How Can a Strategy Everyone Knows About Still Work?

by Clifford Asness, Ph. D. AQR Capital Management, Inc.

Some assert that once a strategy is “discovered” it can’t work anymore. Others, often implicitly, assume the future will look as wonderful as the past. Perhaps not surprisingly, we stake out a middle ground. We’re going to argue that certain well-known classic strategies that have worked over the long term will continue to work going forward, though perhaps not at the same level and with different risks than in the past.[1] We will focus on classic “factor”-type strategies.[2] Our favorites won’t shock anyone. They are things like value, momentum, carry and quality/defensive.[3] Of these, we’ll use value investing as a common example throughout this discussion.

We don’t consider these classic strategies to be “alpha” in the traditional sense. However, there can be better or worse versions of them, and creating new, better versions is certainly a form of alpha (this can lead to great semantic battles).[4] Still, to be real alpha something has to be known to only a modest number of people/organizations (one being optimal). By this definition, classic strategies defined in well-known ways don’t fit. But, presumably sometime in the past, when they were much less well-known, they were indeed at least closer to “alpha” in all senses of the word. This brings us to the title question — now that they are “classics” and known to many, why should they still work?

First, of course, let me say that all else being equal, everyone would prefer that only they knew about these strategies! It is hard to argue that widespread knowledge of them is a good thing for those few who knew about them before. We think in the past we (the “we” is those collectively doing many of these systematically 20-25 years ago) were in the position of knowing about these strategies and using them when they weren’t widely known. We believe that many strategies make a journey from alpha to a middle ground. This middle ground is a place where they are known, still work — though perhaps not at the same level as in the past — and eventually fall under a set of overlapping labels like alternative risk premia, style premia, priced factors, exotic beta, and, of course, smart beta. When you realize this journey has occurred, there are two important things you must do. First, decide if you really believe the strategies will work going forward. That is, are they now really “premia” or are they gone? Importantly, if you believe they will keep working, be cognizant of how they might act differently now that they are more widely known, both from return and risk perspectives. Secondly, make sure these strategies are available for a fee consistent with something being known and not with the higher fee appropriate if you believe something is true, unique alpha.

If you believe in these classic strategies going forward, and you can invest in them at a fair fee, we think they are very special in the investment world. They can be a source of return with very low correlation (either low correlation of total return if delivered in a long/short structure or of potential outperformance as long-only factor or smart beta strategies) with the rest of most investors’ portfolios. Let me adapt an old joke. In four corners of a room are (1) Santa Claus, (2) the Easter Bunny, (3) classic known factors and (4) high capacity, truly unique alpha that you can identify ex ante and invest in at a high but fair fee. A prize is placed in the middle of the room. Who gets it? The answer is the classic known strategies because the other three don’t exist.[5] And yes in our anthropomorphic example (3) and (4) are living beings desiring the prize!

Why Do Systematic Strategies Work to Begin With?

So, now we begin to tackle our main question. Why, even if something has worked for 100 years in a variety of places (actually especially so, as this is how it gets to be “known”), can well-known classic styles still work going forward? To start, of course, we have to discuss why any, known or unknown, systematic strategy (be it “factors” or smart beta) works to begin with.[6] Basically there are two reasons.

The first reason is they work because the investor is receiving a rational risk premium. Let’s use as our example the value factor among individual stocks[7] — going long cheap stocks and short expensive stocks (use your favorite metric or metrics for measuring valuation). If the long (cheap) stocks are, in some relevant sense, riskier than the short (expensive) stocks — and riskier not just individually, which can be diversified away, but as a portfolio — then it’s completely rational for them to be awarded a higher expected (or average) return. Now, keep in mind, to be risky, that investment has to lose sometimes, particularly when it really hurts to lose! This is something often lost as some investors assume that risk is simply that something occasionally goes down. That would indeed be risk if it was all you owned, but it isn’t the right measure of risk for a small part of a portfolio. Rather, winning on average is the compensation you get for the times you lose only if those are very painful times to lose (and, yes, the industry is still debating how to define this pain, with the CAPM’s answer being that it’s about falling when the overall portfolio of invested wealth falls). If you win or lose completely randomly, most theory, and basic intuition, says you are not compensated for it with higher expected return as this randomness can be diversified away.

