getting the economic results they are seeking, and their actions create stress for their neighbors. But while a new commitment to coordination would be ideal, securing it may be a bridge too far.

The world was a different place in the middle of the 1980s. Walls still hadn't fallen, Europe still had multiple currencies, and China's economy was one-tenth the size of the United States'. But globalization was advancing, and with it the notion that collective success could be achieved through collective behavior.

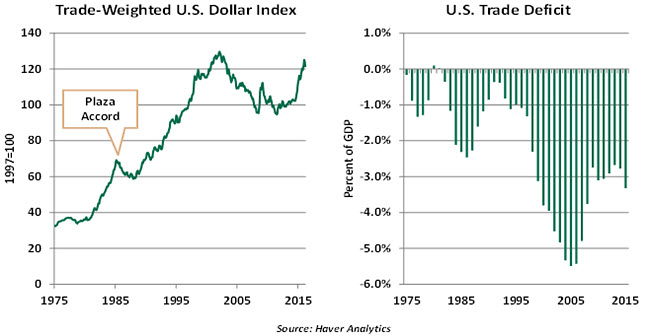

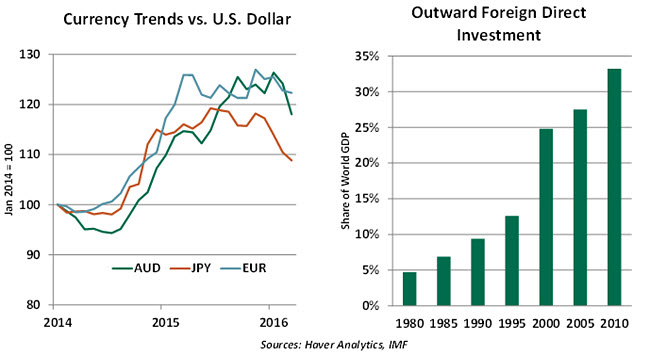

When officials gathered at The Plaza in 1985, they were intent on addressing a very specific issue. The U.S. dollar had been gaining alarming strength, nearly doubling in value on a trade weighted basis in five years. That made U.S. exports substantially more expensive, initiating a rise in the U.S. trade deficit that had reached a then unheard-of level of 2.5% of gross domestic product (GDP).

Accusations of manipulation were rampant. Japan, which was in ascendance, was thought to be holding down the value of the yen to promote sales of its products overseas. The U.S. Congress was under pressure from American manufacturers to retaliate with trade restrictions.

The five signatories to the Plaza Accord (known then as the Group of Five, or G-5) agreed to intervene in currency markets to drive down the U.S. dollar. Over the next two years, the U.S. dollar declined by almost half versus the British pound, the West German mark, and the Japanese yen. The trade picture responded in turn; the U.S. import/export position returned to near balance before the decade was out.

The Plaza Accord is still revered as a shining example of what international policy coordination can achieve. To build on this initial momentum, the conclave was widened to become the G-7, a group which still meets today. Some have said that the success of the Plaza Accord helped boost prospects for the euro, which is the ultimate expression of economic cooperation between sovereign nations.

The Plaza Accord is still revered as a shining example of what international policy coordination can achieve. To build on this initial momentum, the conclave was widened to become the G-7, a group which still meets today. Some have said that the success of the Plaza Accord helped boost prospects for the euro, which is the ultimate expression of economic cooperation between sovereign nations.

These fond memories have spurred calls for a new Plaza meeting. Some would like a conclave to discourage currency manipulation, a potential race to the bottom which might leave everybody worse off. (There have been suggestions that G-20 members moved to restrict this activity in Shanghai earlier this year, although the turn in exchange rates can be traced to late last year.)

But the reality of what happened 30 years ago is much more complicated, and the spirit of cooperation which prevailed back then would be difficult to recreate. A careful reading of the history suggests that a new Plaza Accord might not be very effective.

