The cha-cha and baton pass between asset classes dances on.

As gold has taken the lead and made forward progress - taking two steps forward and one step back; equities have mimicked golds moves - albeit, losing a half step along the way.

As gold has taken the lead and made forward progress - taking two steps forward and one step back; equities have mimicked golds moves - albeit, losing a half step along the way.

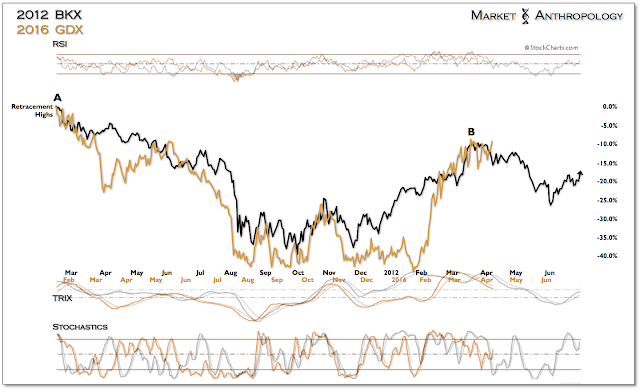

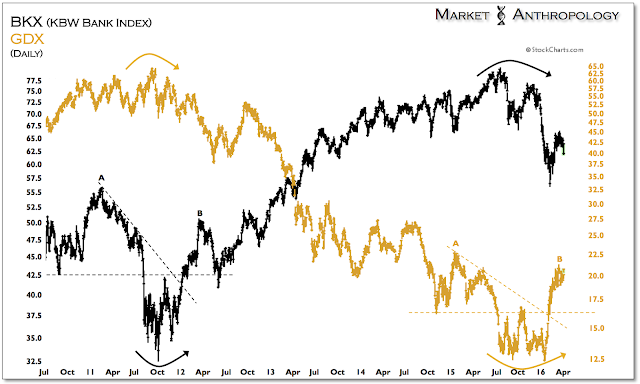

Over time - and as framed below by the chart of the financial sector and the gold miners, we expect the divergence in performance to narrow considerably, as gold leads the commodity sector finally out of a cyclical low and as equities retrace from a corresponding high.

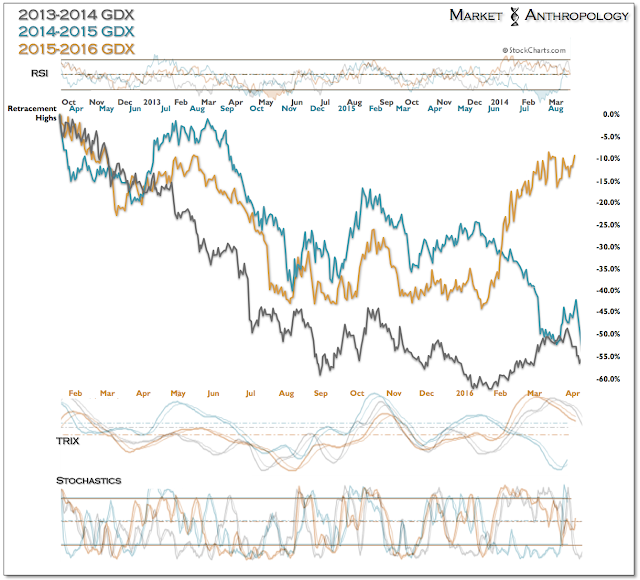

At the end of last year we speculated that precious metals investors would finally find themselves on the right side of the market this year, after the sector had languished with replicating downside moves over the past three.

Overall, the third time appears to be the charm - as gold and the gold miners have broken pattern. That said, over the near to intermediate-term we suspect that the retracement decline is still underway - which could extend throughout the spring and along the lines of the banks in Q2 2012.

And while the yen's leading performance points towards a continuation of the sector's nascent uptrend later this year, the US dollar continues to tread water near the lows from last fall, where we have expected another bounce to materialize.

Should the dollar break below the lows from last October over the near-term, it would likely correspond with the next leg higher for gold and the broader commodity sector. From a tactical perspective, however, we believe the former is still more likely.

Copyright © Market Anthropology