The second reason these strategies may work is because investors make errors.[8] Errors, mispricing, inefficient markets, overreaction, underreaction and myopia of various kinds are all in the bailiwick of behavioral finance. In this case, following our value factor example, the long (cheap) stocks have higher expected return not because they are riskier, but because investors make errors. In other words, these stocks are “too cheap” and you make money when things return to rational (or from the superior carry while you wait), and vice versa for expensive stocks.

Of course, just to complicate things, these explanations are not mutually exclusive. They can both be true. Furthermore, their relative impact can vary through time. For example, cheap value stocks might usually be cheap because they are riskier, but in the 1999–2000 technology bubble they were too cheap because investors were making errors. Much ink has already been spilled by researchers arguing over these competing explanations (though few seem to explicitly deal with the annoyingly complex possibility of both mattering). It’s not our task here to adjudicate between them. Rather, we’re focused on what happens as a strategy that works for either reason becomes more known.

What Happens When a Strategy Becomes Known?

Let’s consider the first case where a strategy works for “risk”-based reasons. The good news is this strategy may remain fairly robust after becoming “known.” In fact, it’s odd to think of it as ever being unknown. If cheap has beaten expensive because investors have correctly perceived the cheap as riskier in a deep, meaningful and undiversifiable sense, and thus demanded a premium, that’s always been known even if less formally and more implicitly. Still, being risk-based wouldn’t make a strategy entirely impervious to popularity. The price of risk (how much you’re rewarded in extra expected return) can vary though time, and perhaps fall as the risk premium is more popularized (if, in this case, not really “discovered” but just disseminated). The good news is that if something is rational compensation for risk, then there is no reason it should ever completely disappear or necessarily fall below a rational level. But, there’s bad news in this case, too.

The bad news is, of course, that risk is risky! Remember this shouldn’t be some mere label called “risk” but actual pain coming at the times it’s hardest to bear (this might be short sharp pain, or long periods of less-severe agony, but it has to be pain when pain really hurts). In our opinion, those espousing risk-based stories, sometimes, at the margin, don’t seem to want to uncover this real pain but merely use the word “risk” as a proxy for “rational” so everyone can feel good about investing. “Oh, you get paid for doing this on average, but sometimes it ends your career or ruins your retirement” may or may not be an exaggeration but it’s certainly not a great tag-line for an investment product! But it is indeed a reason for the expected return premium associated with bearing this risk to be real.

This brings us to the more interesting case, and the one we’ll focus more attention on: a strategy that works based on behavioral finance reasons — that is, investor errors. This type of strategy starts out, all-else-equal (same belief in its efficacy), better than one based on risk. Why? Well, because it doesn’t come with risk! It is a stochastic free lunch (that’s a free lunch you get to eat on average but not all the time).[9] But it also has a big potential problem: it is likely more susceptible to going away. This can come from the irrationality that drove it going away (investors collectively wising up) or other investors pouring into it, taking the other side of those making errors, and “arbitraging” it away (a subtle difference where the unanointed don’t wise up but the cognoscenti are more active in exploiting them).[10] Let’s examine both of these things with some objective analysis and also, admittedly, some editorial opinion.

Expected Return and Risk When a Strategy Becomes Known

What might change when a strategy becomes more widely known? Consider the generalized idea of expected return (in excess of the risk-free rate) compared to the risk taken. If the “compared” in the prior sentence means division and the “risk” is volatility, then this reduces to the familiar Sharpe ratio. In fact, we’ll discuss it as Sharpe ratio but this discussion is fairly general to other measures of risk. We’re using Sharpe ratio not to defend all the assumptions behind it but to make discussion easier.

