Almost Does(n’t) Count: Ackman Valeant – Buffett Salomon

by Peter Cook, WhiteTree

“Risk is more things can happen than will happen” – Elroy Dimson

“Many things can happen but only one will” – Howard Marks

Sometimes a thing creates an echo in your mind. That is to say you keep thinking about it, and while you know it’s important, you can’t quite externalize why. An exchange of words between hedge fund titans Ray Dalio and Bill Ackman has been one of those things for me. The highlight of their conversation, at least for me, was when Ray Dalio more or less said to Bill Ackman:

“Hey Bill, how can you sleep at night with such a concentrated portfolio of equity securities?”

As much as I’ve thought about this, I expect Bill Ackman has thought about it more because his fund is down over 40% in the past year, largely due to the implosion of his position in Valeant Pharmaceuticals (VRX).

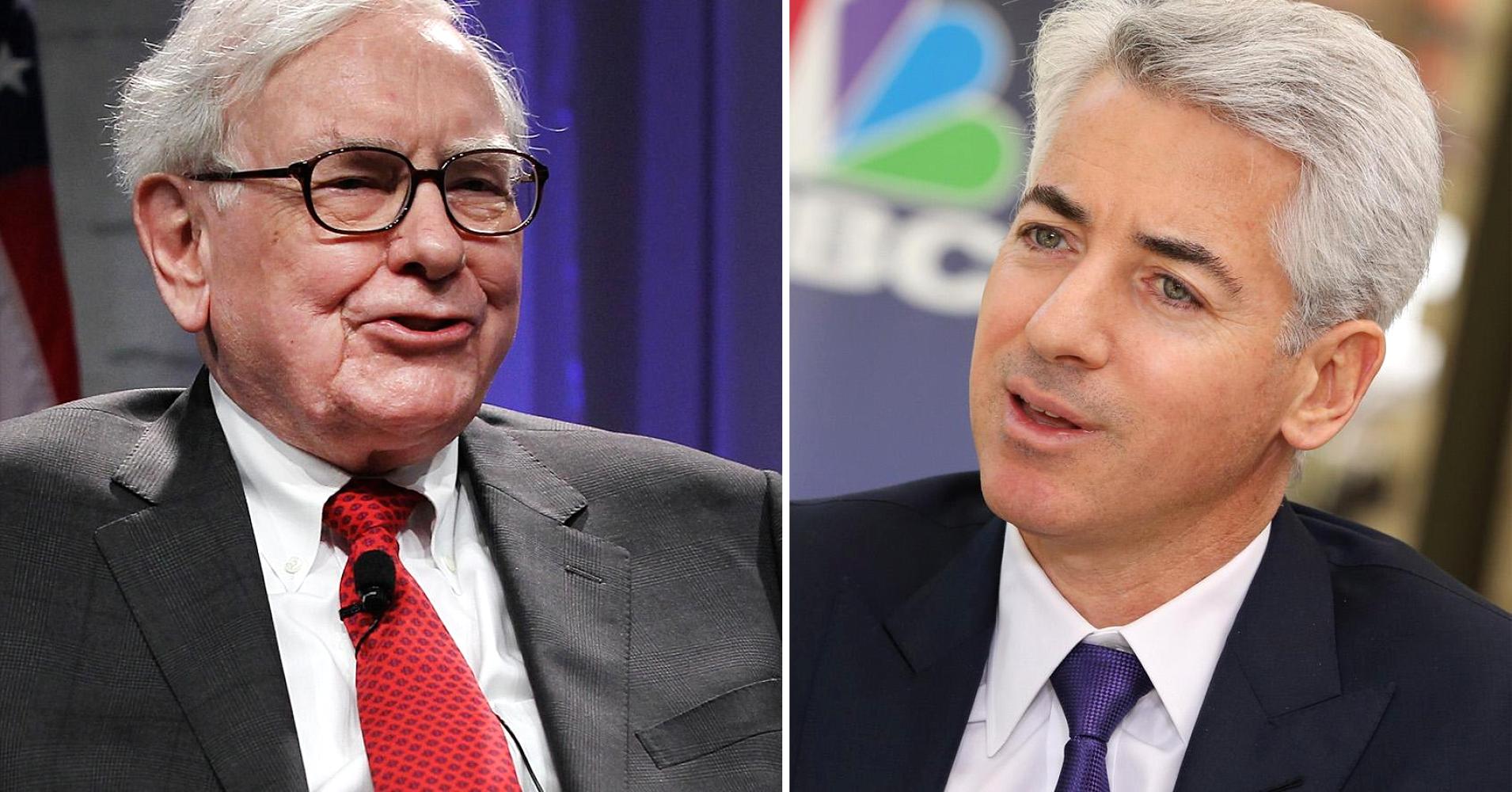

It is of the moment to criticize and dissect Ackman-Valeant, and while there is no shortage of things to say about that specifically1, I think it is also illuminating to consider the parallels between Ackman-Valeant and what transpired between Salomon Brothers and another successful investor: Warren Buffett.

In 1987 Warren Buffett made an investment in the preferred equity of Salomon Brothers, in order to save it from a take over attempt by Ron Perelman. He purchased $700 million of a preferred stock yielding 9% percent. Alice Schroeder describes the security in her wonderful Buffett biography Snowball:

The nine percent yield gave Buffett a premium return until the stock went to $38, when he had the right to convert to equity. So the upside was unlimited. But if the stock went down, he had the right to “put” the security back to Salomon and get his money back. The deal worked out to an expected fifteen percent profit, on an investment that carried very little risk.

Despite the “very little risk” structure of the investment, Buffett’s close friendship with Salomon’s CEO John Guttefrend, and he and his partner Charlie Munger’s seats on the board of directors, the investment would almost turn out to be a total disaster.

As with Valeant, Salomon’s near-implosion was precipitated not by a competitive threat outside the company, but by the misdeeds of those within. In 1991, Salomon’s head of government bond trading was found to have submitted fake orders to the U.S. Treasury’s auctions, in an attempt to manipulate the market for U.S. government bonds. When Salomon’s management was alerted to this, it not only failed to fire the individual responsible, it also failed to disclose the activity to its regulators. It therefore found itself in a particularly precarious position when that same trader manipulated the auction process again! And this time in a much more public fashion.

