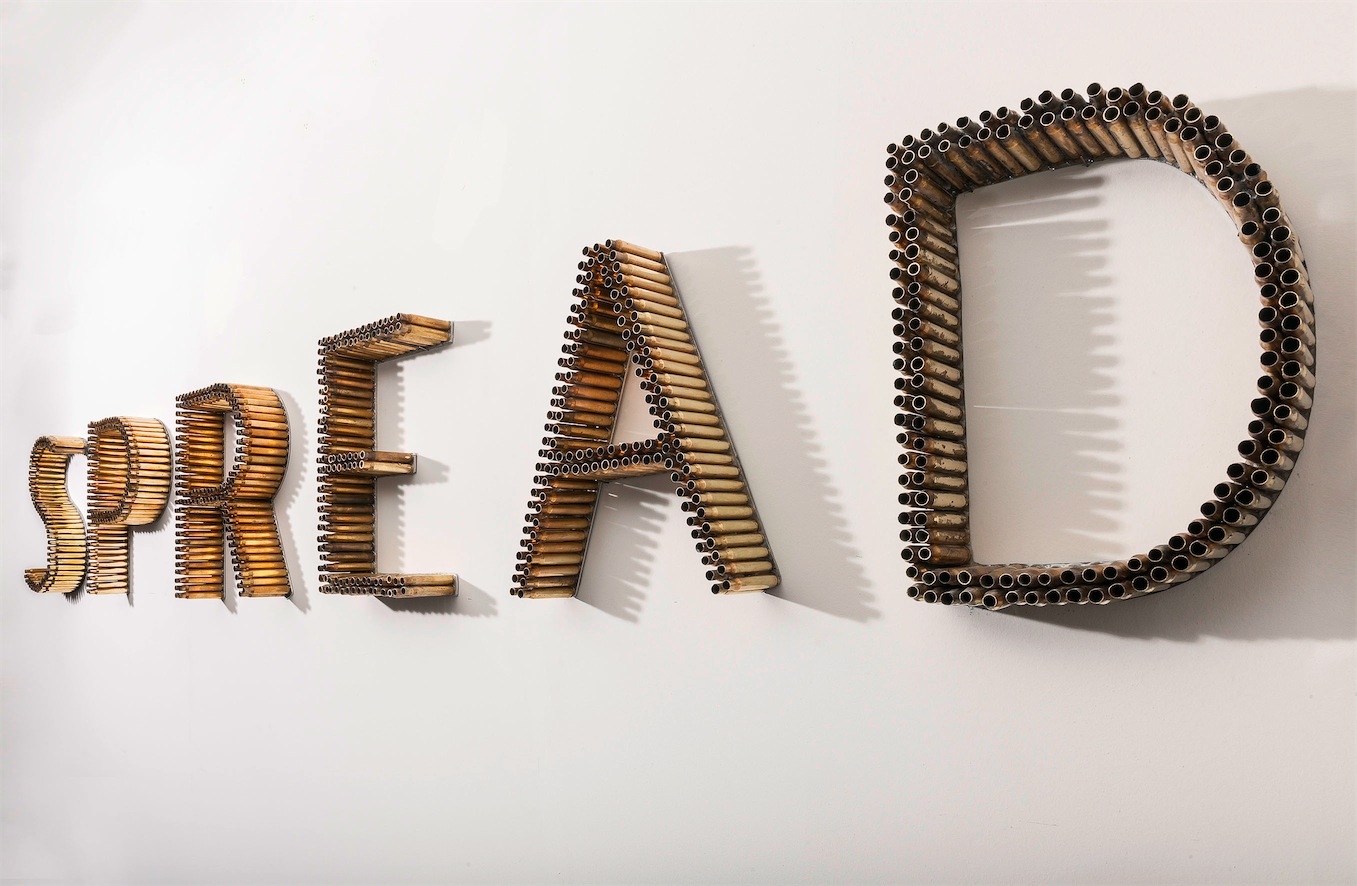

Spread Product is "Holding its Own"

by Doug Drabik, Fixed Income, Raymond James

The bond market is digesting a lot of data. Friday, nonfarm payrolls rose significantly at 242,000, well above the estimated 195,000. The previous month’s number was bumped on a revision from 151,000 to 182,000. No good number seems to go without some sort of countering negative number and last week was no exception. The very closely watched average hourly earnings data fell -0.1% quickly dampening thoughts that inflation might be ready to awaken. It appears that consumers won’t have a lot of extra disposable income on hand, at least in the near future.

| 12/31/15 | 03/07/16 | ||

|---|---|---|---|

| 1yr | 0.600% | 0.660% | 6.0 |

| 2yr | 1.050% | 0.900% | -15.0 |

| 3yr | 1.308% | 1.065% | -24.3 |

| 5yr | 1.761% | 1.414% | -34.6 |

| 7yr | 2.092% | 1.709% | -38.4 |

| 10yr | 2.270% | 1.912% | -35.8 |

| 10yr | 2.270% | 1.912% | -35.8 |

| 30yr | 3.016% | 2.718% | -29.8 |

The continued saga of mixed data continues. The U.S. bond market is being pulled and pushed, tugged and shoved. It remains the most promising show on a global scale but the economy’s slow positive growth hardly appears ready to burst. What is going to make this lackluster economic environment change is yet to be formed. Consumer spending contributes to over 70% of the gross domestic production (GDP). Some studies suggest however, that when you consider production of goods-in-process, manufacturing and wholesale stages, business investment plays a bigger role with GDP growth. Higher investment spending is associated with higher economic growth. Is consumer spending the effect or the cause of a healthy economy?

We have seen companies use excess capital to purchase back company stock rather than invest in research and development and/or reduce company debt. One contributing decision factor is the lack of demand. The strength of the dollar has weakened multinational U.S. company profits too. Europe’s economy is still shaky as is China’s, Brazil’s and Japan’s.

So does it seem like we’re jumping all over the place? That’s the point. The bond market continues to digest and attempt to make sense of so many factors. Although there continues to be more downside risk, it’s not all negative. The yield curve is still positively sloped. There still is over 200 basis point (bp) spread between the 30-year Treasury and the 1-year Treasury bond. More importantly, most investors are not Treasury buyers. Most investors buy spread products such as corporate bonds, municipal bonds and preferred securities. Spreads have widened and thus realized yields have held their own despite slight drops in Treasury rates. The widening on spread products remains well within historical norms, meaning risk is not extraordinary.

Resist the temptation to invest on what may happen and continue to focus on what we know. Bonds remain the cornerstone of wealth preservation. Low inflation keeps realized yields on spread product favorable. Investment-grade spread product yields continue to provide steady and predictable returns. Please use the Fixed Income Weekly Interest Rate Monitor publication to help direct your portfolios to the appropriated investment-grade spread product.

Copyright © Raymond James