Sharpe Ratio = [Expected Factor Return minus Cash Return] / Factor Volatility[11]

Let’s first talk about expected return. Thinking about each of these strategies as a long and a short portfolio,[12] we can easily imagine that as a strategy or factor gets more popular the “value spread” between the long and the short side will, on average, get smaller.[13],[14] The value spread is a measure of how cheap the long portfolio looks versus the short portfolio (and for some factors can go negative). For value strategies the long portfolio always looks cheap, that's by definition, but how cheap, or the "value spread," varies through time. You can think of the value spread as one potential way of measuring the crowdedness of an investment. If too many people buy the long side and sell the short side, the long side gets bid up and the short side bid down, squeezing the value spread. A tight value spread should logically lead to lower long-term average returns to the factor going forward. But, lower does not have to mean irrelevant or disappearing. That will depend on how many investors on net are trying to lean this way. As of now, in broad generality (we expect to write more on this soon) we do see spreads on many factors somewhat tighter than they have been in the past, but not shockingly so (in fact, in our main example today's spread is almost exactly at the historical median). Moreover, they are considerably less tight than are the valuations of long-only stock and bond markets versus their own historical valuations.[15] In other words, if value spreads on these known factors are somewhat tight versus history, they are not, in our view, nearly as tight as traditional markets are expensive versus their own history.

Let’s look at one very simple version of this exercise. But, before doing so, we must caution you that even intuitive measures of strategy attractiveness like this are poor predictors of short-term strategy performance, and only somewhat better at predicting long-term performance (you just never get that R2 of 100% you want!). We think measures of strategies’ attractiveness are most useful when at unprecedented extremes (e.g., near the peak of the technology bubble, and if someday we ever see valuation spreads way lower than the past), and even then no indicator is perfect, certainly as to timing. Still, if the cheap stocks looked way less cheap versus the expensive stocks than ever before, we might not panic or abandon a strategy, but we would certainly pay attention. Let’s take a look at one simple intuitive measure we’ve been examining and writing about for more than 15 years.

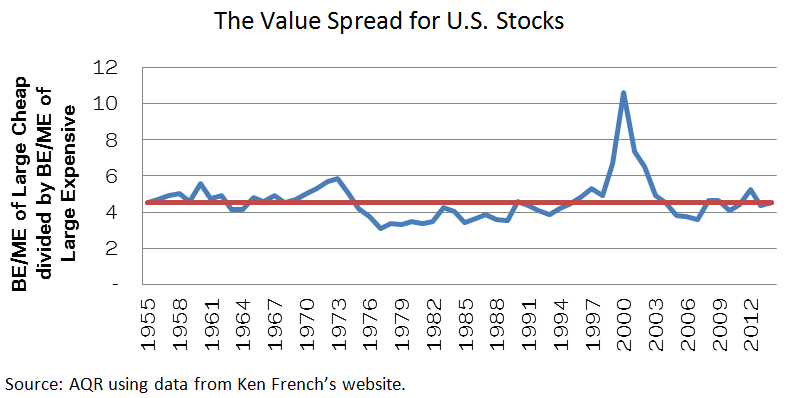

Using the Fama-French approach (data from Ken French’s website) below, we plot the ratio of the summed BE/ME (book-to-price) of the cheap one-third of large stocks over the BE/ME of the expensive one-third of large stocks (all U.S.) through June of 2015.[16] In brief, the cheap will always have a higher BE/ME than the expensive, that’s a tautology, but how much cheaper can and does vary dramatically through time, and seems to be a reasonable, intuitive and empirical measure of prospective long-run expected returns to the systematic value factor (as in all these predictions, it’s far weaker short term and still far from perfect long term). The red line is the median, and higher implies cheap is cheaper than usual versus expensive:

The current level is almost exactly at the 60-year median. While the strategy might be more exciting to invest in at times like the peak in 1999–2000 or the milder but still famous growth stock frenzy of the late 1960s and early 1970s, one usually has to suffer greatly before those opportunities turn profitable! Anyway, fairly basic measures like these show little evidence of a strategy that’s recently been arbitraged away.[17]

We don’t know the precise effect on the numerator (expected excess return) as a strategy gets more known. Does it go away entirely, get reduced significantly or is it only mildly affected? Directionally, however, what happens to the expected return of a factor as it gets more popular seems straightforward even if we see little evidence it’s happened yet! What happens to the denominator (risk) is perhaps a bit less obvious.