The dollar's strength in the early 1980s may have had less to do with currency manipulators and more with the restricted growth of the money supply implemented by the Federal Reserve beginning in 1979. The dollar started declining in value months before the Plaza Accord, suggesting more fundamental forces were at play. And the impact of the Accord was very short-lived: the dollar and the trade deficit resumed their upward trends just two years later.

The ability of policy makers to steer market outcomes is more limited today. International capital flows are significantly larger than they were 30 years ago, and their movements can have an outsized influence on exchange rates. While countries in many parts of the world have tried to build their reserve levels, their ability to intervene successfully in markets is limited by the power the investment community wields.

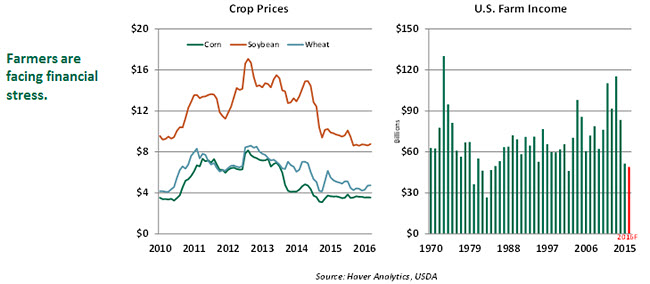

International politics are not presently supportive of international policy cooperation. Rising nationalism in many areas has all but stopped new trade agreements and would certainly complicate efforts to intervene in markets. Any attempt would have to involve close coordination between monetary and fiscal authorities, which might compromise central bank independence.

The number of countries that would need to be engaged is much larger than the five countries represented in 1985, which would make it far more challenging to achieve consensus. While the original five were aligned from a defense perspective, an updated guest list would include participants who are not NATO members. This certainly complicates matters. All of this is not to say that modest levels of international policy coordination aren't possible. But the standard set by the Plaza Accord may no longer be realistic. Eventually, world markets are going to have to find their way to a productive global equilibrium without the heavy hand of intervention.

The number of countries that would need to be engaged is much larger than the five countries represented in 1985, which would make it far more challenging to achieve consensus. While the original five were aligned from a defense perspective, an updated guest list would include participants who are not NATO members. This certainly complicates matters. All of this is not to say that modest levels of international policy coordination aren't possible. But the standard set by the Plaza Accord may no longer be realistic. Eventually, world markets are going to have to find their way to a productive global equilibrium without the heavy hand of intervention.

The Plaza Hotel is a lovely property. Even after extensive recent renovations, parts of it appear frozen in time. The same may be true of the Accord that bears its name.

A Bountiful Harvest Is Not Always a Blessing

The U.S. agricultural sector is adjusting to significant changes in the marketplace. Different financial metrics show the effect of these developments on the farm economy, and have raised questions about the financial health of this sector.

Agricultural and agriculture-related industries account for close to 5.0% of U.S. GDP. America's farms make up 1% of GDP and employ 1.5% of the labor force. Agricultural exports are roughly 6.5% of total exports of goods and services. These numbers suggest that the agricultural sector's relative position in the economy is modest, but nonetheless important.

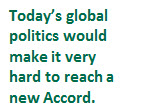

The U.S. Department of Agriculture notes that crop production was elevated in 2015, including the largest soybean crop and the third largest corn production on record. World production of these crops also advanced during the same period, with Brazil and the Black Sea region reporting rich harvests.

But relatively stagnant domestic demand and soft global economic conditions have translated into lower crop prices since 2014. Corn and soybeans, the two largest crops in the nation, have registered big price declines since reaching peaks in 2012. Also, the dollar gained substantially in 2015 and held back exports of U.S. agricultural products. There were widespread reductions in agricultural exports, with China leading the group.

The supply-demand equation consisted of robust production and weak demand last year. A similar situation is most likely to prevail in 2016, which implies even lower crop prices.