In the months that followed, Salomon’s conduct would earn it civil and criminal investigations, the resignations of its top management, and most importantly for Buffett, push the firm to the brink of insolvency2.

In fact, just as Buffett was about to take the helm as interim chairman in an attempt to save both the firm and his investment, the Treasury Department put out a press release, that to all concerned, was the nail in the coffin for Salomon Brothers. As Alice Schroder recounts it in Snowball:

Suddenly, a lawyer appeared in the conference room where Buffett was meeting with Gutfreund and Strauss, waving a message from the Treasury Department. It was going to announce in a few minutes that Salomon was barred from bidding at Treasury auctions, both for customers and for its own account. All of them understood that in minutes, Salomon would be shot in the head. “We immediately saw that this would put us out of business—not because of the economic loss, but because the message that would go out to the rest of the world in headlines in the papers on Monday would be ‘Treasury to Salomon: Drop Dead.’

Only the combination of Buffett’s threat to walk away from the role of interim chairman, his reputation, and the concern that Salomon’s bankruptcy would mean a global financial meltdown, barely convinced the few key regulators to change their position. At the last possible hour, the government announced that Salomon would be allowed to bid in government bond auctions for it’s own account only. This was a stay of execution that effectively ended the run on Salomon Brothers, at least temporarily. But even as relative calm ensued, Buffett reflected on how limited his capacity was to ensure a desirable outcome for Salomon Brothers and for himself:

I couldn’t do anything about what the troops were going to do every day. I couldn’t do anything about discovering things that I didn’t know existed when I went in. I couldn’t do anything about what Jerry Corrigan felt about everything that had taken place, or what the U.S. Attorney for the Southern District of New York or the Antitrust Division of the Justice Department would do. I knew it was terribly important that it get worked out right, and I knew that was something that—no matter how hard I worked—I had no control over. I could stay up all night and think about things, but that wasn’t necessarily going to guarantee a good outcome. And it made a lot of difference to a lot of people. It would change my whole future life.