It does seem clear that you have more risk of a crisis — a “run” on a strategy, if you will — when it’s well known. There are more candidates to start running, and more price impact of the run, which can itself stimulate more running. Moreover, people who get into a strategy for “me-too” reasons are likely to run sooner than true believers.[18] It’s hard to imagine a run on a strategy only one person or firm is doing, or even a modest handful, except by coincidence. That is, unique strategies seem relatively immune from runs, and the chance of a run seems logically to follow a strategy becoming known. Besides runs, there are other more mundane reasons we might rationally worry that risk would increase when a strategy gets known.

Let’s examine this mundane everyday risk. Think of it for now as the classic measure of volatility if you’d like. Imagine a world without crises (it isn’t hard to do ♬). Not having crises doesn’t mean a strategy always works or even works on average. Consider the value strategy again. You are long “cheap” stocks (whatever your own favorite measures are) and short expensive ones. Even in a world where nobody else is doing it, there is still risk. The expensive stocks could turn out to be worth their prices, or more than worth them, and the cheap stocks could be not cheap enough. That’s not what happens historically on average, but it could have been the case, and it certainly can be and is at points in time. Even if a strategy is known only to you, it is still buffeted by real world news and outcomes and even just changes in opinion. If a lot of good and bad news comes out for your short and long positions, respectively, then you lose at that time.

Now imagine that a strategy becomes well known and popular. You still have the mundane risks we just mentioned, but now you have the addition of potential big and systematic “flows.” Flows only happen, except by large coincidence, when a strategy is known. What we mean by flows is somebody raising or lowering an allocation specifically to the factor in question (or some version of the factor: an allocation away from capitalization weighted and to fundamental indexing, for instance, would affect all value strategies implemented over the same stocks because fundamental indexing is simply a value tilt). All-else-equal, a flow into the factor would be expected to increase the return to that factor over the period it’s flowing in, and to lower returns after it stops. This can happen quickly should the return reverse fast as price-pressure abates, or slowly should the inflow compress the value-spread discussed earlier. Outflows, of course, work the opposite way. Essentially flows now become a new source of day-to-day volatility. In fact, we can unite these two things by thinking of a crisis or “run on a strategy” as just an extreme flow.[19] Even with no change in the long-term average return we’d expect a somewhat lower Sharpe ratio to a “known” strategy just from this effect — higher volatility from the additional risk source of flows. How much higher is an empirical question.[20]

Just as we did earlier for the value spread, we can examine the realized volatility of the value strategy. There are lots of ways to do this, but here is a basic and obvious way. Below we plot the realized, rolling 5-year monthly volatility (annualized) of long cheap, big stocks and short expensive, big stocks (again, using the Ken French data):

Again, the technology-driven 1999–2000 period is the outlier. Smaller extremes happened in the late 1960s through early 1970s (remember the graph looks back five years) and during the 2007–2008 financial crisis. Also, note that the rolling volatility of the value factor is 0.7 correlated with the volatility of the market itself, and the “residual” volatility (that not explained by the market) of the value factor is mostly negative since the technology bubble (in other words, the volatility of the value factor portfolio has been lower than average when adjusted for market volatility). While it is reasonable to worry — and we will continue to worry — there seems little evidence, at least at the monthly frequency, to suggest that we are seeing the steady rise in volatility to the value factor that one might fret about as “flows” become a bigger and bigger part of life. So, while we stand by our theoretical discussion of flows, we can’t find a lot of evidence they have become a big issue yet (admittedly realized volatility is a coarse measure affected by many other things, again more work for the future).[21]

Can We Say More About Current Attractiveness?

