China's gift to us: Cheap goods

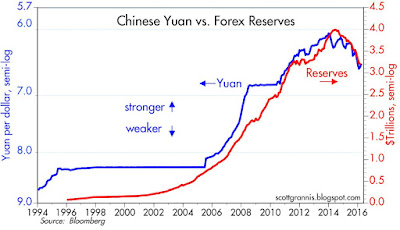

Since 1994, the net effect of China's exchange rate policy was a doubling of the real value of the yuan vis a vis the currencies of its trading partners, as the chart above shows. That's right: for the better part of more than 20 years China's currency has been adjusted higher—not lower—against other currencies, after taking into account relative differences in inflation. China became an exporting and manufacturing powerhouse not because it cheapened its currency to unfairly compete, but because it worked hard to become a world-class manufacturer. China became a world class exporter in spite of the fact that its currency was steadily appreciating for two decades. This is not unfair competition, its healthy economic development. The productivity of Chinese workers has skyrocketed, as have the living standards of the Chinese people. And what's good for China is good for the world.

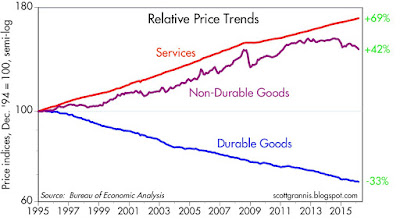

Most of what China has exported is what we call durable goods. China managed to make fantastic and innovative products in an ever-cheaper fashion, and the benefits of that productivity miracle were shared by all the world's consumers. Since China first launched its exporting and manufacturing boom in 1995, cheap imports have resulted in a continuous decline in the price of durable goods in the U.S., which shows up in the blue line in the chart above. Since 1995, durable goods prices on average have fallen by one-third. That's the first time in recorded history that durable goods prices in the U.S. have declined on a sustained basis. Meanwhile, the prices of other things—services and nondurable goods—have continued to rise.

The story is relatively simple: technology, coupled with the rise of China's manufacturing prowess, has driven down the prices of manufactured goods and boosted the productivity of labor. Labor is more productive today, thanks to computers, technology, and the internet. It takes less and less input from people to make more and better things as a result.

As the chart above also shows, durable goods prices have fallen by one third over the past 20-some years, while the prices of services (a reasonable proxy for labor costs) have risen by over two thirds and non-durable goods prices have increased by over 40%. This has led to the most amazing change in relative prices in modern times, and it's a gift that keeps on giving to the vast majority of the world's population: a typical wage in the U.S. today buys two and a half times as much in the way of durable goods as it did 22 years ago (i.e., 1.69/.6 = 2.5), and there is no sign that this won't continue. Wow.

I should add that monetary policy has had little if anything to do with durable goods deflation. It's all about China opening up its billions of people to the global marketplace, the blossoming of international trade, and the technological wonders released by the combination of ever-more-powerful computer chips and incredible software technology.

This is not something to fear, this is something to celebrate.