Uncharted Territory: Emerging-Market Debt Cleans Up Its Ratings

by Fixed Income AllianceBernstein

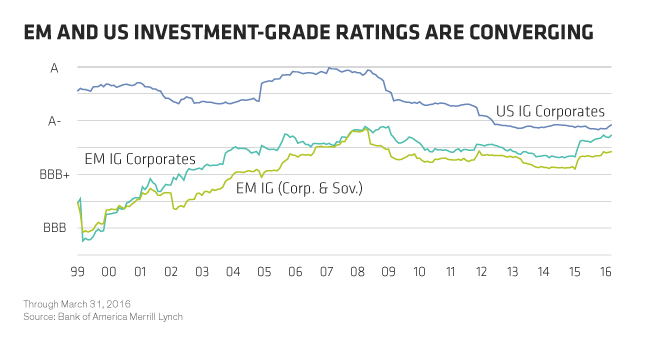

Over the past decade, the average credit quality of emerging-market (EM) investment-grade (IG) bonds and US IG corporate bonds have converged to an unprecedented extent. Why? And what does it mean for investors?

The EM ratings landscape looks different today than it did in 2006. Economic growth in many EM countries has helped significantly expand the IG playing field, which today has more EM issuers—both companies and countries—than ever. Colombia, Peru and the Philippines are a few sovereigns that were bestowed with the IG mantel in the not-too-distant past.

Fallen Angels Provide Lift

On the flip side, EM countries have not been immune to volatility in recent years. Deteriorating fundamentals, political turmoil and geopolitical stresses have gripped countries like Russia and Brazil. Many of the countries’ biggest companies were downgraded, such as Petrobras in Brazil and a slew of Russian banks, resulting in the loss of their IG status.

Similarly, on the sovereign side, some of the largest fallen angels have included Russia’s and Brazil’s debt. These countries had maintained a large presence in EM indices, and when their downgrades relegated them to junk status, the effect on the IG indices was noticeable.

The indices the fallen angels were forced to vacate now have much higher-rated bonds that, for the first time, are converging with US IG corporate bonds (Display). And as the lower-rated companies have moved into high yield, the overall credit-quality averages of the EM IG indices have improved.

The average rating of the US IG corporate bond index, on the other hand, has moved lower, especially as some companies within the basic materials and energy sectors have been downgraded to borderline IG.

But in the EM space, many companies in the energy sector are fully or majority-owned by the government—support that helped cushion the impact when their ratings were being evaluated. Additionally, the local producers in these industries have been helped by local-currency depreciation in maintaining competitive cost positions.

Implications for the Future

The rating convergence of EM IG indices with the US IG index is uncharted territory for the market. With some of the riskier names gone from the EM indices, the convergence of higher-rated EM and lower-rated US IG bonds means investors may not get the relative yield advantage they’ve earned historically as the market adjusts and relative yields decline to US levels.

As a result, investors will likely find that historical relative-value comparisons and top-down analyses no longer serve as helpful guides when comparing the two IG markets. To choose wisely and to know what risks you’re taking on, the best approach is to take a closer look at each investment—no matter where it’s grown.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Portfolio Manager—Emerging Market Corporate Debt

Shamaila Khan is a Senior Vice President and Portfolio Manager, focusing exclusively on emerging- market corporate issuers across all of AB’s emerging-market debt and credit strategies. She is a member of the Credit, Emerging Market Debt and Emerging Market Corporate Debt portfolio-management teams, and a member of the Emerging Market Debt Research Review team. Khan has been actively managing and evaluating corporate and sovereign emerging-market debt issuance since 1999. Prior to joining AB in 2011, she served as managing director of emerging-market debt for TIAA-CREF, specializing in hard currency and local-currency emerging-market debt, with a specific focus on corporate issuers. Khan has participated in many emerging-market panels and discussions worldwide, including Fitch’s Annual Emerging Markets Outlook Conference and the Latin America–US Symposium, part of the Harvard Law School Program on International Financial Systems. She holds an undergraduate degree in business administration from Quaid-i-Azam University (Pakistan) and an MBA (with honors) from the Stern School of Business at New York University. Location: New York

Director—Emerging-Market Debt

Paul DeNoon directs all of AllianceBernstein’s investment activities in emerging-market (EM) fixed income and is a senior member of the Global Fixed Income and Absolute Return teams. He oversees a variety of global fixed-income assets and has overall responsibility for all of the firm’s Multi-Sector teams. DeNoon is also Portfolio Manager for the Next 50 Emerging Markets Fund and a member of the EM Multi-Asset Strategy Committee, the Dynamic Asset Allocation Committee and a number of other management committees. Prior to joining the firm in 1992, he was a vice president in the Investment Portfolio Group at Manufacturers Hanover Trust and an economist in the bank’s Financial Markets Research Group, where he was primarily responsible for the analysis of monetary and fiscal policy. DeNoon began his career as a research analyst at Lehman Brothers. He holds a BA in economics from Union College and an MBA in finance from New York University. Location: New York

Related Posts

Copyright © AllianceBernstein