As a strategy becomes well known it leads to a potentially lower numerator (expected reward) and — probably less obviously — a potentially higher denominator (risk). Yep, it’s better to be the only one to know about a good strategy! But does broad knowledge of a strategy, even if it’s based on investor error, mean it has to go away? Does the numerator have to go to zero, or the denominator so high that the risk is unacceptable? The above is some very early evidence that, at the very least, this has not occurred yet for the most basic version of the most widespread smart beta, or factor, which is value. Let’s continue this discussion (with, admittedly, more opinion than factual graphs).

First, we think the evidence that these strategies are flooded with money, as compared to the past, is weaker than many critics believe. These strategies have been well known since the late 1980s. (We mean becoming known in their systematic form, many were obviously “known” more generally well before that; value and momentum in general are not new ideas!) The widest value spreads to the value strategy ever witnessed were in the late 1990s during the technology bubble, when the systematic value strategy was widely known (in fact, widely ridiculed). Yet, as we discussed above, value spreads do not look like “the world has changed” for value.[22] Given that the value strategy forms the core of many factor and smart beta strategies — for example, the famous fundamental indexing strategy is precisely a known systematic value tilt versus a capitalization-weighted index — we take comfort in this finding.

While money has been moving to smart beta — and this worries some people, a worry that might ultimately prove justified — it has to be coming from somewhere. If it has been coming from more expensive (in terms of fees, not the stocks they chose) stock pickers, and those stock pickers themselves had a bias to value investing, it’s less than obvious how big the net effect is. Furthermore, the inflows being discussed today are (mostly) into long-only unlevered smart beta, or factor-tilted, investments. This contrasts sharply with 2005-2006 (which preceded the sharp sell-off and the almost as sharp recovery of some of these factors in August 2007), when much of the flow was into levered long/short strategies.[23]

Interestingly, at the same time that many are worried about these strategies “going away” because they are too well known, we also read all the time about how it’s a “super-narrow market with some stocks overpriced and many underpriced.” We’re only being half-serious as reasoning from anecdotes in the financial press is generally unproductive. However, to those saying both these things (and you know who you are), we ask, well, which is it? Are investors mispricing the cross-section now in a big way, or have we all achieved rationality? We doubt either extreme.

In fact we have doubts about the extent to which these strategies are “known.” We encounter skeptics every day (being skeptical is allowed!) who find that these strategies are too simple, leave out too much (how can anything work without the judgment of a skilled stock picker?) or are just too naïve to be effective. In fact, it’s kind of odd to be called too obviously right (and thus too popular) and too naïve at the same time, but that’s often the case (and sometimes in the same meeting!).[24]

Going further, many implicitly assume that if more people pursue a strategy, they will “arbitrage it away.” In truth, it’s unlikely that even real arbitrage opportunities — let alone attractive expected returns (an expected return is not an arbitrage as it sometimes loses!) — get fully closed. This is not the place to discuss these theoretical limits. It’s a long topic, but those who want to begin should start here, here, here and here. It’s comforting to know that besides empirics and general economic reasoning, there are strong theoretical reasons why known strategies, if real to begin with, might be less attractive but not completely eliminated.

Until we see evidence (and perhaps this will never come, but if it does, the trip there, but not the destination, will be fun[25]) that value spreads are at, and remain at, unprecedented low levels versus history, we see no reason to believe these strategies are so well known that all the expected return is gone from them.

Advice to Investors[26]

So, in a world where these strategies are more known and more popular than they were during the history they’re studied over (which includes at least 20+ years of real-life results), but not so well known as to be eliminated, what’s an investor to do?