There is an expectation that great investors, and especially activist investors, be immaculate business analysts. That they understand their investments as well, if not better, than the management. But Buffett’s reflections, and the events at Salomon and Valeant, seem to beg the question; are complex companies with “performance driven cultures” beyond the ken of even the best investors – are they inherently more risky?

While it is true that some businesses are more prone to scandal than others. The reality is that even relatively simple businesses, really almost every business, is subject to the risk of a catastrophic implosion. Volkswagen is a case in point. And so the question thus becomes, is it ever truly responsible to hold a very large position in any single business, and if so how large can it be?

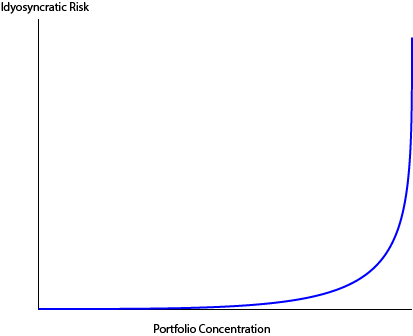

Because investing, like life, is richly contextual, that is, every situation is unique; there is no right answer to the question of when a position is too large. What we can say with confidence is that investors must maintain constant vigilance with respect to both the limits of their knowledge about an investment, and the rapidity with which increasing concentration increases their vulnerability to a “blowup”, or in academic jargon: idiosyncratic risk.

The rate at which idiosyncratic risk increases with concentration can be difficult to appreciate. After all, mathematically a 40% position is just four times a 10% position. However, and this is key, from a portfolio risk perspective, a 40% position entails far more risk than a 10% position. This is because the idiosyncratic risk you bear from portfolio concentration increases in an exponential fashion. Five 20% positions carry more than twice the risk of ten 10% positions. This is an easy thing to overlook when things are going well, and that, of course, is when it is most critical to remember.

Less obvious, but equally important, is how increasing portfolio concentration interplays with liquidity profile of an investment managers capital base. Poor performance alone is enough to shake investor confidence, but when combined with public humiliation, the urge to take what’s left and run becomes all the more powerful. Thus Valeant and Salomon prove the wisdom of Ackman and Buffett’s emphasis on permanent and near-permanent investor capital.

The corporate structure of Berkshire Hathaway does not allow for redemptions, and thereby long before his Salomon investment, Buffett insulated himself from whims of outside investors. Ackman, largely due to his experience with his first hedge fund vehicle Gotham Partners, has made a point of limiting the ability of his investors to redeem3. Without such protections, the combination of a single scandalous investment and investor withdrawals could cause a total meltdown of the manager’s portfolio4.

In fact, if there is a definite lesson in any of this, it is that you have to match your investor liquidity with the volatility of the assets in your portfolio. And if your portfolio consists of only a few equity investments, you should expect it to be volatile, and plan accordingly.

Finally, it merits reflecting both on how often the world turns upon small things, and how little we consider what might have been. The Salomon Brothers investment represented approximately 25% of Berkshire Hathaway’s equity in 1987 and ~ 9% in 1991 when it almost filed for bankruptcy. If the few men who regulated Salomon had decided that it was acceptable for the firm to fail, Buffet’s investment would have been worth nothing. If Salomon had gone bankrupt in 1987, the loss would have done considerable damage to Buffett’s track record as an investor5 and probably his reputation as well.

But we live in a world where almost doesn’t count. We see only outcomes; risks that almost come to pass but don’t barely make the footnotes of history. Indeed, the episode with Salomon Brothers is remembered more as a triumph of Buffett’s brand of corporate morality than as a blemish on his investing record.

Bill Ackman knows better than most that conviction, and thereby concentration comes at a price. But it is easy to forget this. To forget what a challenge it is to both correctly allocate our conviction and bear through its inevitable trials. We forget because great people make difficult things look easy, and because we are quick to disregard those that fail. Thus Ackman and Buffett’s examples, if nothing else, should serve as a reminder to approach both our own and others endeavors with prudence, humility and sympathy.

Disclosures / Disclaimer

No Position: VRX, PSH Long: BRK

This information should not be used as a general guide to investing or as a source of any specific investment recommendations.

This post was originally published at WhiteTree.net