Farm income showed an outstanding performance during the three years ended 2013. The strength of the U.S. farm economy came from record U.S. demand for corn-based ethanol, surging demand for food purchases in Asia and a low-interest rate environment that spurred investment in the farm sector. But farm income plunged 38% in 2015, the largest decline since the 42% drop in 1983. A modest setback is predicted for 2016. If this is accurate, farm income would be near its low point over the past 30 years.

A projection of lower crop prices is the primary driver of reduced land values. Farmland values in Iowa, North Dakota, Minnesota and South Dakota posted spectacular gains during the 10 years ended in 2014, while the Southwest and Southeast parts of the country were mostly excluded from this phenomenon. Farmland prices have dropped in the last two years in most states and the adjustment to lower commodity prices and profits will be varied just as they were on the upswing.

Total outstanding farm debt rose 33% from 2010 to 2015, with a large part incurred when farm income was moving up rapidly. The debt reflects loans advanced for capital purchases during periods of prosperity and for covering short-term financing as margins narrowed. Following the drop in farm income during 2015 and the anticipated decline in 2016, debt service could be problematic.

The debt-equity ratio of the farm sector hit a low of 12.7% in 2012, and it has moved steadily to 14.6% in 2015; a higher ratio is predicted for 2016. Although this debt-equity ratio is low relative to the oppressively high levels of the 1980s, future balance sheet challenges are likely.

The key takeaway is that fundamentals are deteriorating in the farm economy and increasing financial pressures are developing. Given that the world supply of grains is high, and growth projections of the major developed and emerging markets are low, it is easy to appreciate the bearish outlook for the farm sector.

Is Slowing U.S. Growth Real or Technical?

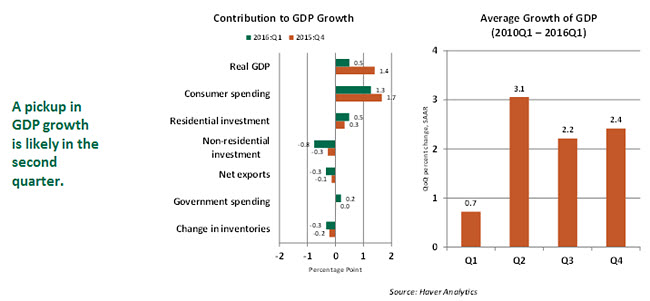

The pace of business activity slowed in the first quarter, raising questions as to whether this is a genuine scale back in economic momentum or if technical factors explain the mild increase in real GDP growth.

Real GDP grew only 0.5% in the first quarter, after a 1.4% increase in the prior quarter. Consumer spending, housing, investments in intellectual property, and the state and local government components advanced, while outlays on structures and business equipment investment declined. Inventories and net exports made negative contributions to real GDP. These are weak spots to monitor closely.

There are two issues to note. First, the advance estimate GDP is based on incomplete information, and it is revised as more data are available. The final GDP estimate, after a preliminary version in May, will be published on June 28. Therefore, our view of the first quarter could change a bit in the next two months.

Second, research indicates first-quarter estimates of GDP growth tend to be downwardly biased. Residual seasonality may be the culprit. Analysts have pointed out that the Bureau of Economic Analysis (BEA) does not conduct a complete seasonal adjustment for some components of GDP. The BEA is collaborating with other government agencies that provide source data to fix this problem.

Also, gross domestic income (GDI), an alternate measure of growth, is not subject to residual seasonality and typically runs higher than GDP. A comparison is possible when these estimates are published next month.

From another perspective, consumer spending growth slowed in the first quarter, driven by a sharp drop in auto sales. Auto sales are predicted to stabilize, and labor market performance supports expectations of higher growth in consumer spending in the quarters ahead.

The Fed downplayed the weakness in first-quarter GDP growth in its message after the latest policy meeting. It is looking forward to more robust performance during the balance of the year, and so are we.

Copyright © Northern Trust