- First, assuming attractive but lower-than-historical rewards (the numerator) seems prudent.[27] Recall we believe this “lower-than-historical” verdict applies even more so to traditional long-only capitalization-weighted stock and bond markets (index returns). Thus, the marginal benefit of adding these strategies may be as or more important now than ever, even if stand-alone they are somewhat attenuated. And, remember, we’re certainly agreeing that logic says they should be somewhat attenuated when known, but our one simple test (for the most basic, but still only one, factor) didn’t find evidence of this![28],[29]

- Second, on the risk side it seems clear, and pretending otherwise would hurt not help, that crises or runs on these strategies are more possible now that they’re well known. However, historically, and logically, such runs are about surviving the short term. This is particularly an issue for levered versions of these strategies, something far less popular today than a decade ago (and thus, again, probably actually safer today). Crises and runs have an impact on volatility over different horizons. Short-term volatility — say, daily or weekly — may be higher and have the risk of some large extremes when strategies become popular. But volatility over long horizons, call it monthly and beyond, might not go up much at all as the “flows” we discuss have less importance than the reality of economic outcomes. This is because these crisis events have been, and in fact should be, highly mean-reverting because they are based on price pressure and not fundamentals. That doesn’t make them something to ignore. If they kill you, you’re no less dead because they will right themselves soon (for someone else!). But institutions or individuals allocating to these in sizes they are confident they can stick with through extremes can take comfort in this longer horizon. In fact, if the possibility of short-term craziness scares off many, it can be a reason that these strategies remain attractive (still a good “numerator” with value spreads not super-compressed compared with those in the past). Remember, just because they are now known doesn’t mean everyone believes in them or is comfortable with them! With all this said, regardless of value spreads, if much more of the industry eventually adopts a long/short levered implementation of these strategies, it will be time to worry about them more. Bottom line, we recommend open eyes. Short-term crisis risk, and the risk that this will occur when markets have short-term problems, is likely larger in more well-known strategies. But again, it’s a short-term not long-term issue. Plan for crises so you can survive them without giving up the long-term benefits, but it’s not a reason to eschew factor strategies.

- Given how much factor strategies can improve a portfolio that was devoid of them, the current expensive state of traditional long-only market exposure, and the evidence that the “arbitraging away” of these strategies is still incipient, the strategies can have a lot of attenuation and still be valuable, so we believe they should be added to portfolios lacking them. While we, and other providers, always strive to be as good as we can, it’s often surprising how small a risk-adjusted expected return that a truly uncorrelated investment needs in order to have an important impact on a portfolio.

- We think you allocate to factors and stick with them. We think higher-frequency timing of them should not be dismissed out of hand, but should be treated very much like timing the stock market. It may be a good idea but should be treated with great caution. We think sticking with these smart betas / factor tilts — and setting yourself up to stick with them (through study, preparation, risk-control methods and the size of your allocation) — will be more important than timing them.

- Among the classic strategies, look to those that might, at the margin, be less crowded. Our AQR-centric answer is that we’ve written extensively about how these smart betas / factor tilts apply to not only stock picking but also to many other decisions (e.g., country equity and bond markets, currency, commodities) that are underappreciated. Evidence supports these strategies not being arbitraged away even for choosing stocks — but to those particularly concerned we emphasize the perhaps underutilized fact that they, again, work in many other places (indeed, this gives us much of our confidence they aren’t data mined even in the original locale stock picking) and we would recommend diversification across choosing stocks and choosing non-stocks.

- For those who can we’d look to well‑constructed long-short versions of these smart betas / factors. You can get far more diversification across themes and geographies and asset classes this way (and do somewhat better by incorporating the short side). If this method ever becomes dominant again, we must revisit this recommendation. For those investors for whom such an implementation is just not feasible due to constraints (a very common situation), we continue to believe the long-only implementations — smart beta in bottom-up construction or the much related factor tilt approach in a long-only portfolio — can significantly improve long-term risk-adjusted returns.

- Make sure fees are reasonable! Known strategies are OK: that’s our main message. But paying true alpha prices for known strategies is not OK!

In conclusion, it’s always better to be the uniquely informed investor. We don’t pretend otherwise. But unique is also much harder to evaluate (skill versus luck, real versus data mining versus lucky good draw) and much harder to find and invest in scale. Known strategies have the advantage of, well, you know about them! And they are often available in scale. If the known strategies make sense to you, if they have a great body of in- and out-of-sample evidence behind them, and if they pass some basic intuitive tests of whether they’ve been arbitraged away or not, then it makes no sense to ignore them. Don’t be blasé about the potential problems that might come with extreme crowding into these strategies, but also don’t assume that once something is known it’s gone forever from that day onward, and thus ignore good diversifying strategies that we believe will be with us for quite a while — and are needed now more than ever!

This article also appeared in the September 2015 issue of Institutional Investor.

[1] By “work” we mean statistically, i.e., a little more often than not. If your car worked like this you would fire your mechanic. On the other hand, if your investments worked all the time, you might need to turn your manager in to the authorities!

[2] “Smart beta” strategies are classic factor strategies that are long-only, usually about stock selection, and that focus on simple bottom-up portfolio construction, implicitly generating tilts versus cap weights that are usually entirely factor based. In contrast, but still usually coming out quite similarly, long-only factor-based “quant” strategies start from a benchmark, generating tilts by thinking in terms of “tracking error.” Both are covered by this discussion.

[3] For those not that familiar with these strategies, here’s a quick summary: value bets on cheap investments, measured using simple measures, beating expensive investments; momentum bets on winners over the last 6-12 months beating losers; carry bets on investments that yield more beating investments that yield less; and quality/defensive bets on investments that are lower risk or higher quality (e.g., more profitable) beating their opposites.

[4] Of course, using the word a different way, if we’re right that these strategies work and you’re not currently invested in these strategies, they may act like “alpha” to your portfolio. Something that makes a portfolio better might be phrased as alpha to that portfolio, but if it’s known we wouldn’t consider the source of the returns true alpha. Sorry the investing world’s terminology here is a bit odd.

[5] OK, that's a bit extreme, we are always looking for alpha too...

[6] For this essay we’re going to assume that these strategies really “work,” that their past efficacy was no accident. This is important as one worry is they have been found by diligent data miners and only appear to have worked in the past out of random chance: perhaps they are a result of random patterns, or perhaps are strategies that have the possibility of a very bad event that just didn’t occur in the sample. If so, the strategies didn’t really “work” — this is a separate and very important topic. (While we don’t live in a world of guarantees, we try to defend against data mining many ways — with out-of-sample tests across time, geography and asset classes being the most important — and we try to use fundamental economic principles to consider potential tail risks absent from our sample. For example, if there’s a sign options are implicitly being written, then we apply a basic conservative assumption that the future won’t be as strong as the past. See Harvey, Liu and Zhu for more discussion.)

[7] Value is only one factor and individual stocks only one of many places this and other factors have shown efficacy.

[8] We are using a broad definition of “errors” that admittedly could include some things better called “preferences not captured in a traditional asset pricing model.” We have discussed highly related issues in tests of market efficiency before.

[9] Both risk-based and behavioral-finance-based factors with positive average returns serve you lunch on average, and both fail to provide lunch sometimes. You may think of error-based behavioral strategies as failing to provide lunch at mostly random times, but risk‑based strategies as failing when you’re already starving.

[10] A risk-based factor can, of course, also be arbitraged away if enough investors decide to pursue it, but given it represents a rational and scary risk, it seems less likely.

[11] If the factor is already a long/short portfolio we do not subtract the risk-free rate.

[12] Again, if analyzing a long-only portfolio we can think of these as over- and underweights versus a benchmark includinthose implicit in a smart beta implementation.

[13] Of course this process may take quite a while and those in the strategy while it’s occurring can make more than usual during it (the normal strategy return plus the extra return from investors on net buying what you’re long and selling what you’re short).

[14] This is not the place to go into depth on the value spread but for those who want background here and here are good starts.

[15] There are various ways to define a value spread of a factor or a strategy. Some are independent of the market’s own expected return, like the one we use here (which we have been examining since 1999). But some, like the difference in valuations instead of the ratio of valuations between the cheap and expensive (yes micro stuff like this matters!), are more tied into the overall level of the stock market, and can compress if the market’s own expected return goes lower (price goes higher). We think of that as a common component to the expected return on all forms of risk taking — perhaps meaningful for future performance in an effect more akin to “carry” than “value” and more a sign of market cheapness/expensiveness than a sign of strategy crowding. Again, this is a topic we hope to return to soon but for this essay we will stick with the definition we’ve been using since the technology bubble.

[16] French also supplies a slightly different version — the capitalization weighted average of the BE/ME of the cheap over that of the expensive. You get essentially the same graph.

[17] Note that we’ve only scratched the surface of possible formulations of these measures.

[18] Generally, the degree to which investors in a factor or strategy are homogeneous vs. heterogeneous will likely impact the probability and severity of crises/runs. Fertile ground for future research.

[19] We’d even add that the risk of the strategy hitting bad times when the market is in trouble is higher when the strategy is well known (i.e., it becomes harder to be short-term market-neutral, and we emphasize short-term). If a factor is mostly unknown and only acted on implicitly, it’s hard to imagine, in a crisis, investors massively reducing this factor bet. But once something is a known bucket to invest in, it’s something that can be explicitly reduced when times get scary, not because it’s particularly scary itself, but just because risk is being cut in general in all forms. We think this, like flows in general, affects volatility and diversification over the short term way more than over the long term. The chance that these strategies do well (or poorly) when the market does well (or poorly) over longer periods is likely not affected very much by this change — though it is again something to monitor and worry about. Events are about survival, the long term is about prosperity.

[20] We can only conjecture about how big a source this is. We know they occasionally matter a lot (e.g., the crises we refer to). But how much do they matter in more normal times when a strategy is well known? That will depend on their magnitude and also how correlated they are to contemporaneous performance (if positively correlated, their impact will be to exacerbate current moves; if negatively correlated, as if investors were net short-term contrarians in the strategy, they could even dampen volatility). Indeed, there could be a strong feedback loop where crises (or some extreme positive event) are an interplay between performance and flows that is large and continues for a bit. This is all important stuff for future work. Here, we are about to show that there’s little indication that normal times see large volatility increases due to flows.

[21] We do have evidence of one very extreme period — August of 2007 — when the intramonth craziness is hidden by the use of monthly data rather than daily. Later, we will implicitly discuss what time horizon is relevant to most investors, but as a preview, unless you’re very levered and taking a big part of your risk budget in a strategy, we think what we examine in the text is more relevant than the dailies. Similarly, continuing a theme, we have long argued that the short term is the wrong time horizon to judge international diversification.

[22] For other factors (e.g., momentum and low risk) it is harder to get a handle on the value spread than for the value factor itself (we have a forthcoming AQR white paper on exactly this: S. Chandra, A. Ilmanen and L. Nielsen (2015), “Are Defensive Stocks Expensive? A Closer Look at Value Spreads”). However, we stress again that the value strategy is, in our view, the most economically important factor both to those who think of this as factor investing and those who’ve labeled it smart beta.

[23] Paradoxically, while not for everyone, we think this makes some exposure to the long/short versions actually safer now than if this version of the factors were more popular.

[24] Along a similarly amusing line, some seem to worry in a way we’d summarize as “avoid these strategies as I’m afraid money is about to pour into them.” That’s odd.

[25] A running joke at our firm is that us older employees might be OK with the strategies being “arbitraged away” over the next 10 to 20 or so years, but the younger generation might not appreciate a great 10- to 20-year run under our watch and then being handed the keys with no spread left! Of course, the world cares little for what we root for.

[26] This section does not purport to give advice to investors.

[27] Recall we’ve stuck with the ratio version of the value spread we’ve been looking at since 1999 and we think best measures how “crowded” a strategy has become. “Difference” measures also matter, again more as a carry than a crowding indicator, and are, in our view, more affected by the generally lower level of prospective long-term traditional market index returns.

[28] Again, a more carry-based “difference” measure would show more attenuation than our ratios, due to the market being expensive rather than the strategy being popular.

[29] Please note: this conservatism is not a new thing. Even for strategies that have withstood tremendous out-of-sample tests across time, geography and asset classes, we’ve been using estimates like “assume it’s half as good as its backtest” for decades now.

This post was originally published at AQR Capital

Copyright © AQR Capital